In both traditional and crypto markets, there are all sorts of proverbs to help investors navigate through the volatility. You may have heard phrases like “don’t put all your eggs in one basket” or “only invest what you can afford to lose.” While these are certainly nice little reminders, they do little in terms of depth and detailed explanation. That’s where the Barbell Strategy comes in.

In both traditional and crypto markets, there are all sorts of proverbs to help investors navigate through the volatility. You may have heard phrases like “don’t put all your eggs in one basket” or “only invest what you can afford to lose.” While these are certainly nice little reminders, they do little in terms of depth and detailed explanation. That’s where the Barbell Strategy comes in.

The Barbell Strategy, made famous by the author, statistician, and trader Nassim Nicholas Taleb, is a portfolio balancing concept that involves keeping some part of your portfolio in low risk and stable assets while allocating another part to profit from market movements. Today, we’re going to cover the basics of this strategy and how to use it in real life on a platform like YouHodler, which is one of my favorite platforms for crypto lending and borrowing.

The Barbell Strategy: Understanding the Basics

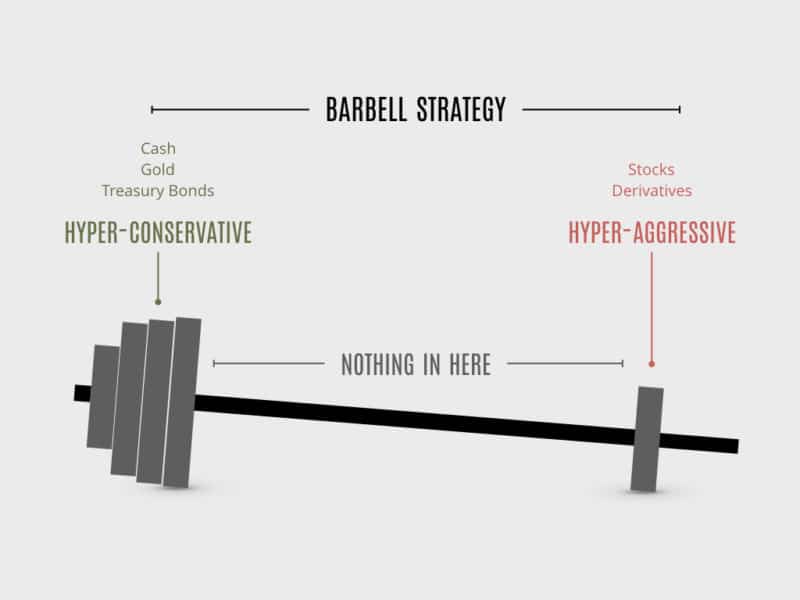

What comes to mind when you first hear the term “barbell strategy?” Most likely, you think of some buff weightlifter in a gym attempting to find the perfect balance for his barbells for a more efficient workout. You’re not necessarily wrong in picturing that image but fortunately, the Barbell Strategy of this article requires no exercise whatsoever.

Much like a barbell in real life, the Barbell Strategy involves finding a perfect balance between assets to ensure you have the most efficient and profitable portfolio possible. On one end, you have investments with low risk and low reward potential. On the other, higher-risk assets with a potentially higher reward.

To use an example from the traditional world of investing, a portfolio using this strategy could consist of higher yield, short-term bonds on one side, and long-term, lower yields on the other.

Let’s see a second example with stocks. In this case, one side of the portfolio would consist of the top 10 stocks on the market while the other side consists of high quality, but low-performing stocks on the other. There is no middle ground here.

The barbell strategy doesn’t have to be a 50/50 split per se. It all depends on the investor’s personal level of risk. For those that want strong protection against big market swings, then the majority in safe, stable assets is a wise choice, but at the same, time you can miss out on huge opportunities for profit playing with volatility. Again, this part is all up to you and should be taken into consideration before practicing this strategy.

Why would someone want to use the Barbell Strategy?

Are you ready for an unsettling fact? Here we go. No one can predict the markets. That’s right. Even those “expert analysts” and their fancy Fibonacci sequences, “head and shoulder” patterns, etc. are more or less guessing the future based on past behavior. Sometimes they are right but sometimes, they are very wrong.

Hence, it’s more valuable if you spend time learning how to balance your portfolio as opposed to learning how to predict the future. The Barbell Strategy helps you with this. If you learn to design your portfolio in a specific way, then you can protect yourself during bad times and gain heavily during good times. The idea here is that the investments that are low risk can help absorb the bulk of the damage done to preserve your capital while the risker assets can carry you to great profits during bullish markets.

So now that we understand the basics of the barbell strategy in traditional markets, let’s put this philosophy into action using cryptocurrencies and stablecoins.

A carry trade or “carry trading’ is a unique trading strategy where one takes a loan at a low-interest rate and then takes that loan to invest in an asset that provides a significantly higher rate of return. It’s a strategy that has been used in traditional markets for many years between various fiat currencies but lately, many cryptocurrency enthusiasts are using this same strategy with a twist. It’s time to introduce yourself to the crypto carry trade.

A carry trade or “carry trading’ is a unique trading strategy where one takes a loan at a low-interest rate and then takes that loan to invest in an asset that provides a significantly higher rate of return. It’s a strategy that has been used in traditional markets for many years between various fiat currencies but lately, many cryptocurrency enthusiasts are using this same strategy with a twist. It’s time to introduce yourself to the crypto carry trade.