As discussed in previous posts, once you’re using PayPal to sell your stuff online, you will also want to eventually withdraw the money you make into your bank account so that you can actually use it. Here’s where things get a bit nasty, unfortunately.

If you have a US bank account and a US PayPal account, you can stop reading right here. You’re in luck. All you have to do is attach your bank account to your PayPal account and withdraw USD from your PayPal account to your bank account. There are no currency conversions to worry about, and the transfer itself is free from PayPal’s side.

If you are the owner of a non-US PayPal account and you don’t have a US bank account, things are not so pretty.

You are given two options (depending on your home country, it might even be just one option):

- Withdraw to a debit or credit card

- Withdraw to your local bank account.

If you sell online you probably use USD as the main currency on your store and hence your PayPal balance will be in USD. What happens is that since your local credit card or bank account are not in USD, an automatic currency conversion takes place on PayPal’s end as the money is on the way out. The conversion rates are bad, to put it mildly. Hence you’re going to lose a lot of money on that conversion.

Withdrawing your funds from PayPal to a debit or credit card can be annoying if you have significant funds. The reason is that you can only withdraw up to $2,500 at one go, and every time you make a withdrawal you are charged $2,50.

So let’s say you need to withdraw $50,000. You will need to go through the withdrawal process 20 times for a total cost of $60. This sounds ridiculous; a time-wasting activity and also a money-grab by PayPal. It is, there’s no other way of looking at it.

The other way of withdrawing is to send the funds directly to your bank account. There are no limits when compared to withdrawing to a card. Sounds like we solved our problem right?

Well, not so fast.

If your bank account is in a different currency than the funds you have stored on PayPal, be prepared to lose a significant amount of money due to PayPal’s horrible exchange rates. PayPal does not let you send, say, USD directly to a EUR-denominated account. This is a limitation on their end, and I suspect an intentional one to fleece their users. There are no such limitations when using other payment gateways such as 2Checkout.

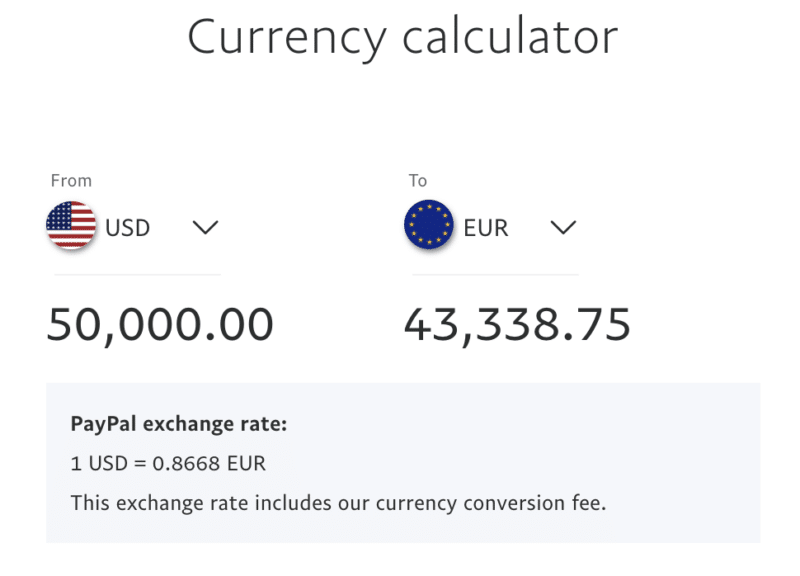

So let’s get back to the $50,000 example. Let’s see what PayPal is ready to offer us in Euros:

So for $50,000 PayPal will offer us €43,338. On the other hand, using the rate from a local bank, I get a significant difference: €43,775. And that’s just a local old-fashioned bank, not one of the dedicated currency conversion companies like Wise.

Wise would, in fact, give us €44,378, more than a €1,000 difference compared to PayPal, while Currencyfair would give us ¢44,332, which is also significantly better than PayPal.

I personally find it unacceptable to drop a thousand euros like that. This is why I will continue to withdraw using the silly method of withdrawing $2,500 at a time, simply because the total cost is still much lower. Using that method, as I showed you in another post, you can get PayPal to send USD directly to your credit card, whatever its currency.

