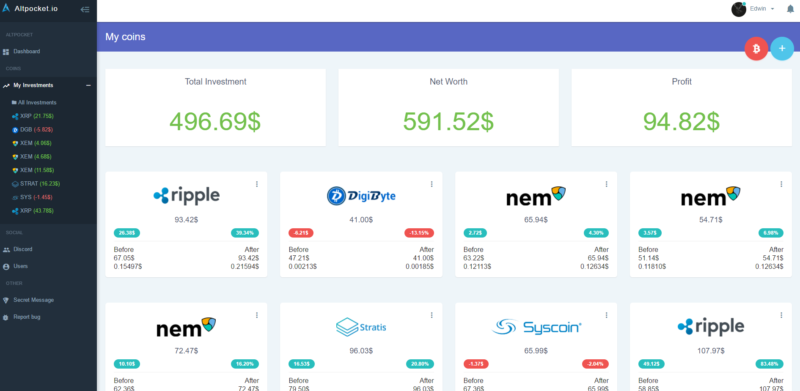

With thousands of crypto tradeable assets available, it is hard to keep track of your crypto portfolio these days. Even if you’re just buying and selling one or two different coins, you can quickly lose track of things, especially if you’re using several crypto exchanges or trading apps like Coinbase, Binance etc. Not to mention if you’ve been dabbling around in DeFi and DEXes like Uniswap and Sushiswap.

It is also important to track other crypto-related activities, for example when earning interest on your crypto through platforms like Nexo and YouHodler.

You could also be using one of the various crypto debit and credit cards, like Crypto.com, where for tax purposes you will need to keep track of every single purchase done with your card.

As you can see, it is important to know your positions in an easy way, and there is no better way than to use an app or software solution.

You need to know where you stand at all times:

- to keep track of your overall investment

- to be prepared when tax time comes along

Here are my favorite portfolio tracking and tax preparation tools.

CoinTracking

This is one of the earliest and most complete services available out there. They have two offerings, one for crypto traders and the other for crypto companies.

See also: My detailed review of Cointracking

CoinTracking.info has one of the most extensive customer service areas I have seen on tax reporting platforms. It has an elaborate documentation section that covers almost every question you might have. It also has a separate FAQ that caters to the most commonly asked questions.

There is even a CoinTracking.info robot ready at your disposal. This is all aside from the typical customer service tools such as communities, live chat, video tutorials, and email contact. There is also a demo version of the website available that can give you a good idea of what to expect once you start using the platform.

Of course, CoinTracking also calculates crypto taxes every year for you. Given that it’s still so hard to find competent accountants who understand crypto (plus it would be very expensive), it’s well worth it to pay for a tool like this that prepares everything for you. At any point, you can review your tax summary, and download the reports you need to file your taxes. CoinTracking is seamlessly integrated with TurboTax and your accountant’s software. Full support is offered in US, UK, Canada, Australia, and partial support for every other country. They are adding full support for other countries too, so check out the site for the latest list.

I’ve spoken to the founder of CoinTracker on my podcast Mastermind.fm, so check that episode out if you’re interested in learning more about the platform and crypto taxation in general.

You can not only connect it to your exchanges to pull in all the data about trades you’ve made, but you can also mark transfers to your Ledger Nano or other cold wallets so that they are not deducted from your overall balance.

In terms of exchanges, they practically support every exchange out there, including my favorites Binance and Binance. You can import your data automatically via API or upload a CSV of all your trades. Cointracker uses read-only access to your exchange accounts to protect your funds. That is very very important as it means that Cointracker will never have any permission to operate with your crypto.

Read more: The Best Books about Bitcoin and Crypto

This service offers a broad and comprehensive analysis of your crypto portfolio – which allows you to manage all your digital currency accounts at once.

Moreover, its longstanding reputation has allowed the CoinTracking.info team to update the platform regularly to cater to the changing needs of the crypto community.

To ensure the provider is right for you, CoinTracking.info also offers a free account to help you understand whether the platform can fit your tax reporting needs. Overall, CoinTracking.info comes across as one of the most efficient management tools you can use for your crypto portfolios.

