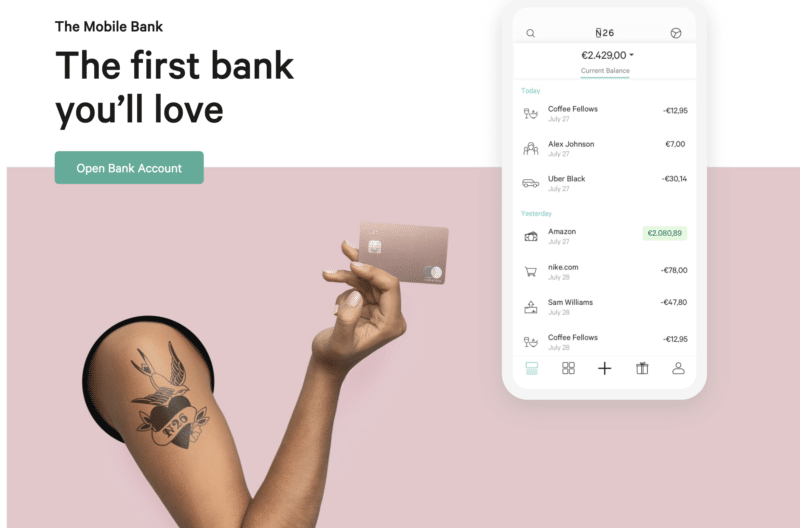

In an earlier post on this blog, I had talked about the best commission-free Spanish banks, and eventually came to the conclusion that the best option is to actually open an account with N26, which is a German bank that offers us the ability to open an account in a very straightforward way and manage everything from a mobile app.

Unfortunately, as some of you have pointed out, many Spanish companies refuse to accept non-local IBAN accounts for payslips or direct debits, leaving the majority of us with no option but to find a local bank to conduct our transactions.

N26 has decided to start offering Spanish IBAN accounts to their Spanish customers in 2019, solving that issue. For those who sign up through the link below from now onwards, you will automatically get a Spanish IBAN immediately.

For those of us who have signed up with N26 some time ago, we will unfortunately not get the option to switch to a Spanish IBAN. The only solution is to closer your current account and open a new one with N26, and then you will get a Spanish IBAN assigned.

Further reading: Best Online Banks in Europe