Before we continue, it would be a good move on your end to check whether other services like Wise or Payoneer would be an even better fit for you than PayPal. In general, I recommend trying to find an alternative to using PayPal for whatever you are trying to do, since PayPal has terrible customer support and charges high fees.

Withdrawing to Cards

In the case of cards, you can ask PayPal to switch off automatic currency conversion, and have the conversion happen on your bank’s side, which will give you a better rate. I wrote about how to do this in my earlier post on currency conversion and PayPal. There are still two inconveniences when withdrawing in this manner:

- You will be forced to convert USD to your home currency upon withdrawal.

- There is a limit per transaction of $2,500, and an associated fee per transaction.

These two points are problematic. Let’s say that your home currency is in a weak position and you would therefore store money in USD and convert later when things improve. You cannot do this as you can’t do a straight through USD-USD transfer, given that your card will be denominated in the local currency. You can open a local bank account in USD but you won’t be able to get a card associated with it. At least that’s the case with all the banks I’ve checked so far. If you find a bank that lets you do that, please leave a comment and let me know.

The limit per transaction poses some obvious problems. Let’s say you are a high-volume seller and you want to withdraw $100k per month from PayPal. You will have to make 40 separate transactions and you will be charged for every single one of them. Of course, all you ever wanted to do is one transaction, if only PayPal let you do that. Apparently, this limit per transaction is dictated by the card providers (for example MasterCard or Visa). Still, it’s not convenient for serious sellers.

If your bank does not provide good conversion rates, remember that some PayPal users have had success linking their PayPal account to digital banks such as Revolut, Wise and N26. They typically provide much better rates than your local bank. You might want to give that a shot since opening an account with these digital banks is free anyway.

Note that as from April 2020 the $2,500 limit seems to have been modified, as I have been able to make significantly bigger transfers to the debit card. I’m not sure if this is a glitch or whether something really changed from PayPal’s end.

Buying Crypto with PayPal

Did you know you can now buy crypto with PayPal? That’s right, you can use Binance since it accepts PayPal deposits. Just hit the links below to get started.

You can also read my full review of Binance to learn more about this crypto exchange.

This withdrawal method is extremely popular at the moment, as people worldwide seek to get themselves some Bitcoin or Ethereum due to their extremely bright future price prospects.

Withdrawing to a Local Bank Account

Withdrawing to a local bank account does not present any limits, so you can pull out that $100k without any problems at one go, however, you will be hit by PayPal’s bad exchange rate plus currency conversion charges. It is usually easy to open a USD account with your local bank, the big problem is that PayPal will not allow you to transfer USD from your PayPal balance into your local USD account if you are based in Europe, as they consider all European bank accounts as Euro-based.

Note that in April 2020 I was able to add a USD account to my PayPal business account, so there seems to be a way to get a non-Euro bank account added. I had to ask PayPal to add it manually, as the link in the dashboard did not let me do it. I will be testing a few withdrawals with this method and will update the section below if I see that it becomes more advantageous to withdraw to the USD bank account instead of the debit card.

Real Example – Withdrawing to Card vs Local Bank Account

As an example at the time of writing this article, if you transferred $10k out of PayPal via a bank transfer to a local bank in Malta (the country where my bank is account is located in), you would have ultimately received €8,839 in the bank account. My bank does not charge any fees for currency conversion.

On the other hand, if you were to withdraw that same $10k out of PayPal to a debit/credit card linked to the same account, you would get €8,911. That amount is after deducting PayPal’s card withdrawal charge ($2.50/€2 per withdrawal, up to a max of $2,500 per withdrawal; hence four withdrawals would be needed in this case to get $10k out).

The local bank was using 0.8921 as the exchange rate between USD and EUR.

PayPal, on the other hand, was using 0.8839, a significantly different rate.

PayPal includes the charges within the exchange rate, so if you accuse them of having a really bad exchange rate their excuse will be that it includes the currency conversion fees.

At the end of the day then, we would be better off when withdrawing to a card by €72.

Not that small of an amount, especially if you start considering transferring higher amounts. The difference would be around €700 on a $100k transfer, which is ridiculous.

