I love Spain. Living in Barcelona is the perfect fit for where I am currently in life. Anyone who’s spent their time as a digital nomad or perennial expat will tell you that some countries and cities will suit you if you’re after X, or you’re at Y point in your life.

I love Spain. Living in Barcelona is the perfect fit for where I am currently in life. Anyone who’s spent their time as a digital nomad or perennial expat will tell you that some countries and cities will suit you if you’re after X, or you’re at Y point in your life.

Of course, how much you feel at ‘home’ somewhere is subjective: my experiences are different from yours, and even different from others walking the same path as me. You need to dive into a place to see whether you want to live there and I firmly recommend trying before you buy: spend at least 3 weeks in a place to really get a feel for it.

With all that being said, I feel like it’s time to compare the lifestyles in two countries that are well-known for their fantastic coastlines: Spain and Australia. Previously, I covered living in Spain vs USA, but personally, I believe this match-up is a little more equal.

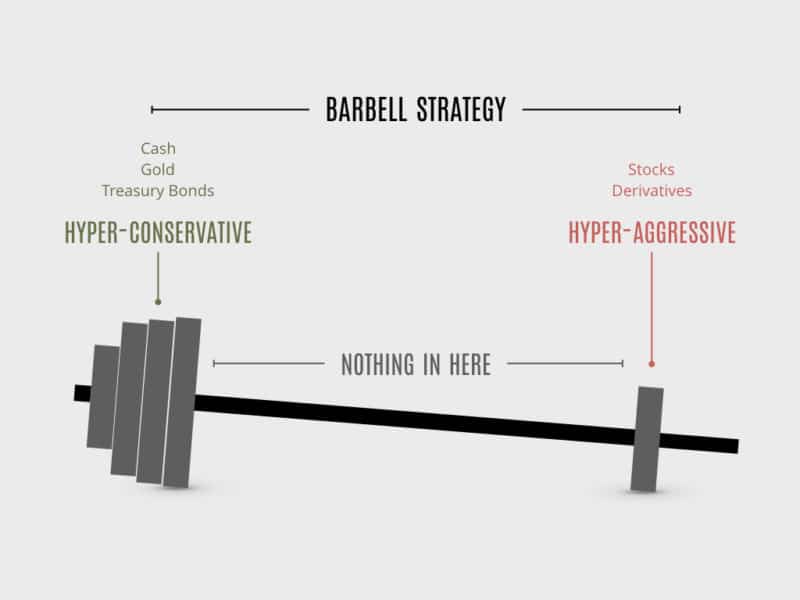

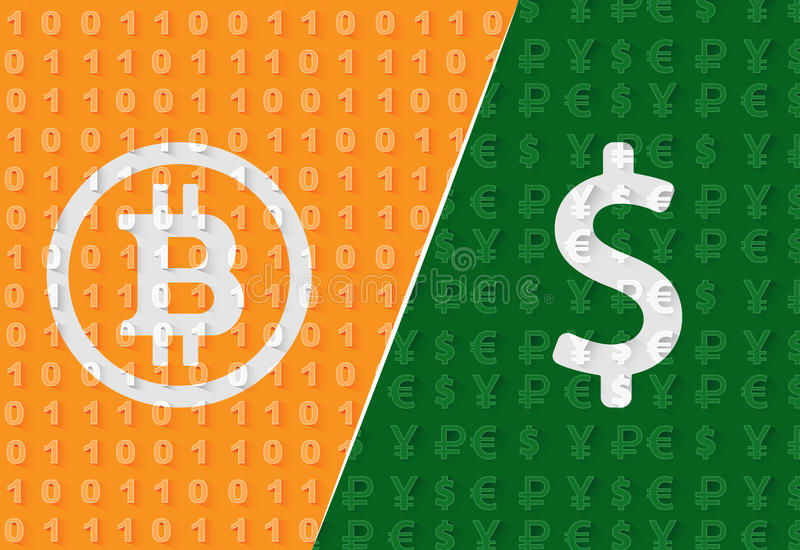

In both traditional and crypto markets, there are all sorts of proverbs to help investors navigate through the volatility. You may have heard phrases like “don’t put all your eggs in one basket” or “only invest what you can afford to lose.” While these are certainly nice little reminders, they do little in terms of depth and detailed explanation. That’s where the Barbell Strategy comes in.

In both traditional and crypto markets, there are all sorts of proverbs to help investors navigate through the volatility. You may have heard phrases like “don’t put all your eggs in one basket” or “only invest what you can afford to lose.” While these are certainly nice little reminders, they do little in terms of depth and detailed explanation. That’s where the Barbell Strategy comes in.