Wise introduced borderless banking in 2017. The big advantage it gives you is that you can have bank accounts in multiple currencies. As soon as they launched I started to think of how it could help me get rid of PayPal and its high fees.

First, let me introduce you briefly to Wise Borderless. If you want to read my full review of this product, do browse over to my review of Wise Borderless.

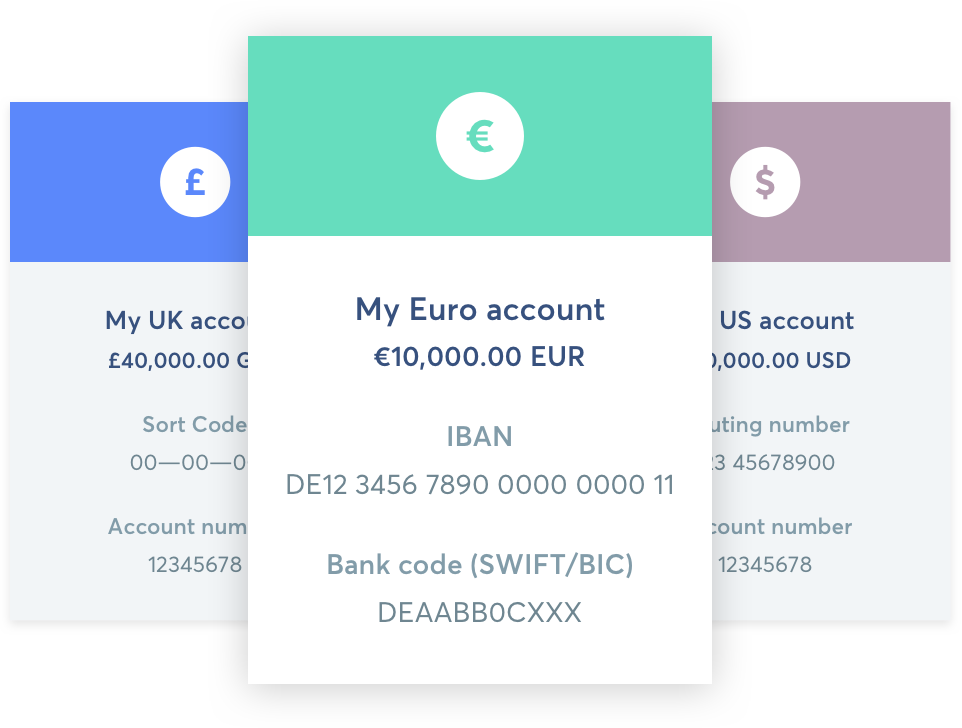

The vast majority of entrepreneurs I know require a combination of accounts in these three major currencies:

- US Dollars (USD)

- Euro (EUR)

- British Pounds (GBP)

The problem so far has been the simple fact that it’s unnecessarily and frustratingly hard or downright impossible to open a bank account in another country than the one your business is based in.

So for example if your business is based in the UK, but you make all your online sales in USD, you would probably want a USD account so that you would be able to transfer money to it without losing on exchange rates.

This problem is now solved with Transferwise’s borderless banking system. Once you open an account with Transferwise, you will be able to apply for borderless banking and select the accounts you need (USD, EUR and GBP available at the moment). Within two days you will have them in place and you can then start receiving client payments to these accounts.

So what are borderless accounts?

Your borderless account is a bit like having local accounts all over the world, without having to open a real bank account abroad.

It’s a multi-currency account that lets you keep money in 28 currencies, and convert between them at the real exchange rate whenever you need.

You get bank details (like account numbers, bank codes and IBANs) issued by TransferWise so you can receive money in different currencies around the world with zero fees. These aren’t actual bank accounts (they only work similarly to bank accounts), so you don’t have to fill in any forms or have a foreign proof of address. They’re your unique bank details issued by TransferWise to you, that you can give to your friends, company or customers in the US, UK, Eurozone and Australia to get paid in those countries as if you had a bank account there, with zero fees.

How do they work?

- Add money to your account in any of the supported currencies. Then activate the currencies you want to convert to or hold money in.

- Convert money between your currencies in seconds whenever you need, always at the real exchange rate, with our low conversion fees.

- Send money directly from any currency in your account to pay bills, pay friends or move it to another account of your own.