Another problem is that PayPal does not send you any kind of bill for the currency conversion fee, hence you cannot expensive it in your company’s books. It is totally hidden within the exchange rate they use so there’s nothing you can do about it from an accounting point of view.

Other Options

The difficulties detailed above affect every country in the world except for Canada. In Canada, users have found a loophole that allows them to perform USD to USD transfers without any charges. See here and here. Once again I had this confirmed by a PayPal support agent, as can be seen in the email excerpt below:

While not being familiar with all of our 200+ countries’ user agreements, I am fairly confident saying that Canada is the only country we have with an exception that allows a local USD denominated bank to be added and used.

I believe this is also related to how the US and Canadian bank network is cooperating. Regardless, this is not something we offer to a Maltese account, other than if you had an actual bank account registered in the US to withdraw USD to.

There are some other options one could explore:

- Use BrainTree instead of PayPal

- Open a non-resident Canadian bank account with RBC

- Open a Canadian PayPal account connected with an HSBC bank account in Malta

- Use Payoneer

- Use Etrade

- Open a US bank account

I’ve written about BrainTree already, so you can refer to my earlier post about the service, although I don’t really consider it a full alternative to PayPal as buyers would need to use their credit card instead of a PayPal account when paying.

Opening a Canadian bank account with RBS is easier than opening a US bank account. I don’t have much experience in this area except checking if it’s possible and confirming that it is. What one would do then is use the routing number of that bank account to add it as a US bank account within PayPal and withdraw money into the RBS account. Then one would use Wise to transfer the funds to a Maltese bank account. I am still checking to confirm 100% whether PayPal would allow this setup on a Maltese bank account or not.

The Canadian PayPal account plus Maltese HSBC USD account is an option that I’m still checking about, so I can’t make any recommendations at this stage.

Until a few months ago it was possible to open a Payoneer account and then add that to PayPal as a bank account via the routing number you are given. The idea was to then withdraw the money into your Payoneer account as you would have done with a US bank account. From then you would then be able to transfer to your local bank account or else pay using the Payoneer Mastercard or even withdraw cash from an ATM. It appears that this is no longer possible, although it’s worth monitoring this option as things may change in the future or an alternative to Payoneer might crop up.

Opening an Etrade account and withdrawing money to it is also another option that I’ve seen being discussed, and again I need to look into it in more detail.

The last option would, of course, be to open a USD account with a US bank, something that is easier said than done. Usually, a Social Security Number (SSN) is required, however, some banks allow you to open an account without it when visiting the branch in the US. There might still be limitations though (for example, no bank transfers possible) which would limit the practicality of such an account for my particular desired usage. Some people have also asked me whether it is possible to open a US bank account for their non-US company. As far as I know this is impossible unless you are going to deposit a few million dollars into that account.

If you have found a solution I’d love to know how you managed, please go ahead and leave a comment!

Further reading

Looking for Investment Opportunities?

Here’s a handy widget that will help you sift through a varied collection of platforms. Some of them are based in the U.S. but are also available to international investors.

Thanks for this article Jean, there’s quite a lot of confusion in this area, tough to figure out custom work arounds for our situations, but glad to see you helping folks with your knowledge!

Not sure if this helps anyone here, but I live in Australia and operate a Shopify store that sells mainly to the USA, where my products are also stored, so I charge in USD via Shopifys c/c processor or my Australia PayPal. To keep the c/c payments in USD instead of converting to my Aus bank, I set up a US based bank account via World First and listed that as my payout bank on Shopify. (I also had to get a US mail address (virtual post mail) and EIN (US tax number) and US phone number (phone.com) so SHopify would accept it as legit, which it is.

So any USD payments form customers via credit card eventually get paid out into my US World First bank in USD (minus shopifys transaction fee, but 0 conversion fee). Then any USD PayPal payments received into my Australia PayPal are withdrawn to the US bank account too, and then all funds from there are transferred form US into my HSBC Everyday Global account in Australia that can hold USD. Paying out into the HSBC account from my Austraia paypal will always convert funds to AUD first (as it’s the master currency of the account, being Australian). So, I send it to US and initiate a transfer with World First with great transfer rates, no conversion fee and instructions to keep funds in USD. From here, I can use the debit card to pay for native USD purchases (online payments, monthly direct debits), IN USD, with no transaction or conversion fee.

