Did you know that you could earn interest on Bitcoin, Ethereum and other crypto-assets that you own?

Bitcoin has been criticized by certain people in the past for being an asset that does not yield any dividends, but this argument no longer holds any water.

Many crypto investors store their digital assets on exchanges like Coinbase and Binance for long-term safekeeping. Doing so means they are assuming counterparty risk, however, so in my opinion, if you’re going to opt for keeping your crypto with a third-party custodian, you might as well put it to work.

These are my favorite crypto lending platforms where you can earn interest on your crypto and also obtain loans by providing crypto as collateral.

- YouHodler – biggest number of cryptos supported, lowest fees

- Nexo – best all-rounder in terms of provided services

Alternatively, you can store your crypto in cold storage, but you won’t be able to grow your wealth in that way unless your crypto asset prices appreciate over time.

In this post, I’ll show you how you can earn 5% and upwards on your Bitcoin by using the interest accounts on the platforms featured here.

Most of the platforms I will describe help you earn interest on your crypto by implementing some form of lending. I have written extensively about my P2P lending experience and my favorite P2P lending platforms, but today we’ll add the crypto factor into the mix – hence we will be talking about crypto-backed loans. In my opinion, as an investor, the addition of crypto as collateral marks a huge improvement over the traditional P2P lending platforms, which can lack transparency and that mostly work with no collateral.

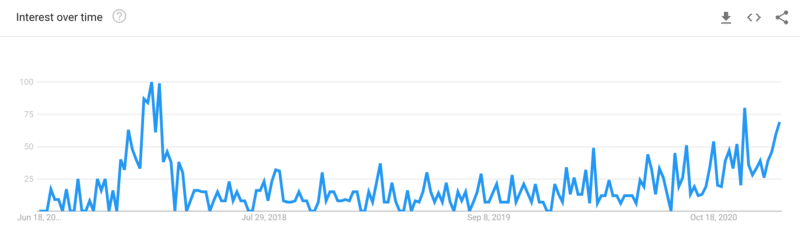

Crypto lending is becoming a huge industry, and we can take a look at Google trends to verify this. Have a look at the chart showing a strong worldwide uptick in interest in crypto lending options over the past three years.

Let’s take a look at the best platforms available. One of the important things to note before we start is that these platforms exclude fewer people than traditional P2P lending platforms. While the traditional platforms operate within very strict geographical limitations, with crypto lending platforms basically anyone who holds crypto can participate.

YouHodler

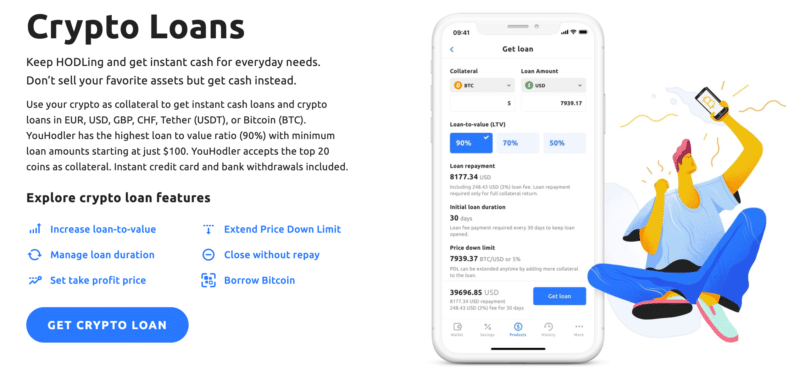

YouHodler offers an extensive set of crypto-fiat financial services. In its essence, the platform intends to help investors take advantage of cryptocurrencies, without having to actively trade them.

YouHodler has managed to make crypto-HODLing an active strategy. For investors, access to a crypto-exclusive savings account and interest-bearing loans are preferable ways to expand your portfolio.

This solves an instant issue with digital currencies – opportunity costs. That is to say, rather than leaving your digital coins sitting idle in a private wallet, YouHodler allows you to earn a yield on your holdings. At the same time, you get to keep hold of your investment and thus – you can cash out your coins whenever you see fit.

