If you have a PayPal account that you regularly use for collecting payments, and your main home currency is not US dollars, you would do well to read on.

Not too long ago, I had written about biding your time to get the best exchange rate possible when transferring your money from PayPal to your bank account. Soon after that, I discovered that there is another area of optimization which we should be aware of.

My home currency is the Euro, so my bank account uses Euro by default. Online I collect payments in USD since that’s the de facto currency on the web. That means that when it’s time to get the gold home I am subject to conversion rates when changing from USD to Euro. This is precisely where many people lose a good chunk of money, so you have to be careful.

Since your bank account is in Euro and your PayPal account is in USD, a conversion needs to take place. Now it’s a well-known fact that PayPal currency conversion rates aren’t the best; they incorporate quite a healthy profit for themselves here. So it might actually be better for you to let your bank handle the conversion at their exchange rates.

All you need to do is check out your bank’s exchange rates, make your calculations on how much Euro they would give you for a given amount of USD, then compare it to what PayPal would give you via their currency converter.

Beware also that some banks charge an extra fee for currency conversions. My bank charges around 1 Euro each time there is a conversion.

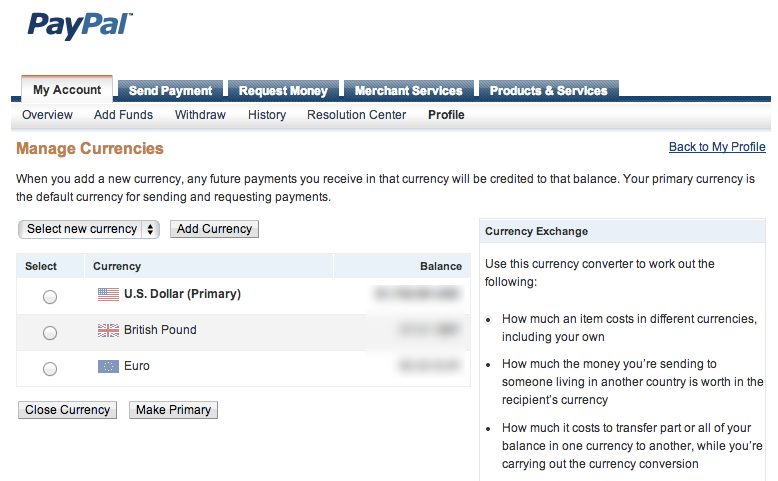

If you establish that it would indeed be beneficial for the bank to handle the conversion, you can change your PayPal account from being Euro-based to USD-based via this link.

On a related note, you can check the net amount you will receive from a PayPal money transfer via this PayPal fee calculator. Sadly, it appears that the calculator’s formulae are a bit out of date as the net amounts didn’t exactly correspond when I tested it on my account.

Note that if you have a Europe-based USD bank account, you will not be able to send USD directly from PayPal to that USD bank account. There will always need to be a conversion happening on the bank’s side, and the money will then go to your Euro account. You can try your luck with linking a multi-currency account like Wise Borderless to go around this issue, but it doesn’t always work.

As a test, I made a few transfers of $2,500 to my Euro-based bank account just to test the difference in money between using PayPal’s exchange rates and those of the bank.

Here are the results:

- $2,500 converted to Euro by PayPal: €2,171.92

- $2,500 converted to Euro by my bank: €2,216.06

Crazy huh?

More than €44 difference on each transaction!! That’s around 2% more added cost on each transaction. Keep in mind that PayPal is already charging you $2.50 per transaction as a fixed fee.

It definitely works better for me to use USD as my PayPal account currency, then withdraw directly in USD to my credit card. Note that changing your withdrawal currency has to be done manually by following my guide.

Buying Crypto with PayPal

Did you know you can now buy crypto with PayPal? That’s right, you can use Binance since it accepts PayPal deposits. Just hit the links below to get started.

You can also read my full review of Binance to learn more about this crypto exchange.

This withdrawal method is extremely popular at the moment, as people worldwide seek to get themselves some Bitcoin or Ethereum due to their extremely bright future price prospects.

