I’ve been involved in the web industry for around twenty years, and one thing that’s always fascinated me is the possibility of buying and selling websites. I’ve touched on this in my guide to investing as well. While this has perhaps been the domain of technical people 10+ years ago, in the last few years we’re seeing this type of investment hit the mainstream.

I’ve seen funds operating exclusively in this niche, whereby cash-rich investors would pour money into the fund, and the fund would then have its management team that would work on growing the portfolio of sites and then resell them for a profit, thus providing returns for investors.

The other option is to buy a website directly and either manage it yourself or build a team that can manage it for you. I’m seeing more and more people take the dive. As the web has become more user-friendly, non-technical people have built up the courage to learn the skills needed to manage a website and thus be able to switch industries or else build a profitable side income to supplement their day job.

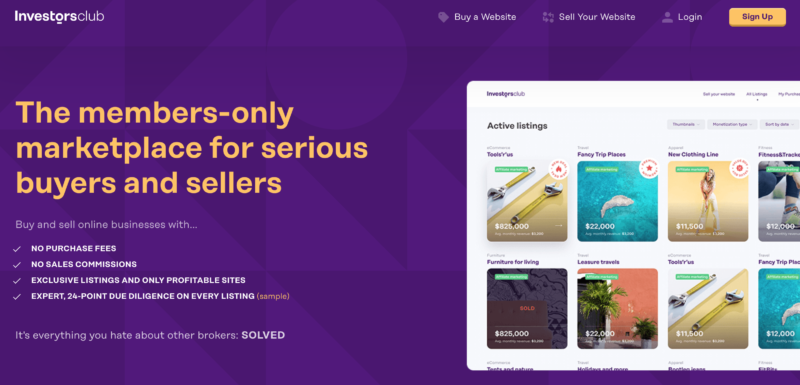

I’ve written a post on the best places to buy and sell websites but I recently came across the new project of Andrej Ilisin: Investors Club.

So when I heard about his new project that aims to make buying and selling websites a more pleasant and safer experience, I reached out to him to see if he would be willing to share his knowledge on the topic.

So without further ado, here’s Andrej’s guide to website flipping and investing in digital assets. Both myself and Andrej look forward to reading and replying to your comments.