YouHodler implements some innovative strategies to boost your returns, so it is an ideal platform for those who like to tweak things and see what works best. The company is registered in Cyprus and is regulated in Europe, while client funds are stored securely within the Ledger Vault platform.

You can also use YouHodler as an exchange to trade cryptocurrencies. If you’ve already made some amazing profits on your Bitcoin, perhaps it’s time to give yourself a break. For example, YouHodler savings accounts pay 12% annual interest on stablecoins. Hence, you could do a Bitcoin to fiat exchange with just a 2% fee right on our platform, and then convert fiat to your favorite stablecoin in orer to start earning interest.

You can read my full review of YouHodler if you want to learn more about this platform, or just click the link below to go to the Youhodler website directly and get started.

Binance Savings and Staking

With Binance, you have several ways of earning money on your cryptos.

Flexible Savings

The easiest way is probably using their Flexible Savings product. Flexible Savings is your Crypto savings account. Subscribe your crypto to earn interest, with the flexibility to redeem your funds at any time.

To quote a few estimated annual yields available at the moment, we have:

- BUSD at 2.44%

- USDT at 2.11%

- DASH at 1.83%

There are 24 coins you can use for the flexible savings account.

Locked Savings

For higher returns, you will want to opt for the Locked Savings product. By subscribing your crypto to locked savings periods you will in return get higher interest earnings. You can choose from several durations depending on the coin you are using, but it’s typically one or more options from the following:

- 7 Days

- 14 Days

- 30 Days

- 90 Days

For example, with BUSD you get an annualized interest rate of 7.42% at the time of writing, while USDT gives you 6.79%. Both of these are stablecoins that can be easily bought from the Binance exchange itself.

See also: How to earn interest on crypto with Binance

The range of coins available for locked savings is more limited, we can only choose between 6 coins: BUSD, USDT, COCOS, ONE, EOS.

Earn money on crypto with Binance

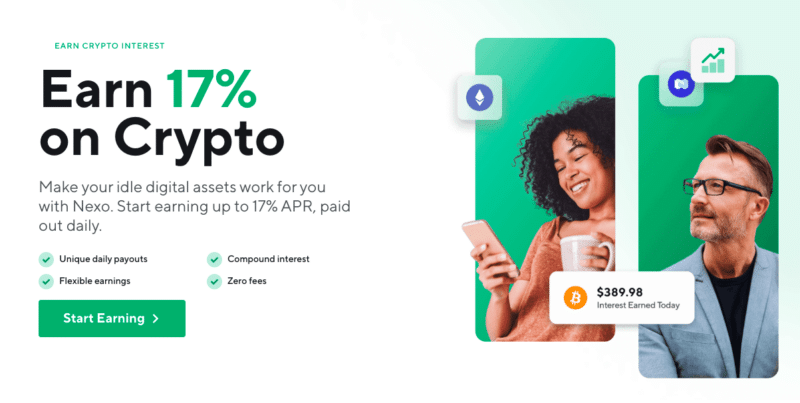

Nexo – The All-Round Financial Service

Nexo is an excellent platform for those investors seeking an active strategy for their crypto holdings by providing access to a crypto-exclusive savings account, interest-bearing loans, crypto exchange and a Nexo card which will give you access to fiat without needing to sell your crypto.

Once you top up and buy crypto you can start earning up to 17% annual interest immediately without further action being required from your side. Apart from earning interest on cryptocurrencies, you can also earn up to 12% APR on USDx, EURx and GBPx stablecoins. The actual APR is determined based on Loyalty Tiers depending on the ratio of Nexo Tokens against the balance of other assets in your portfolio.

Read my in-depth review of Nexo’s plethora of services here.

Nexo also offers crypto-backed loans where your digital assets act as collateral without any further need for a credit assessment. Put simply, Nexo gives you fiat or stablecoins, and you provide crypto as security for repayment. Apart from the tax benefit associated with not selling your crypto, Nexo provides you with the opportunity to access fiat funds at the touch of a button, something that with legacy banks is unimaginable.