Note: If you have any questions after reading this and the several other articles relating to PayPal on this site, please leave a comment or contact PayPal directly. Unfortunately, due to time constraints, I am unable to offer any advice over email so all emails related to PayPal will remain unanswered.

As for transferring money from Paypal to a local account, here’s their reply which I find not that clear to understand. I post it as I received it. Thanks

Dear james borg,

Thank you for contacting PayPal regarding your withdrawal.

I have reviewed your account and it shows me that your account is registered in Malta.

PayPal provides different features in each of the countries where our services are offered. Currently, our customers in Malta can withdraw their funds to U.S. bank account in USD or to their local bank account in EUR.

I wish you productive day!

It is my pleasure to assist you. Thank you for choosing PayPal.

Yours sincerely,

Vladislava

PayPal

Yes that is correct, that’s how things stand for Maltese businesses at the moment.

Great News Jean, a breakthrough for me and here’s the reply:-

Thank you for contacting PayPal regarding the withdraw of funds.

I have received your request to change the currency of your credit card ending xxxx to USD. This is now complete and the currency of your card has been updated in your PayPal account.

We are unable to refund the currency conversion losses you incurred with your past transactions but all your future payments for that card will be charged in the correct currency.

Please remember to notify us if you add any other cards denominated in a foreign currency in the future.

It is my pleasure to assist you. Thank you for choosing PayPal.

Will the same thing apply to a debit card?

Hi Jean,

I am Maltese, I received small payments but still when I go to BOV I’ve asked them several times if they accept payments from paypal in USD if I open a USD account with them. However they’ve told me that I still need to convert the money in euro and then convert it once more in USD savings or deposit account. I am intrigued how you succeeded to do it. I think from your credentials that you can develop some payments from mobile to mobile for example as paypal is fearing this move and they want their chunk of money. I will leave you my email if you have time to contact me.

James

Hi James, I updated the post to make this point clearer, but in essence what BOV are saying is the way things stand at the moment. There is no way to do a direct USD transfer from PayPal to BOV nor any other account at a Maltese bank for that matter. There will always be a conversion needed. My understanding is that this is the way it works across all European banks, although I’m not sure why exactly it is so. Perhaps another reader can enlighten us on this matter.

Jean just this morning I went to BOV and now they changed their version i.e. I can open a USD account and transfer money in it but I have to give them a proof that it is money made in a legal way and FS3 and 3 payslips. They told me that I have to contact paypal and they check if they can send payments via iban number. Can you contact Paypal and enlighten us as I did the first part and you can verify it but I need help on the second part. Does Paypal accept to send money through an iban number? Please help?

Thanks

James

That’s an interesting development. I will double check with PayPal and get back to you.

Thans Jean, it will really be a breakthrough for both of us!

So I tried adding my own USD bank account from a Maltese bank, but PayPal doesn’t allow it. I will send them an email anyway to confirm fully that they don’t allow it.

Here’s the official reply from PayPal, confirming my experience:

“Regrettably at this time we only offer withdrawals in EUR to Maltese local bank accounts regardless of the currency set on the account.

However, you are still able to withdraw your funds to Visa debit or credit card from your PayPal account in USD once your Visa card is updated to USD currency on your PayPal account.”

I have contacted paypal to stop automatically converting my USD to Euro and to send my money directly to my account in USD. I have already send them email. Let’s hope for the best as with Paypal you’re taking a Russian roulette shot.

Thanks Jean and will keep you updated.

Sent from Mail for Windows 10

Hello,

Untill two week ago I could make withdrawal to my credit card in USD without any conversion fee, but for my last withdrawal PP made the conversion to RON,my local currency as I’m based in Romania,even if I have two bank accounts linked to that credit card,one in USD and one in RON.I will contact PP via email and get back to you.

The strange thing is that they didn’t even send an email to let me know about this change and for that matter for the reasons behind it.

Switching currencies doesn’t help… the only way to withdraw in USD (if not in the US or Canada) is to send to a card. If you are outside the US or Canada and try to send to a bank account, they always convert the USD to the local currency (EUR in the EU).

Withdrawing to a card and to a bank account are two different things… but I see you’ve already acknowledged this in some other articles.