It’s quite messy, and I’ve been looking into Transfer Wise Borderless as a replacement for World First, but their rates seem a little higher and more limits on quantities of money to move around. Also, isn’t there an limit to how long funds can be kept IN the alternate currency accounts? The direct debit card sounds good tho.

I certainly need to streamline this, but has been a good work around so far for my position (Australia, selling in USD, wanting to keep USD funds in USD and avoid conversion fees, so I can still pay for USD based purchases with minimal fees, inetad of going USD>AUD>USD – 2 conversions and transaction fees.)

Currently, I’m going to try paying a supplier in Asia in USD via PayPal, pulling USD from my HSBC multi currency account using the debit card. Hopefully it won’t try to pull AUD, or USD then convert to AUD before converting again to USD for the final payment.)

Crazy crazy complicated. Anyone who has any simpler advice for me here, I’m all ears. Otherwise, I hope you find this helpful.

Hello

Called PayPal Hong Kong yesterday 26 March 2019, and no change – if withdraw US$ savings available on one`s PayPal Hong Kong account, to Hong Kong bank account, will get HK$ and suffer terrible rates and fees.

Thank you Jean for this post and all for sharing your experience, in particular, Mark – all sounded great until just read today that WorldFirst is closing business in the USA – https://www.worldfirst.com/us/…

Is there an alternative to WorldFrist that does the same Job?

Anyone?

Mig

My question is a bit general which I appreciate if anyone share his experience:

1- I have a PayPal account in country A (where sending/receiving/withdrawal options are permitted by PayPal). Now can I add a debit card issued from a bank account in country B to withdraw money into?

2- Then just in case of account limiting and verification requirement, do I need to prove my residency in the country B where I have got the card from (cause I open the account there as a tourist) ? Or PayPal only needs my residential info (ID card/utility bill) for country A where I physically reside?

3- If my PayPal preferred currency is dollar, Do European banks open USD account too for getting over the PayPal bad exchange rates? Does anyone know any good European bank (opening account for tourists, less fees, fair exchange rate etc.)?

Thanks in advanced!

How about if you just open a company with a bank account in the US, connect it to a US Paypal business account, and.. that’s it? 🙂 Or am I missing something?

Yep you can do that too 🙂

Just open a Borderless Acccount with TransferWise and link it to PayPal. It’s proven and highly accessible. Besides, every Borderless Account for “business” is free and can be apply via online by anyone, anywhere. Under the said account, four sub-accounts will be automatically available for continental US, Europe, UK as well as Australia. They have good exchange rates and debit card access.

Sounds good but unfortunately it doesn’t solve the problem of USD currency conversion if the business is EU-based.

Paypal only allows to add bank accounts from SEPA countries for my business account, and if you withdraw to these, they get “mandatory” conversion to EUR on PayPal side (with a hefty 2.5% fee).

It gets worse when I need to receive money in USD to my bank account and then pay in USD again. Then we have USD->EUR->USD double conversion, 5% fee in total.

However, I found the solution with Revolut Visa card. I can receive from PayPal to their Visa in USD and also pay with the same card in USD, without any currency conversion. Officially Revolut doesn’t give corporate Visa cards (only Mastercard), but you take their Visa card from their vending machines and just connect it to a business account. And, suprisingly, it works.

Does Revolu works for individuals who just want to withdraw small amounts? Less than 1k from paypal?

Haven’t tried, but if it works for corporate accounts, it should work for individual ones as well.

The problem is that you can only withdraw $2,500 at one when you withraw to a debit or credit card.

Only withdrawing $2,500 at a time doesn’t seem such a big problem to me, if only i could do that at all… (which i doubt i will be, but we’ll see). If you have to withdraw 100000 US$ it will “only” cost 100$ on withdrawal fees. I would gladly have paid that, if only i succeeded in getting my US$ unconverted out of Paypal at all… I believe it will cost you thousands if you have Paypal convert your 100k US$ into euros with their draconian fees. I heard it’s not 2.5%, but 3% or even 3.5% now, since they changed their policy earlier this year.

Tomas, what is this Revolut VISA vending machine you mentioned?