Nexo also offers crypto-backed loans where your digital assets act as collateral without any further need for a credit assessment. Put simply, Nexo gives you fiat or stablecoins, and you provide crypto as security for repayment. Apart from the tax benefit associated with not selling your crypto, Nexo provides you with the opportunity to access fiat funds at the touch of a button, something that with legacy banks is unimaginable.

Concluding Thoughts

I’ve tried out all these platforms and found YouHodler and Nexo to be the ones I liked most. The platforms mentioned in this post all work fine, but you’ll need to find the one that has the best branding and user interface for your tastes. Some of them also reward you in their native tokens, but in general, I prefer going for Bitcoin rewards.

Read more: The Best Books about Bitcoin and Crypto

What do you think of P2P lending platforms that provide crypto-backed collateral? I think it’s a nice upgrade on the traditional P2P lending platforms and as an investor, it gives me more security.

I am surprised that BlockFi is on your list. Due to US Government stuff their interest accounts are essentially frozen for US citizens abd has been for months. I still earn interest on the money I have in there but can add no more funds and if I want to trade, the new crypto I buy cannot earn interest.

Hello,

BlockFi.com locked my account with $25,000 inside, around 80 days ago, and they are not willing to process a refund. They are asking for a court order just for them to process a refund.

After seeing a bunch of info about the products BlockFi offers that seemed attractive at first glance, I decided to open an account. Within minutes the account was ready to take the money out from my bank. No photo identification required, by the way.

I started depositing money, and seemed easy compared to other services of this kind.

After a while, I thought it would be a good idea to secure some funds by processing two Crypto withdrawal requests.

I’ve been waiting for two days (the minimum waiting time offered for a Crypto withdrawal), but instead of processing my requests they asked me for verification via ID/Passport, photos/video using my phone..(a regular request of any CEX), but what’s strange, it’s that they will ask for Verification after they allow you to deposit large amounts of money, and not before, as any other service does. I wonder what would happen with your money in a strange scenario where (for some reason) you can’t successfully pass the Verification.

But… that was Ok. I successfully processed the verification within minutes.

Then, surprise….. Because I had two pending withdrawal requests for two different Crypto coins, even if one of them was for a very small amount being executed just for me to understand their withdrawal process, BlockFi asked me to get Verified once again. Not a different Verification process. Just the same one I had successfully executed minutes ago.

No problem! I did it again “You’re all set !”.

Within minutes, I got an email notifying that my BlockFi account was locked. No explanation other than asking to read their TOS, and the following notice….. “Should you be unable to retrieve funds through your bank, you must wait 60 days from receipt of this email before requesting a manual wire withdrawal to the source bank account. Please note that we may require identity verification to process the withdrawal. Note: Any requests made to BlockFi about your account funds will be ignored until we can process a return of funds which will only be eligible after 60 days. Do not reach out to BlockFi until after this date. ”

The 60 days have passed and even though I used every possible method to contact BlockFi, it doesn’t seem like anyone’s going to reply. (Several support tickets or by sending any kind of message using any possible form on their Help/Support pages, trying to call them using the phone number listed over their Help page, sending message via some of the previous support tickets that were used around two months ago to communicate with them..and more..

Let’s not forget that a considerable amount of money is still with BlockFi, and my account is still blocked.

If that can’t be called an extremely frustrating situation, I’m curious to hear another 🙂 .

——— UPDATE

Finally I’ve been contacted, being informed that they will return my money…soon.

This is definitely good news, but … I still find myself in a “strange” situation.

Let me explain: When BlockFi locked my account they said: “At this time, we are not able to return any funds to you directly. We’d recommend that you contact your bank and request that any ACH transfers you made to your BlockFi account be canceled and reversed. Should you be unable to retrieve funds through your bank, you must wait 60 days from receipt of this email before requesting a manual wire withdrawal to the source bank account. ”

I thought it would be faster to follow BlockFi’s advice by asking the bank to proceed as per their instructions,but a nightmare was about to start.