Paypal suck!

i tried this. my bank was ok with it. but paypal refuses to send US dollars to countries that are not the US.

Make sure you are withdrawing to your debit or credit card not to your bank directly. In that case they will allow it.

This would be okay, but paypal will not allow withdrawal to uk debit or credit cards!

That’s true. switch to Payoneer they offer low bank transfer

I’m based in Slovakia so my bank account is held in Euros. Does it mean that I my PayPal account should be set to USD as long as I’m receiving the payments in USD? So that when the withdraw will take place (via debit card) the conversion will be made within my bank’s terms? Thanks a lot in advance!!

20/10/2016 – PERSONAL ACCOUNT

The paypal chekout page no longer has the option to change the conversion options. By default you use PayPal’s conversion. They make huge money with this.

They don’t want us to know how to change to “Bill me in the currency listed on the seller’s invoice.”

I talked to them (via email) and they didn’t give me any solution, so that I would continue to pay with Paypal’s conversion.

SOLUTION, after searching, searching and searching:

1. Login to Paypal account (you are in the page “SUMMARY”

2.Right side of the page there are two icons:

– one bell (stands for “Notifications”)

– one gear (stands for “settings”)

– click on the gear “settings”

3. Then there is (from left to right):

Account / Security / Payments / Notifications

– click PAYMENTS

4. Left side there is “Manage pre-approved payments”

– click in it

5. In the next page “My preapproved payments” there is a rectangle, a text box.

In the right side of the box there is on blue and underlined the option:”Set Available Funding Sources”

CLICK ON IT!

6. Next page: Manage Funding Sources

In front of the credit/debit cards you will find blue text underlined that says “Conversion Options”

-CLICK ON IT!and we are almost there!!!Jesus thanks

7. At last but not the least we are on “Conversion Options”

– you just have to CLICK on “Bill me in the currency listed on the seller’s invoice.”

You choose the The MasterCard and Visa currency conversion process.

ALL DONE! MONEY SAVED! GOOD SHOPPING!

AND THAT IS ALL FROM PORTUGAL!

Thanks for the tip Carlos!

hi

Thanks for sharing . but i tried and i saved as Bill me as per invoice . but still when going to send a payment its showing again its own conversion.

any other solution ?

Awesome carlos!!

Hi,

first of all big respect for all your help in here and apologies if this has been answered, I spent a good amount of time and didnt find the answer.

I am based in the Czech Republic where the currency is CZK. Have a business account and need to withdraw Euros. Only bank transfer is possible and I cannot add any different account than a CZK one. Tried changing country of the account with no luck. Any way out?

Many thanks.

You’re welcome David. If the situation is as you described I’m afraid there’s no other way to do things. I would contact PayPal anyway and try to see if there is a credit card option hidden somewhere. With the credit card withdrawal option you would be able to request that automatic conversion be switched off.

Another alternative would be to accept payments via Braintree instead.

Hello i am living on Greece and i am searching for days to avoid Paypal’s withdraw currency rate.In my country i can only withdraw to bank account.As i have read above if i open a bank account that accepts dollars and it is based ouside of US Paypal will charge me twice.But if i have a bank account inside the US and buy a US address and telephone number can i withdraw funds to it?

Yes, I believe that should be possible but I haven’t tried it myself. Let us know how it goes.

I was wondering. Do you know if there is alternative for paypal ?

If would be possible transfer money from paypal to another company , then do there conversion of currency and withdraw

money to your credit card or home country bank.

What about transferwise? Somebody mentioned that.

Yes Transferwise would be ideal for that case.

You cant deposit money into transferwise from PayPal so this is not possible.

I have been Googling for days how to bypass paypals currency rate and here is what I have learned.

PayPal accounts are country specific.

If your account is UK based and you receive USD there is no way to avoid paypal converting your USD to GBP.

You can ask your bank to accept dollars or euros is doesn’t matter, paypal will still convert it, its how they make their money.

Jean seems to be doing it differently, he is withdrawing his paypal balance to his credit card. This is not possible in the UK. You can only withdraw to a bank account.