Vending machine is (or at least was) in Revolut’s office building in London. But access is restricted – you need to be there for some event, or be visiting someone.

I used the machine more than a year ago, so cannot guarantee it’s still there.

In Australia, start using PayID. It works like Paypal and most banks and credit unions are now signed up to it. Anyone registered for PayID can send a payment using their email address or phone number. The payment arrives instantly, directly into your bank account from the payee’s bank account! If you sell on eBay, offer a free gift to the value of what the Paypal fee is already built-in to your listing and provide the free gift to people who use PayID, thus saving you the Paypal fee and giving the customer the benefit of the saving. It’s a new revolution sweeping across Australia.

Hello Jean,

Thanks for this informative post. I couldn’t make it all the way through the comments though, so forgive me if you have answered this already. It is something like Stanly’s question #3.

I have a French business and am starting to sell online. I believe a large percentage of my customers will be American. I have a US bank account (real, not virtual).

Questions: 1. Can I be doing business from France, but use an American bank account in my deaings with Paypal?

2.Am I better off linking my US bank account, OR its associated debit/credit card? Both in terms of fees and ease of transferring paypal payments to myself?

I am living in a country where paypal does not permit to withdraw money. I can deposit money and transfer payment but paypal forbid me to withdraw the money because of the restrictions it has with my country. So I want to know can I have other alternative to withdraw paypal money?

How can I redraw money from my PayPal in Ghana in Africa

I can help you with that if you already have funds you wish to withdraw.

YOU CAN join leopay it will help you alot… i saw it on youtube

why i cant to withdraw much more money i can only 90 usd for what can u tell me

I’ve tried withdrawing money, a non US account and it took 5-7days to transfer and a very low exchange rate!

what did you use?

I am living in a country where paypal does not permit to withdraw money. I can deposit money and transfer payment but paypal forbid me to withdraw the money because of the restrictions it has with my country. So I want to know can I have other alternative to withdraw paypal money?

Many people in your situation have friends in other countries open accounts for them, then send them the money through other channels.

I have used many times paypal but in my opinion transferwise or conotoxia are a little bit cheaper than paypal. When I have to transfer my money by conotoxia I have very good course and generally it is more profitable for me. Not so much but always something

How do you use Conotoxia in conjunction with PayPal Jessy?

Not sure if this has been stated yet as I have not read through comments yet but I was just informed that Payoneer is now blocked by PayPal. I am now looking for alternatives. Hopefully braintree is it.

Yes that has been my experience too.

I was still able to transfer funds from PayPal to Payoneer in early November 2018, so perhaps it is dependent on where your account is based. I’m in New Zealand.

Hi,

Let me get this straight. I am new to this. I live in East Africa (Uganda). If I open a PP account, must it be with PayPal Uganda (if it exists), or if I live in Kenya, with PayPal Kenya (again, if at all it exists).

Can I not open an account as a US or UK PayPal account for example? (as a non resident in those countries)

What are the ramifications? Could you give me a brief list of a few of the benefits and pitfalls of signing up from different regions of the world?

Thank you.

PayPal won’t let you open an account in another country, unless you use some VPN tricks. You would also need to have a bank account in that country to withdraw funds.

hai jean, you paypal has the same owner of ebay. the seller is ebay member from jamaica. but the return address is us address in florida. can he open paypal in jamaica and selling in us address?

Hi,

I am doing dropshipping from saudia Arab, i have my running store and using paypal as a payment gateway.

I mostly visit to pakistan once a month.

How can i access my saudia paypal from pakistan? As pakistan is not supporting paypal.

Will paypal block my account if they catch my pakistan IP?

How to handle this problem.

I don’t think they’ll block your account, the safest bet would be to use a VPN.

I have an Australian-based Paypal account and I’ve just set up a US virtual bank account using Transferwise. I was able to add the Transferwise US account to my Australian Paypal account, but they are charging me a 2.5% fee to transfer USD from Paypal into it, which is (not coincidentally) the same markup they put on currency conversions. Looks like they’ve wised up to this workaround.

Thanks for sharing your experience Tim.