Shortly after asking the bank to return transfers made by me (no scam or hack involved), they decided that something is not right, ending by closing my bank accounts. PERMANENTLY.

So BlockFi will not be able to send a Wire Transfer as it will be automatically returned.

But when they blocked my account, part of the money was in Crypto balances. I wonder what are the terms used to close my positions. Crypto coins rates have changed in the past 70 days. Maybe they will process my original withdrawal requests via crypto? Or will they accept my request to send my money to another bank account in my name? Also I wonder how they could have sent a Wire Transfer to an account that does not accept wires (if they were sent to BlockFi from a NeoBank). Not the case here, but just wonder…

— UPDATE

BlockFi’s final word is: “Any funds on the account will remain locked until BlockFi receives a court order to refund the funds”

$25,000 of my money are locked and they also refuse a refund to the source bank account

I normally don’t feel comfortable investing online but because the company I worked for downsized due to the pandemic and I was one of those affected. I had to invest the money I had left. This company has delivered my ROI weekly with no excuse or delay. Easy to use ! Wish I had started investing earlier. Thank you Coinbase.com. Definitely the Best investment platform I’ve ever come across.

Hi, I have found on this page a couple of weeks ago your recommendation for the company Midas Investments. However, in the latest version of your page this recommendation is gone. The interest rates on Midas are extremely high which makes me rather suspicious. Could you please explain why you removed your previous recommendation.

Thank you for your help.

The recommendations change on a regular basis as it’s a space with many players and changing conditions. Midas’ rates are pretty high compared to the rest, but they are a bit weaker on the regulatory aspect when compared to established players like BlockFi, which has been battle-tested in the United States, for example.

Another point to keep in mind is that typically newer platforms will offer high rates to attract users, then lower them later. Very high rates are unsustainable, they can only offer them by subsidising the rates with funds from their investment rounds.

Come on now Jean. DeFi, particularly on Fantom, is where it’s at. Not these dinosaur centralized solutions. It’s easy to get 1-3% a day quite safely e.g. on Tomb Finance or Charge DeFi

Thanks for your input, however, things are more nuanced in my opinion.

DeFi has a long way to go to gain public trust. There have been too many exploits so far and the technical challenge remains high. I’m all for decentralization and I understand that most of the current challenges will fade away over time as new solutions are found and the space matures, but as it stands today, the centralized lending solutions remain a better option for most people.

If you are technically adept and have time to spend to understand how DeFi works, and you simply want to earn some interest on a relatively small part of your portfolio, sure, go for it. At the very least, play around with DeFi, especially on new platforms like Fantom and Avalanche to see what all the fuss is about.

On the other hand, if you’re a corporate, or you mostly hold Bitcoin, or you just want to minimize risk, just go with a centralized solution like the ones mentioned in this article.

I would bet that the most successful ones will either be acquired by banks or acquire/become banks themselves, and I don’t think the general population is ready to take over the responsibility that they currently entrust banks with anytime soon.

For those who are interested in yield farming with stablecoins in DeFi, check this Twitter post. Make sure you understand how things work before you put in any money.

Crypto loans for a bear market look interesting. In general, from crypto loans, I would also consider the CoinRabbit resource, they have good offers, especially for the bear market

Hi Jean, what are you hearing about BlockFi adding more coins , like ADA/XRP?

They follow market demand Steven, so I wouldn’t be surprised if they do. I’m not very interested in those coins really so for me BlockFi already provides what I need with the current selection.

Your article says it was updated April 5, 2021. Why then does it not reflect the new, much lower, interest rates offered by BlockFi?

Rates and withdrawal fees are bound to change upwards and downwards depending on market conditions. While I will try my best to keep the rates updated, I suggest you always check the platform’s website for the latest details. Unfortunately, it’s hard to keep everything updated to the minute.

For beginners, I will suggest you buy bitcoins worth of that price and you hold onto it. It’s a long scale investment as you watch your coin grow as time passes. This might not be the fastest way to make money but definitely the easiest way.