There is only a few ways around this as far as I have found

You need a bank account based in the country of the currency you receive your funds in, you would then need to set up a paypal account for that country and accept payments to that paypal account from now on.

Once you have your money going into your new countries bank account you can then use a service like Transferwise to convert it at a better rate and avoid paypals rate.

Another option I am looking into but still do not fully understand well is using a Forex platform to either trade your currency or bitcoins.

Agreed, PayPal rules change from country to country so what I have been able to do may not be possible in other countries.

I’ve changed my PayPal settings, and now USD is primary. But when I try to transfer the money to my bank account, PayPal still converts it into euro’s.. Now I’m missing out on money because of their inaccurate currency rates .. How can I change this ?

You need to contact them by email as I described in the post.

Paypal is robbing the hell out of all the world via monopoly tactics. This sucks.

Hi,

let me share with you my last experience with PP. I am living in EU, I have my bank account in EUR and have EUR credit card. And, EUR is the primary currency of my PP account. Last 2 months I paid for some flights where the invoice was published in EUR. To my big surprise, PayPal converted the amounts into USD and charged it against my Credit Card which converted the sums back into EUR using their rate.

Altogether, I paid 12% more than I was originally charged! This is an incredible rip-off. I wrote 2 complaints to PayPal asking them to pay me back the amount which I have lost. So far, no reply.

There’s a department in the US government that you can complain to, strongly though politely, along with a carbon copy to paypal. Let us know how it goes and good luck…

Hi. I also have the same problem, I mostly want to transfer GBP to EUR and paypal is taking almost 4% in currency converter. I Called to my local bank and what they take to change currency is less then 0,5%. Totaly diff… Called paypal asking to not change currency automaticaly, They said it’s their policy and they can’t change it, sended email and this is the answer:

“Thank you for contacting PayPal regarding withdrawing funds.

Due to the bank regulation, you are only able to withdraw funds in your local currency. Any funds withdrawn from your balance in another currency will be converted.”

I am being forced to combat this, this is a huge robbery 🙁

Hmm, I can’t exclude that things have changed since I got them to bypass the automatic currency conversion, but if they now refuse I would agree that it is daylight robbery.

HI, I have the same problem with USD and EUR. I am Czech based and PayPal does not allow me to register other account/credit card than in CZK. After my CZK credit card expired, I wanted to register EUR czk and the account related. Imposssible! So, now I have funds on PayPal account which I can not withdraw because of PayPal silly rules, which they ILEGALLY call Bank Regulations. When I have asked which Czwech bank regulation does not allow me to receive EUR or USD to my EUR or USD account, PayPal did not replied. PS. Is there any internation authority which can deal with such complaints and behaviour?

Your PayPal fee calculator link at the bottom of the article is infected with a virus or something as the page was blocked by my Avast hardware,

I recieve in multiple currencies and use PayPal like a stockmarket almost..Paypal takes 2% of the exchange rate as there cutt..So there are ways to combat this ,i wont get into specifics,but it all comes down to when paypal updates there rates and when you update yours in your echo system…the only way to really stay on top and come out even or a little ahead is to play paypal like an exchange.

with every transaction i face these problem. these time they cut half dollar. i transfer $18.92 into my bank account in india. in PayPal exchange rate i got 1129.69 INR, but same time i check onlink exchange rate it was 1170.89 INR. PayPal cut my 41.2 INR. but ts small amout

Thanks for the advice Jean.

Would it be best to ask people to send payments in Euros? Then you wouldn’t incur any additional currency fees would you?

Yes that’s right Jamie if the flow from customer to PayPal to bank account is all in Euro there would be no currency conversion fees, and actually you would also be saving on the fee PayPal charges for payments made in different currencies e.g. if you PayPal account is in Euro and the client pays in GBP.

Great! I will start asking for payments to be made in my default currency then.

What if the person paying default currency is USD, but sends the payment as Euros, is it them that incurs the conversion fee and not the seller?

Cheers!

Jamie as I suggested elsewhere you should be selling your products or services in the currency that most of your clients are using. That’s from a marketing standpoint, if we don’t consider that then it would be better to sell your products in your own currency (EUR), however it is not advisable to do that as people generally prefer paying in their own currency.