I opened a Transferwise Borderless A/C and added this A/C to my PayPal list of bank accounts (PP system regognised it as an A/C at COMMUNITY FEDERAL SAVINGS BANK and there was no problem doing that). When I went to withdraw money (USD) from PayPal to the TW A/C it flagged “There’s a problem. We can’t complete this transaction right now.”

I asked the PP help centre to explain “the problem”.

Their answer: “You cannot withdraw the money on your Community Federal Savings Bank because it is not support you might want to contact your bank for more information.”

So…….I keep banging my head against the PP brick wall!!!!

– if the bank is not supported why the hell does the PP system allow an account at that bank to be added?

– it is a US bank a/c so why the hell doesn’t PP allow it?

If there was a suitable alternative I would ditch PP TODAY. Their business model is to squeeze as much $$ out of us as they can – and they are succeeding.

Trouble is, most of my customers want to pay by PP. 😠

Hi,

I received a deposit from Canada in my paypal account and I am trying to take out that money to transfer it to my debit card or bank account but paypal is requesting to associate an U.S bank account, so the problem here is …I am from El Salvador and I do not have any U.S bank account.

Can you please help me with that?

Thanks,

Ivana

U.S bank account, so the problem here is …I am from El Salvador and I do not have any U.S bank account.

Can you please help me with that?

Thanks

this shit doesnt help … like i read almost half of it and then stopped… im not from USA and i dont have US Bank Account. when i click withdraw instead of offering me my card it asks me to add an account … so i cant send money from paypal to the card that i have added on it… thats unfortunate that you didnt say anything about that

Hi Luka, help me understand, had you already added a card or does PayPal plainly not allow you to add any card?

There are countries where withdrawing to card is not permitted. For example UK based PayPal accounts do not have an option to withdraw funds to debit/credit card only to bank account.

Hi,

i am from srilanka . problem is i can not withdraw money to srilanka. is there way to do that?

Hey dear

is there any way to get the money out of paypal once they ask for doc?

Becouse when i submitt the doc the account will be in hold for 180 days .

I want to be able to withdraw funds from an ATM Machine

in Canada but without it going through a bank account, I just want the funds

transferred to a card, a prepaid credit style card that is accepted at ATM machines would be great. I have not been able to find a solution to this

altho I have looked around a lot.

Paula, have you tried those paypal debit cards that they have at walmart? You can transfer funds to it and use it at ATMs.

Hi Paula,

I just comment posted a few links to Canadian card options I am testing right now.

It seems that FDIC or CDIC insurance designations are required to successfully fund linked cards.

https://jeangalea.com/withdrawing-money-from-paypal-for-non-us-accounts/#comment-10717

In El Salvador what options do we have to turn PayPal money into cash, I wanted to use Payoneer acct but it no longer works here, do you guys have any idea?

Hi Jean and Team,

You have very detailed described the limit of $ 2500, thank you.

Do you think this limit VISA or PayPal?

I also encountered, with a monthly limit of $ 10,000 (4 x 2500(2495) 🙂 )

Has anyone had such a problem? The maximum output to the card is 10 000 $

Geogria – PayPal

Thank you.

This is a VISA-imposed limit that PayPal can do nothing about.

My PayPal account

Update Settings All Chung phone number

Gmail id–

[email protected]

The 10,000 limit can be lifted by contacting PayPal.

Hi Jean, great article! Quick question ; I am in Canada and have a Canadian

paypal account, I want to be able to withdraw funds from an ATM Machine

in Canada but without it going through a bank account, I just want the funds

transferred to a card, a prepaid credit style card that is accepted at ATM machines would be great. I have not been able to find a solution to this

altho I have looked around a lot. Is there any solution for this? If there was

some other electronic funds service outside of paypal that allows withdrawal

of funds via a card, from an ATM and would let me send funds to the e-acct

from paypal, I wouldnt mind the extra hoops and or associated transfer fees.

Thanks for any direction you can provide!

PayPal has the option to transfer funds to a credit or debit card, with which you can then withdraw from your ATM. However bank issued cards are of course associated with a bank account, so the money would still pass through a bank account.

I believe what you’re looking is for one of the more disposable prepaid debit card options that you can easily buy at stores in North America. I have no experience linking those types of cards to PayPal, although I would suspect that it wouldn’t be possible. Do let us know if you manage to link one.