Do not invest more than you can let go. Bitcoin is independent of any commodity or currency which makes it unpredictable and as such, prices might change overtime. However, if you decide to invest it in Forex or any investment company out there, I advice you do proper research to avoid being scammed.

Hello there,

nice review but what about Nexo?

Cheers

I’m currently trying it out, will update the post when I have a solid opinion.

What about binance.us ? Seems very limited comparted to binance outside USA

Thank you for the information.

I’ve been using MyConstant, Nexo, Block Fi and Ledn to earn on both crypto and stable. I tried using Crypto.com & Binance, but gave up as I couldn’t navigate their sites easily.

Is there a site that you’ve found which aggregates a majority of the sites out there with updated rates? I’ve tried both BitCompare & Loanscan but they seem to focus on those sites that pay for ads. More importantly, the rates are often incorrect.

I don’t know of any good aggregators, but let us know if you find one.

I’m curious why you found the ones you mention hard to navigate. BlockFi, for example, has a very simple interface.

Sorry for the confusion. The first four: MyConstant/BlockFi/Ledn/Nexo have been great….It’s the other two (Binance/Crypto) that I had trouble with their platforms.

Thank you, that makes more sense. BlockFi remains the leader at the moment in my opinion, but it’s still early days for all these platforms.

Do you feel confident in earning interest on stablecoins? As much as they function well now, I always have the feeling Tether and other stablecoins might just prove to be thin air one day, and lose their 1:1 value.

I prefer using Bitcoin rather than stablecoins. I think the risk with stablecoins is not big, but I’d rather avoid them if I can.

You mentioned ‘I think the risk with stablecoins is not big, but I’d rather avoid them if I can.’….anyway to show USDT as a stablecoin that’s not stable/secure? Is it due to the 1:1 pegged value not justifiable for what they actually own as fiat in the bank?

Yes, the lack of a serious audit and proof of reserves is the biggest question mark in my view.

I am glad that I found your blog. So much useful information here. Last few days I was researching lending platforms to split my investments and reduce individual risk, and it seems that at least 3-4 can be trusted.

You mentioned that you will also review blockchain.com platform. Any idea when we can expect this review?

Glad you found it useful. Re Blockchain.com, it’s not something that’s a high priority for me at the moment.

Bitcoin to the moon soon. It’s not too late to start investing in bitcoin. Just last I acquired a few bitcoins with my retirement funds and proceeded further to learn how to trade cryptocurrencies. Today I can proudly say I this has been the best investment in my lifetime and I am enjoying the bull run in as much as any bitcoin investor is enjoying it.

Great article thank you. Do you know of any platforms that offer btc interest while self custody your keys? I’m so hesitant of counter party risk. Cheers!

Unchained Capital should soon be releasing such a solution. You can also check out HodlHodl.

I am using Celsius and it seems to be very good. I am using it for 3 months now. The Cel token is doing wonders and now ranked 17th in CMC/Coingecko. Lot of new things are coming up in 2021.

Looks decent enough but targeted towards younger people or beginners in investing. I don’t like their branding at all. The CEO/founder has had some weird moments as well. I also dislike the app requiring login every time you access it.

I agree. I should update my previous comments. I’ve now had more time to use Celsius and like it more and more and not only because the token value is rising. The CEO does a very good job at engaging with his customers. I feel that there is a level of transparency that I don’t see with NEXO.

With that said, I still like NEXO, despite the token value not going up as high. As you mention, Jean, I feel that Celsius might be more geared towards younger consumers, which has been a little annoying as an older user. NEXO makes me feel slightly more confident because they seem a bit more polished/mature.

Ultimately, I’ll continue using both NEXO and Celsius, given that they have unique advantages (primarily, higher interest rates). I also feel that given Celsius’ token rise, NEXO’s token is likely going to catch-up soon so I’ve loaded up.

Nexo has worked great for me and I like their 30% dividend and loyalty programs, but wish that I could buy coins directly within their platform. I think they have better interest rates compared to BlockFi, but things change so often.

Celsius and Crypto.com are not that good, in my opinion. Are the others mentioned in your article even available in US?