Get your 10% discount on Cointracking plans

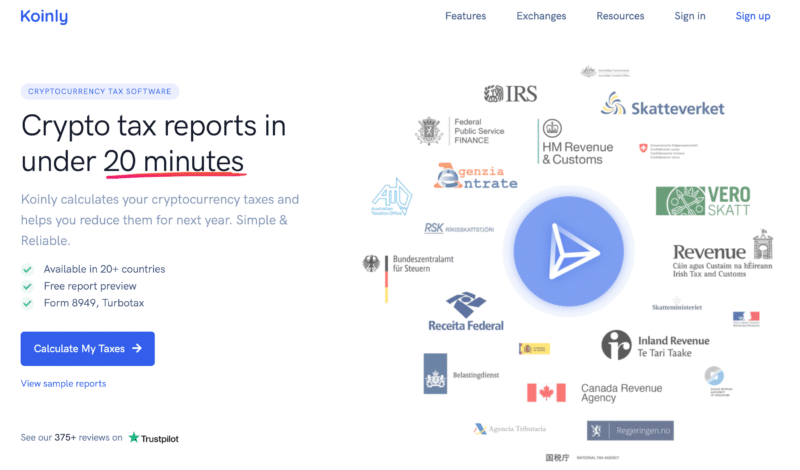

Koinly

Koinly was established in 2018 and has already generated more than 11,000 tax reports for its clients.

I like it since it’s not 100% US-focused, and as such you can use it to prepare your German, Italian, Spanish, French taxes along with many other countries. The team behind Koinly is composed of tax lawyers, accountants and engineers who study the tax implementations of many countries and make sure the software can support these systems as well as a plethora of worldwide exchanges.

See also: My detailed review of Koinly

Koinly automatically imports your transactions, finds all the market prices at the time of your trades, matches transfers between your own wallets, calculates your crypto gains/losses and generates your tax reports.

Cointelli

Cointelli is one of the most recent additions to the crypto tax reporting tools and to date, it is only available to US-based crypto investors who are after obtaining automated US-tax reports.

Cointelli is one of the most recent additions to the crypto tax reporting tools and to date, it is only available to US-based crypto investors who are after obtaining automated US-tax reports.

Established in 2021, Cointelli’s service is intended to ease the pressure of accurate tax reporting by automatically compiling your transactions from across your wallets and exchanges. Once it generates your transaction list, Cointelli’s software will consequently help you to easily fix any errors therein, prepare a comprehensive report for tax purposes based on the latest tax provisions and have it sent out to your accountant or other relevant tax platforms.

Apart from freeing up a great deal of precious time, Cointelli places a lot of effort into helping you generate the required stats and reports as accurately as possible, thus saving you from paying any unnecessary tax.

Cointelli’s pricing structure is lean with a one-size-fits-all price for consumers and customized packages for large transaction-volume enterprises. For a flat annual fee of $49, clients can benefit from all the Cointelli suites and services for up to 100,000 crypto transactions, be it DeFi, margin trades, or NFTs. This is very competitive pricing, particularly when a number of other platforms offering similar services, already start charging a higher fee as soon as transaction volume exceeds 100.

Cointelli also scores high in terms of support. It not only offers customer support via email and chat widget, but also provides 24/7 live customer service with dedicated tax experts.

Get your crypto tax report with Cointelli

CryptoTaxCalculator

- Direct support for hundreds of exchanges, including Binance, Coinbase.

- Handles staking rewards, airdrops, margin/futures trading, perpetuals, lost/stolen funds, ICOs, and much more.

- Direct support for DeFi protocols such as Uniswap, PancakeSwap, Binance Smart Chain.

-

Pricing is an annual subscription, and you can cancel anytime, with a 30 day money back guarantee.

-

The plan covers all historical tax years so if you need to amend your tax return for previous tax years the plan has you covered.

- Prices range from $49 (100 transactions); $99 (2,500 transactions); $249 (10,000 transactions), $399 (100,000 transactions).

Open an account with CryptoTaxCalculator

TokenTax

TokenTax is a crypto tax software platform and a full-service cryptocurrency tax accounting firm. This tool also takes care of tax-loss harvesting. If you hold assets at a loss, then you can save money on your taxes. TokenTax’s Tax Loss Harvesting dashboard tells you exactly how much losses you can claim by strategically selling off assets.