- Activate AUD, EUR, GBP or USD in your account to get account numbers and IBANs. Give them to your friends, company or customers to receive those currencies from any bank account in Australia, Eurozone, UK or US with zero fees.

Wise vs PayPal

I’ve written about the loss of money due to currency conversion when using PayPal before, so I was hoping that Borderless Banking would solve this issue once and for all.

First Use Case – Invoicing Clients

The first thing I thought of was to replace PayPal completely with TransferWise. Instead of issuing my clients invoices through PayPal, I would ask them to send money directly to my Borderless accounts thus incurring no fees. Apart from incurring no fees to receive the money, I would also avoid the currency conversions, since I now have accounts in the four major currencies I use the most.

TransferWise works perfectly in this case, and for this purpose I was able to eliminate PayPal completely from my workflow.

Second Use Case – Paying Employees or Freelancers Globally

I’ve always used PayPal to pay my employees or collaborators who work in other countries, but this is expensive for both me and them. Again, TransferWise Borderless proved to be a great solution.

I can recommend the borderless accounts for this purpose as you will definitely save a ton of money.

Third Use Case – Withdrawing money from PayPal

Unfortunately, I still had to keep on using PayPal as it is one of the most comfortable ways to set up automated payments for digital products, especially in countries where Stripe is not yet established.

The problem, as I described in another post, is that PayPal charges hefty fees for currency conversions when withdrawing money to your bank account. Even if you use my method to eliminate the conversion on PayPal’s end, you will still have the money converted automatically by your bank when it arrives there. The ideal solution is to have USD be transferred from PayPal to a USD bank account, and so on and so forth with the other currencies. This makes borderless perfect for the job.

My idea was to add each of my borderless accounts to PayPal as withdrawal methods.

However, after checking with PayPal, they have informed me that at this stage they don’t support virtual bank accounts, which is what TransferWise’s Borderless banking solution is classified as.

2Checkout do not allow withdrawals to a Borderless Banking account unfortunately, so I can’t use them there either.

It would also be interesting to know what Stripe are doing, so if any of my readers wants to try that, do leave a comment with the results.

You should be able to use Borderless Banking with other services that support bank wire transfers, such as affiliate systems like Avangate and Shareasale.

While I did not have any luck adding the borderless accounts to PayPal, several readers have reported that they managed to do so by calling PayPal directly. I hate waiting on calls to be honest, and the prospect of dealing with some PayPal rep and trying to convince them to do something like this wasn’t very enticing, so I didn’t bother.

If you want to try it, here’s how:

Go to the contact page within your PayPal account, click call us and you’ll get a freephone number to call (which works on Skype too) and a code to give them. Once you call you have to answer some security questions, then give them the ACH routing number and account number of the Transferwise US bank account. If you’re lucky it will show up instantly on your PayPal account as the Community Federal Savings Bank.

Wrapping Up

This is a great step in the right direction. Revolut released something similar earlier this year, but TransferWise’s solution is better. The last step now is for everyone to be able to use this type of account with PayPal for withdrawals.

In any case, you can still ask clients to pay you to one of your multi-current Wise Borderless accounts, and that’s already a huge bonus for those entrepreneurs and companies who receive invoice payments directly rather than through payment gateways such as 2Checkout, Stripe or PayPal.

Don’t forget that you can now also get a TransferWise debit card, which gives you direct access to your multi-currency Borderless accounts so that you can spend your money anywhere around the world where cards are accepted.

Thanks for all your investigations and sharing this valuable info! I have an EU Pp account, an Australian Pp business account and borderless/multicurrency Wise. Found I could add US and AUD (virtual) accounts to my aussie Pp biz account, BUT to send USD to my Wise USD pp account, PayPal slaps on a 3% fee or suggests I convert with their rates and transfer to the Australian bank for “free” 🤦🏼♀️ will be so happy to leave PayPal behind, they are scavengers!

Hello jean

I am an exporter currently based in Barcelona Spain, I usually buy from different countries through out Euro zone and US. My question here is, is there any limit on spending on an account, second is there difference between individual account and company account, third, in the process of opening a company account what are the requirements?

How can you tell if TransferWise will report you company’s transfers to the tax authorities from your country?

They should be reporting according to EU rules.

