Spain always has a healthy property market, despite some ups and downs. It’s probably the best place to live in Europe if you value quality of life, and there is a healthy influx of expats who want to own good properties in the peninsula.

Real Estate crowdfunding platforms, therefore, fit perfectly in the scenario that is developing. They allow small investors to participate in the real estate market by pooling investors’ money to purchase property that is later resold or rented out.

In 2008 Spanish real estate took a big hit in the well-publicized crisis, wiping out many people’s investments when the bubble burst and decimated the value of properties countrywide. Some areas were worse hit than others, but prices were down throughout the country.

Since 2016 we are seeing strong signs of recovery, and the purchase prices of properties in the big and affluent cities (Madrid, Barcelona, Valencia, Palma de Mallorca) have now reached pre-crisis prices. Rents are also strongly climbing, making it altogether a great time for real estate investment. Of course, we need to be careful to avoid another bubble, but that’s another discussion altogether.

Crowdfunding in property involves a number of investors pooling their money together to purchase a property. The crowdfunding platform usually manages the refurbishment and eventual rental of the property and takes a cut for this work. There is also a target date for the resale of the property. As investors, we are therefore looking for rental income as well as a profit on the growth of the value of the property.

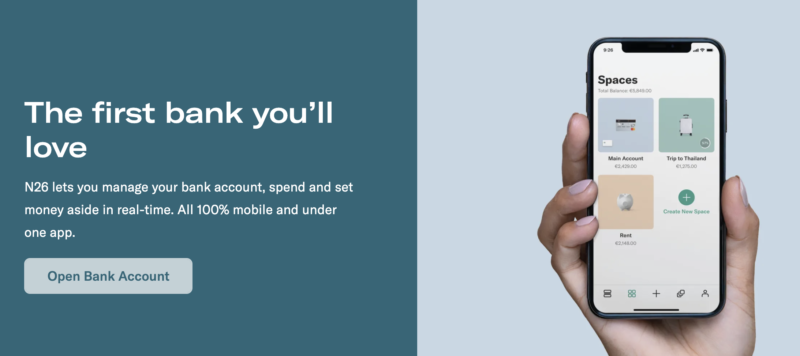

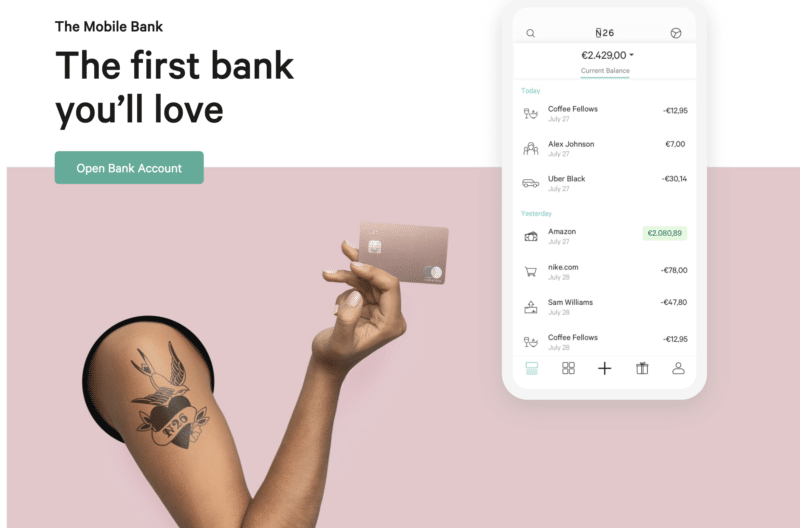

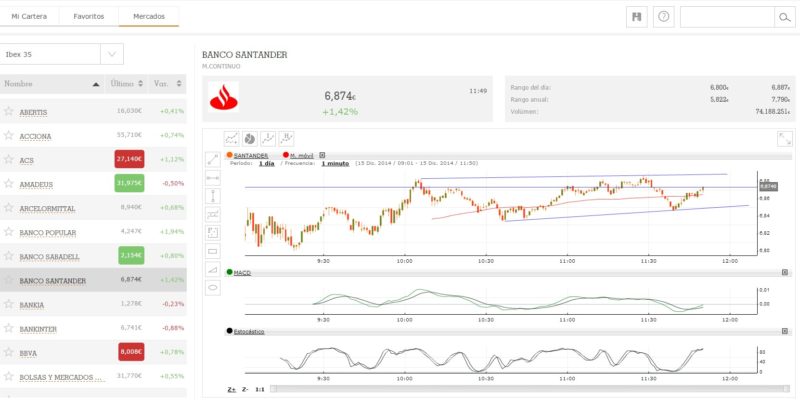

Here are my top favorite platforms that operate in Spain:

I am using practically all the major Spanish real estate crowdfunding platforms as they’re all a bit different from each other. In general, it’s also a good idea to diversify across multiple platforms to protect against platforms going out of business, although that has a low probability. What’s more probable is that a platform gets greedy and forgets to do proper due diligence on new projects, as happened with Housers, which had started well but ultimately became a marketing machine sucking in the money of new investors with zero knowledge of the property market.

From the tax perspective, earnings are based on the Savings tax bands in Spain:

- 19% for €0 – €6,000

- 21% for €6,001 – €50,000

- 23% for €50,001+

As a beginner investor, you will most likely fall into the 19% tax bracket, and the property platforms will automatically deduct the tax from your returns. This is called a retención in Spanish. You will still need to declare these profits in your annual tax return (IRPF). The platforms mentioned in this article all provide documentation showing what you earnt and what retentions they made.

Both new and pre-owned properties are liable to another tax called Actos Jurídicos Documentados (AJD) (Stamp Duty), which represents 1% of the deed price of the sale, plus another 1% of the mortgage. You will have to keep these in mind as well as possible cuts on your final return.

Let’s move on to exploring these platforms then. [Read more…]