Read more: My in-depth review of TokenTax

Tax loss harvesting is selling off assets you hold at a loss to reduce your capital gains. When you reduce your capital gains, you owe less taxes. And, if you take a loss in crypto, you can offset other capital gains in assets like stocks.

Support for margin trading is also included.

Cryptotrader

CryptoTrader.Tax takes away the pain of preparing your bitcoin and crypto taxes. Simply connect your exchanges, import trades, and download your tax report in minutes.

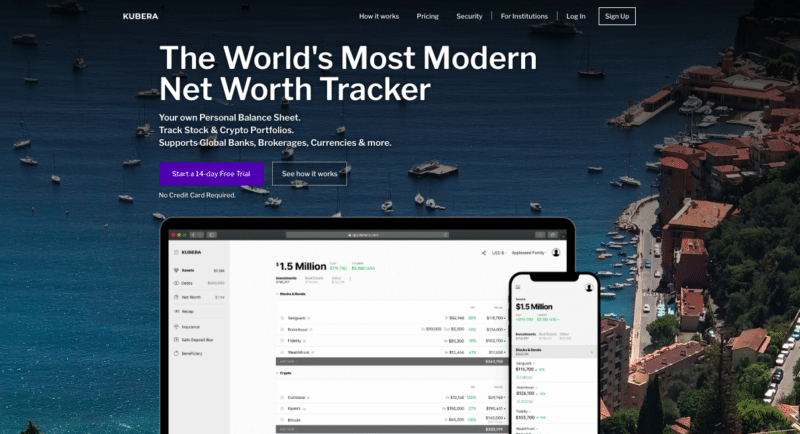

Kubera

Kubera helps you to organize all your wealth in one place and keep regular track of your net worth in a very simple intuitive way. In fact, Kubera is a more holistic tracker than the above platforms in that apart from automatically tracking your crypto position and NFT holdings, it also captures your bank and brokerage accounts, real estate, vehicles, domains and metals. Kubera also allows you to manually input any other assets you own so that you can obtain a comprehensive view of your net worth in real-time.

Kubera will also provide you charts with analytics showing you how your net worth and investments changed over time. Every update to your asset value is kept in history to go back in time to see how you fared. It also allows you to keep an eye on the asset allocation and statistics indicating which asset experienced the highest appreciation or depreciation.

Kubera also calculates accurate rate of returns (IRR) for all your investments based on the multiple contributions & withdrawals and the time invested. It also benchmarks the IRR with the returns from popular indices and tickers (S&P 500, Dow Jones, AAPL, BTC etc.).

See also: My detailed review of Kubera

Another handy feature of Kubera is the possibility to store important financial or asset documents on the platform.

Through Kubera you will also be able to share a read-only link of your portfolio with others. In addition, with Kubera’s “Life Beat” feature you can allow portfolio and document access to your beneficiary of choice, however only after extended periods of inactivity.

How to Easily Prepare Your Crypto Taxes

So you’ve fallen down the crypto rabbit hole, started buying and selling some Bitcoin, then bought some Ether, and perhaps even ventured further to buy some other altcoins.

After some time, seeing that you’re profiting massively, you decide to sell some of your tokens. Sometime later, you decide to buy a new token that you believe will revolutionize the world.

The problem is, of course, keeping track of all these purchases and sales. You want to keep track of whether you’re actually turning a profit or not, plus you need to calculate what you owe your country’s taxman at the end of the year.

Crypto taxes are a complex topic, but I’ve done my best to summarise the situation in several major countries, so check out my post on how Bitcoin and other cryptos are taxed around the world.

So what are your options for crypto tax preparation?

You could keep track of things manually using a tool like Excel, but this quickly gets out of hand, especially if you’re trading on multiple platforms or have multiple wallets.

The better solution is to use an online crypto tax preparation tool.

All the tools mentioned in this post can help you in preparing your taxes apart from acting as a handy crypto portfolio.

If you’re preparing your crypto taxes for the first time, I would suggest you check out my favorite portfolio/tax preparation tools:

Depending on what your needs are, what jurisdiction you’re in, and what your budget is, you can choose one of those platforms. All three of them are excellent and run by serious people, so you cannot go wrong.

What’s your favorite crypto tax preparation tool?