This is an ideal read for the European investor who is looking for growing his/her wealth fast and is ready to assume more risk.

There are very few, if any, get-rich-quick schemes that work long-term in the world, however, it is true that some investing and trading strategies can get you on the path to greater wealth much faster when compared to traditional, passive and low-risk investments such as savings accounts or index funds. Not to mention that things like term deposits and savings accounts have become useless for investment purposes, as banks offer rates of close to 0% or even negative interest in some cases.

Therefore, investors are forced to look at alternatives for growing their net worth. I’ve written many articles on such alternatives, such as P2P lending, real estate developments, precious metals, and even cryptocurrencies like Bitcoin and Ethereum.

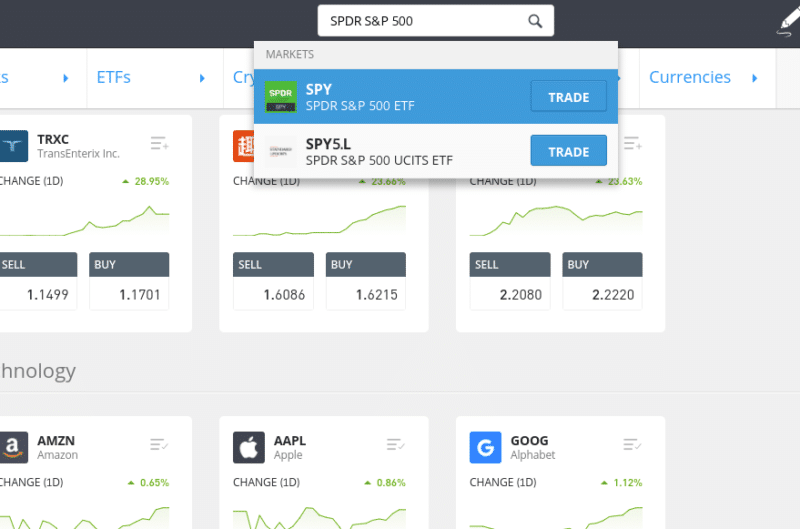

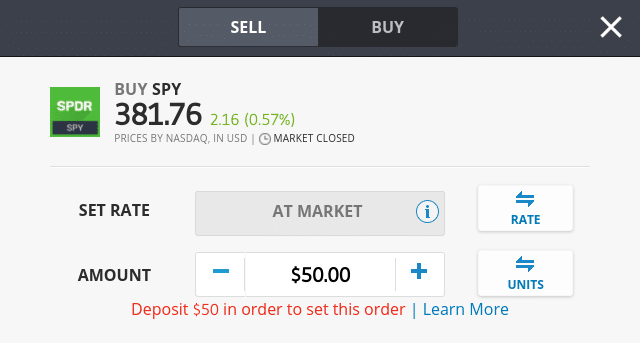

In this article specifically, we are going to focus on market trading using forex and CFDs. These are not for the beginner with a low-risk appetite, as they come with considerable volatility and the possibility of losing your entire investment. As always, the flip side is the possibility of growing your pot relatively quickly. So if you already have investment experience and want to learn about some new possibilities, read on.