I have been used Transferwise. Normally I transfer 100k EURO per month but suddenly they deactivate my accounts with money inside for no reasons. After I keep sending mail to them they asked for extra documents I have sent all the invoice and all the requirements. I was waiting for them for more than 2 month and during this period they ignored my emails. Today they sent email and inform me they will refund my money within 60 working days. To whom wants use transferwise never trust them . they are a financial company that if you get any problem with them nobody will response you. you cannot talk with headquarter , you cannot complain. Try alternatives or keep your money safe and go directly to bank.

Did they tell you they did this?

Thanks it was a good notification, otherwise some body would consider them as a good financial banking service provider, High thumbs.

Transferwise is not a bank, and is new. Recently I opened an account with them.

However, I have concerns:

Who are they backed by, and how is your money protected?

I would exercise caution transferring any slightly large sums through them or similar companies, and instead revert to an established money broker, or a bank. I would hate to lose hard earnt money.

It’s unlikely that they are going to lose your money, they have very significant backing and are regulated. It’s true that you don’t have the deposit scheme guarantee which you would have at a standard bank, however.

Transferring large sums through them is not a problem, and will give you big savings versus banks on things like currency conversions.

Does HMRC accept receiving corporate tax payments from a TW Borderless account?

Do not know, but Curve does 🙂

Hi

transfer wise account was working with my PayPal , but recently transferwise change the account name holder adding (transferwise Fob (name)) , so it’s impossible to link it with paypal , anyone know alternative to transferwise ?

Thank you

I added a EUR Transferwise account to my business Paypal just ten mins ago using their website. No problem.

thanks I am waiting for my test transfer now

can you tell me how you setup with paypal because all I got was an error message

So here’s how it works, and I just did it for a friend less than 24hrs ago. Call PayPal customer service. Their number is +1-402-935-2050 if you’re outside the US. When you get the robot, tell her you want to speak with a customer agent. She’ll ask you a bunch of Yada yada, then tell her to add bank account.

She’ll also ask you to confirm your phone number and your credit ard on file. Once you do that, you’ll get a service agent who will remove the error thingy and you’ll be able to add your bank account.

I also asked someone to send me money via PayPal, I got it and sent it to Transferwise that same minute. It reflected one one business day.

Thank you for taking the time to share this information. I just called that number and was on hold for four hours (!) before giving up. Unbelievable. I’ll try again later this weekend.

So sorry about that. I’ve never been held up by PayPal. I’m not sure if it’s my location or something. I always call from my computer via my Gmail account. There’s a phone icon at the bottom of my email home page. I call and wait. Do try again. I hope it works. I’ve been using PayPal since I posted this and I’m really grateful.

Hello,

I’m from Italy and I tried to call the number you wrote here, but they can’t find any PayPal account associated with my number. My PayPal account is with the number I’m calling, so I think they check in PayPal US and not in the PayPal Italy.

How did you do that? They can find your account calling that number and checking your foreign cell number?

Hello,

I called the number you wrote here from Italy. They answer but the robot can’t find any PayPal account from the number I’m calling, which is the one matched with my Italian PayPal account.

I can’t set a TransferWise account in PayPal, the support told me that I need to open a US PayPal account to do that but I can’t do it, because I’m based in Italy.

Any idea?

Hi Andrea,

I don’t know why that is but I called from my Gmail desktop. I didn’t used my phone number but I did type it in when they asked. Keep trying or maybe try it with chat.

Let me know how it goes.

Hi Jean,

I just added my Transferwise Borderless account to paypal and it was accepted. I’m quite scared to send money in and I wanted to ask if you got that far with Paypal.

I can’t seem to link my Payoneer USD account directly but the GBP account works fine and I’m willing to foot the extra charges if it means I can use Paypal. I really need something to be able to sell courses online.

Please let me know what you think or if there’s a better way.

Thanks.

Have you tried Leupay.eu

No but it looks very interesting, have you used it yourself?

Hi Jean. Can you clarify one thing, I’m not entirely sure I understand, how is this solution better than having a normal bank account in a foreign currency in my own country?

Hi Karol, it’s free and easy to open. While you might already be able to open say a USD account in your country cheaply and without any issue at all, this is not the case for many others. Your bank might also charge other fees, for example for inbound and outbound transfers. With Transferwise already being better than banks for currency conversion, it is also very convenient to have all your different currencies in one place and being able to convert cheaply when necessary.