Why do you think Celsius and Crypto.com are not that good?

I should start by saying, they all have their limitations. As mentioned above, I wish their was an ability to buy crypto via nexo. Also, you can only earn interest on select coins – ADA and LINK are not included yet.

Compared to Celsius, the same issues exist. I found that buying their token had much greater fees associated with the process. The purchase of other coins through their app’s 3rd party affiliated exchange takes forever to show up in your account. They don’t have a website (unlike Nexo, Crypto.com, etc) – the app design is very amateurish. Finally, I am not confident in the CEO/company. If you go to their social media accounts, the posts appear to be directed at teenagers or 20-something crypto investors who like to party. The CEO doesn’t appear professional, in my opinion. Nexo posts, on the other hand, are more focused and about what’s important to me – making more money with my crypto!

Crypto.com may undoubtedly beat both Nexo and Celsius in diversity of coins that can interest and you’re able to purchase crypto in-app (with credit card). I think there is an ability to also purchase with bank account, but I couldn’t figure out how to do that. With that said, the ROI is not as high as Nexo, which is most important to me. Crypto seems to have some overly complex way of earning interest that includes buying a lot of their coin and getting one of their credit cards, which is annoying. Additionally, I’m not a big fan of their app/web design. The fees for purchasing with credit/debit card are much higher than just purchasing with Coinbase pro and moving into another wallet (like nexo or crypto.com).

All in all, I like Nexo’s model for earning more $$, it’s multi-layered, but I feel like they do the best job at clearly communicating how you will earn. In my opinion, they’ve built the best incentive-based system for getting newbies to join as well as keeping existing customers happy. I tried all of them out just this month and have only deposited a small percentage of my net worth. I’m currently feeling confident enough to put all of my savings (less stocks/retirement plans, of course) into Nexo likely as a stable coin, but may shift more and more to Bitcoin as we pass the $20k mark. I do have small stakes in both Celsius and Crypto tokens on their apps, just in case I’m wrong and they blow up. Crypto is also the easiest I’ve found to purchase/earn on non-Coinbase alt coins (eg ADA).

Thanks for your thoughts Sean. Alex Mashinsky the CEO of Celsius is definitely a polarizing guy. On the other hand, he has a long track record as a successful entrepreneur and I do believe he is building a long-term project at Celsius. However, I found some of his public declarations quite questionable and that reduces my trust as well.

The branding on the Celsius website is horrendous too in my opinion. The first thing you see on accessing the site is a teen blowing bubble gum in your face. I can’t understand how that is supposed to inspire confidence, and as you say the targeting of the platforms seems to be towards the young and gullible. It’s quite a pity as it doesn’t match up with Alex’s overall message. However, that’s probably where the money is at the moment.

I recently had to withdraw all of my assets from Binance, as I received notice that they cannot work with US citizens. Very frustrating!

Now I have discovered (via prompt and courteous reply to my inquiry) that BlockFi is not allowed to do business with New York State residents.

Do you know which of your recommended sites are available to a NY resident?Thank you!

Check out nexo.io. I’m pretty sure they’re allowed in all US states. I’ve really liked them and it seems more professional compared to some of the others I use (I.e Celsius, Crypto.com). I never tried BlockFi or Compound Finance.

I find BlockFi to be very professional. What made you pass on them?

I never tried BlockFi and I’m not sure if they had an app when I began the process – I believe they do now. When I did some google searches on which had the best interest rates, Nexo came out on top + Nexo gives 30% profit dividend to its users/holders of Nexo token. Does BlockFi have a token? Thoughts on their platform and particularly their ROI compared to others?

In the past week, I’ve grown to like Crypto.com more and more for altcoins where I can’t earn interest on Nexo. I do think there interest earning program and CRO tokenomics needs to be improved – their token is currently hovering at $0.06 from a high of $0.20 a few months ago. Had I purchased their coin in August, I would’ve been very disappointed.

I don’t really care whether a platform of this sort has an app or not. A lot of emphasis on a mobile app usually means they are targeting beginners or those with a low level of financial knowledge, which actually is a warning sign for me.