With regards to charges for cross border payments, I am digging into this further to make sure I give you the correct information, expect a post about this topic in the next few days.

Sure I get that, but for example if freelancing for a company in a different country, there is no harm in asking when invoicing for the bill to be paid in Euros, even if they reject. At least then it’s them who is paying for the conversion and not me or you.

Sounds good, I found it slightly confusing. Looking here https://www.paypal.com/uk/webapps/mpp/cross-border-and-conversion-fees it appears if someone in the US is sending money to someone in Europe then there would be an additional fee of 1%. So on a standard rate of 3.9% the fee would be 4.9% + the fixed fee.

I feel sorry for people in Brazil, 7.4% + fixed fee standard! That’s insane.

Yes that’s correct Jamie, unfortunately some countries are really getting a bad deal, and lets not forget that some countries can’t even use PayPal. So it’s not all rosy for freelancers in certain areas.

I agree that there is no harm in asking, I was coming at it from a product viewpoint where you put out your product and price, one for all. If it’s freelancing it’s a different ball game and you have more leverage there.

why you take not stripe as payment option….u can overview there well all details of the credit of your costumers, their support is great their fees are lower and all works with stripe very fine.

The have no dispute console like paypal nothing of all ..only the risk of charge back which you have always. Of course its not possible to use stripe in ebay ( the reason you know of course )

Set up by your own some virtual USD bank account which is connected to a Debit card, and use it. Otherwise fly to the states and open a bank account .

I can’t use Stripe yet as it’s not available in my country. I am using Braintree instead.

My problem is not paypal, which i only have to use sparingly. It is just the bank mark up when I change the USD into Canadian dollars, in Canada where I live. I have the USD account at my canadian bank, but when I bring over my monthly income (its almost all in USD), I get slammed with my banks 2.5% “preferred” exchange rate. This seems to me to be alot. Of the services mentioned, which one offers the cheapest fee / best transfer rate ? Skrill, xe, transferwise, payza ?

Skrill *might* be a bit better option, at least there’s no money “receiving fee”, even though their currency exchange rates still aren’t good. But you could also check TransferWise, depending on your business, if you’re dealing with multiple currencies, this might be the best option actually.

Thanks for the tip, Jean. It is good to now this kind of ways to get around paying whose ridiculous fees. However, I really hope that sometime soon there is going to be a strong alternative to PayPal, which should stabilize their conversion rates or at least make it more reasonable. I have tried different alternatives for sending and receiving money online, such as Transferwise, Payza or Paysera, and some of them do offer a better conversion rate, but the general problem is that PayPal is the one global system accepted almost everywhere. While the situation remains like this, there is not much we can do…

Yes it’s pretty much a monopoly that doesn’t look like changing anytime soon.

Can’t seem to withdraw money to my credit card, just my bank account so I can’t seem to avoid Paypal’s ridiculous fees.. If anyone knows of a better way to withdraw money, let me know

Where are you based Kristof? Usually your bank can create a USD account for you, so when you transfer it will be USD to USD and you won’t incur any charges.

Belgium, well my bank accounts are at least :-). I will ask my bank if that’s possible. Thanks for the tip!

Welcome Kristof, post back if you make it work 🙂

I use TransferWise and will not use PayPal anymore.

If I may add something else to the conversation. In my case I live in Mexico and open a bank account in dollars so I’m about to link it to PayPal to withdraw my USD dollars that I get pay to a Mexican bank account in dollars. I don’t think PayPal would need to do a conversión but I will let you know because maybe you can do the same thing in your country 🙂

I’m currently in Mexico as well. Let me know how it goes 🙂

I’m in Mexico too, how did that go?

Paypal and Banks exchange rates are not the same as the actual exchange rate

I don’t know why you’ve mentioned comparing it to banks exchange rate??

Check XE.com or something to get the real exchange rate. Every business takes a cut, the best by far is peer to peer money international money transfers but this is soon to be blocked in the US.

I compared Paypal’s rates to those of the banks in my country. Paypal’s where by far worse than those of the banks. The actual exchange is indeed something different, and peer to peer money transfers are also the most cost effective, although not as easy/secure/user-friendly as transfers via banks.