Nexo also has two things that usually put me on the alert – the fact that they had an ICO and the fact that they have their own token that they push hard. Again, these are common traits with inferior and less trustworthy platforms.

Nexo having these attributes doesn’t automatically put it in my list of platforms to avoid, but it doesn’t put it at the forefront of options either. However, I have been reading with interest the content they have been producing via their blog, and overall the company seems quite solid. I will keep monitoring and evaluating further.

Not sure why Binance made you withdraw? I’m in New Jersey & using Binance.US just fine.

My crypto was on Binance, not Binance.US, which I didn’t know existed until after I pulled out of Binance. One would think that Binance would have mentioned that alternative when sending me their dire warnings of “move it or lose it.”

I now have my Ether and Bitcoin earning 11% in PRV on My Constant, and I’m very happy with them. I can switch between earning 11% in PRV and 8% in BTC or ETH at any time, which is a nice little perk.

I live in CT and because of that, I can’t use Binance.us …so inconvenient! There are a few states still that need to get on board.

Hi,

I have a Nexo account for a few months now, didn’t have a single problem with them. Just to let you know. Why Nexo seems sketchy to you?

Nice Article!

Have you checked out Nexo and/or Celcius Network? Been out for a while now.

Yes, I’m aware of both. Haven’t used Nexo as I’m not 100% convinced of their trustworthiness yet. Celsius I’ve used without any problems.

Hello Jean, Came across your blog when searching info about ‘crypto interest accounts’ on the web. Went through several content on this blog and there are lots of very interesting and inspiring topics you’re covering.

As I’m trying to find out what is all out there in the field of crypto interest accounts I’m curious about your thoughts about the Blockchain.com wallet interest account (only available with verified identity) which is currently at 6% APY?

Another one I’m using for a while is btcpop.co which offer a wider range of products including kind of a ‘pooled’ lending account. I could not find any info about this site on your blog but still curious if anyone has also experience with this?

Hi Tim, thanks for your comments.

Btcpop.co looks very amateurish and fishy, and based out of the Marshall islands. I would automatically distrust such websites. Trust is very important with financial investments, and so I only invest with those platforms which clearly show who is behind them and are also based in jurisdictions I trust.

Blockchain.com on the other hand is a well-known brand and is a huge platform in terms of users. I haven’t delved deep into it so I can’t comment further than that. I hope I’ll have the chance to take a closer look at it in the future and review it on this blog.

Hi, do you know of a platform where you can earn interest on the eurs stablecoin? At the moment even nthe highest rate can’t keep up with the falling usd price against the euro. I’m just losing at the moment with my euros converted to usd stablecoins.

Youhodler added EURS as stablecoin with 12,%

Hi Jean,

Thank you for the writeup! Have you tried Ledn.io? They claim to have the highest interest paid for BTC and USDC with no restrictions?

Hi John,

I haven’t tried them yet. I expect many players to flood the market and interest rates to change very frequently, so I wouldn’t join a platform purely based on the current rate they promote.

Hi Jean, glad to stumble upon this. Just pulled out of Nexo as listened to a not so great vlog re their legitimacy, so glad to see there are more companies out there offering similar benefits.

Hi Fraser, what did you hear about Nexo?

Constant seems a little sketch. You said they partly have FDIC but I couldn’t find it anywhere on their site and the very first thing they asked me to do was do KYC. I’d definitely like to see more reviews with them first, especially after reading their FAQ about working with loan originators and how we could potentially lose our money.

I think they need to work a bit harder to prove that they are trustworthy, however, I have been investing with them for a while now and have had no problems.

Good. Informative.

Might also add comparison stats for eSier comparison.

Hodlnaut offers one of the best and most consistant btc savings rate since it started (6%). Vc funded, no ico. Not much marketed but Singapore regulated so high degree of confidance. (Full disclosure: I save with them.)

Thanks Simon, seems like a decent platform. It is still too small for my liking, but I’ll make a note to circle back to it in a year or so to see how things are going.