No matter what default account currency you set, when you withdraw the money to your Bank, PayPal will ALWAYS convert it to your bank’s country’s local currency. I’ve read this on Paypal, don’t remember where exactly, but you can search for it.

So if your Bank’s currency is EUR, even if ur PP currency is USD, when u transfer money, PP will convert the USD to EUR then send the money. Your bank will receive EUR, not USD. That’s Paypal’s policy, they know what they’re doing.

That’s incorrect Richard, as described in the post, I withdraw in USD and the bank does the conversion.

No, Richard is actually right, they do not send USD outside of USA no matter if you have a USD account or whatever, they always convert to your country’s national currency

“If you would open a USD account in e.g. Switzerland, they will do this: they convert the USD to EUR anyway and transfer the EUR to your USD account. Now your bank will convert the EUR they received from PayPal to USD, using their conversion rate. So you pay twice.”

This is becoming a long drawn discussion. I do transfer USD to my bank and the bank does the conversion to EUR, that’s a one-time conversion. Here is the official PayPal page detailing how to go through the process.

Maybe there is a small misunderstanding and we are both right. I am transferring to my bank via the credit card option, some of you might have the option to transfer directly to the bank account without needing a credit card (I don’t have that option), and in that case I am not sure if avoiding the conversion is possible, since I haven’t had the chance to try it.

What Rick and Richard said is true. It’s their policy so all will be converted to local currency first. It’s useless having local account in USD. I’ve tried that and PayPal contacted me directly by phone explaining this. The only available option withdrawing in USD for us having US bank account to transfer the payment there. Suck, but well they afraid of most country local policies which usually does not prefer transferred money in foreign currency.

Another note on that, if you do received it in USD it’s done via double conversion. First it will be exchanged into local currency via PayPal rates then after that it will be converted into USD via local bank rates. Haha, that’s really suck.

I’ve been able to get PayPal to send the money to my account in my desired currency, so it is possible. See my update to the post for more information.

Hi Jean,

I base in HK , have a USD account and the PP rep said exactly the same thing to me about “they convert the USD to EUR anyway and transfer the EUR to your USD account.”

I am very interested at the method to transfer USD from PayPal to my bank, but I cannot open the link (maybe location different?). Could you do a screenshot or detail blog post about it?

Thanks

Sure, I added a screenshot to the post.

I tried changing USD to my primary currency but when I tried withdrawing, they still use the PayPal exchange rate..

Preferably your bank account would also be in USD, and there is a setting in PayPal to prevent their exchange rate from kicking in.

That’s actually not true, if you’re in the euros zone you can ONLY withdraw money in euros so…

As described in my post, I am in the Euro zone and there is a setting to prevent PayPal from converting automatically, so I actually withdraw in USD.

So what is the setting? I changed to primary currency in US $ and it didn’t help at all.

@Lukas Check out my latest update on this subject https://jeangalea.com/changing-paypal-withdrawal-currency/

I used to think that PP is charging via exchange rate a lot as well. But now I just made the suggested calculations and … well, with the amount of $2000, for example, paypal ends up being 2 euros more expensive. Which by the end of the day is close to nothing.

The lot bigger problem with paypal is their money-receiving fee, which…well, in case of $2000 takes roughly $80. And this already is a huge amount, considering even an international bank transfer is remarkably cheaper.

That’s true, unfortunately they still have a monopoly in the area, and until there is a serious competitor, they can keep on charging their high fees. You can upgrade your account and get some better rates however, I wrote about it in my other post about PayPal accounts.

Not too much better rates though, of course depending on amounts. But while 2.9% is better than 3.4%, it’s still quite high. A quite good alternative to paypal is Skrill (former Moneybookers), but not many businesses and people (compared to paypal) are using it plus it also lacks many features to successfully compete with paypal.

Yes Skrill is an alternative, but mostly theoretically, since PayPal is the dominant player in the market, and there isn’t much choice for sellers but to accept PayPal payments.

sir can u help me I use the converter..then I lost my fund.I dont know what happen.