Hi there, good point on this. PayPal is actually designed for the debit/credit cards to be linked to it safely and securely. PayPal securely verifies the cards by confirming the associated address with it. I doubt that prepaid cards can be used for this process since no address is associated with prepaid cards.

Hi Jean, thank your for this article. Also finding the information here in the comments very useful.

Don,

I am also in Canada and have been going round and round with some of these issues.

I “had” a Canadian PayPal Grandfathered account. More than 10 years ago PayPal issued “PayPal Debit MasterCards” to Canadian residents just like in the US. This worked great for paying suppliers or for the occasional withdrawal at ATMs. My Canadian PayPal account uses USD as the main currency, as 90% of the transactions and all of my suppliers are US Based.

Earlier this year, PayPal discontinued all of these cards for Canadians.

In April, PayPal clarified that it was enabling the ability to withdrawal to prepaid cards… providing that they were FDIC insured. The Canadian equivalent is to be CDIC insured. So it is worth looking for the FDIC or CDIC designation when checking out prepaid card options.

https://bankinnovation.net/2018/04/paypal-focuses-on-debit-cards-in-store-payments/

http://www.cdic.ca/en/about-di/what-we-cover/Pages/list-members.aspx

After several weeks of research I have created a shortlist specific to my needs. And in recent days I have ordered several cards from about 12 different sources in Canada or International.

These 5 links are the ones I am hoping will work out when they arrive. The first ones are affiliate links… if this matters to you just type in the URLs directly:

Koho.ca

https://app.koho.ca/referral/KW9T04QX

– CDIC insured.

– CAD only balances, really low fees. I am really Really hoping this one works out, their mobile App is fantastic with a ATM map to find the closest DC Bank ATM for fee free withdrawals.

– Go to their FAQ and type in “PayPal” for instructions on how to fund your card with PayPal.

Paxum.com

https://secure.paxum.com/payment/registerAccount.php?affiliateId=28663&page=register

– Located in Quebec Canada, and their card is only USD. (strange but true)

– Couldn’t find CDIC info, but they do have PayPal verification information so it might be possible to fund this card directly. In their FAQ, go to the “Paxum Debit Card” > “How do I verify Paxum Card in Paypal?”

– This company has mixed reviews online, and their online account management area is buggy. Their mobile App is better. Not sure if this will work out… but it is one of the few Canadian USD prepaid cards I could find that wasn’t issued by a major bank.

Leupay.eu

https://www.leupay.eu/en/faq/current-client/countries

– UK company with cards available in many countries, including Canada.

– Currencies: EUR, USD, GBP, CHF, HRK, BGN, JPY, RON, PLN and CZK.

– This looks like a really great service, cards are on the way but it will be 30 days before I will know if they will work.

– A few posts can be found online about successfully linking with PayPal, hopefully these cards can be funded too.

Revolut.com

https://www.revolut.com

– Quite a few people online claim they have had success linking their cards to PayPal for withdrawals.

– Opening in Canada, Australia, US, etc at the end of this year. Sign up for wait list.

Desjarins.com

https://www.desjardins.com/ca/personal/loans-credit/credit-cards/visa-us/index.jsp

– USD based non-prepaid Visa credit card for Canadians. Apparently, Visa has better linkability for withdrawals in “Some Regions” than MasterCard… so we will see.

– Desjarins is CDIC insured… not sure if FDIC is a requirement for regular credit card withdrawals.

Good luck!

I’ve not been able to link a revolut VISA to my paypal account, I get the dreaded

“We’re sorry. We’re not able to process your request right now. Please try again later.”

The wording is misleading (or they’re under constant high load), since I’ve been trying on and off for the past 6 months without success…

Thank you for the awesome post!

Im new to this business world. I was wondering if i do make money online in Kuwait and have a US bank account which i can transfer my funds there.. Is there any tax for having these funds in paypal to a us bank cars since i have this business in kuwait?

basically it is a tax question and I’m kinda new to this tax stuff.

Can anybody help?

Thank you

Unfortunately I can’t help on this one, tax can be complex to figure out and I highly suggest you hire a qualified consultant to answer this question.

Hi,

I’ve had PayPal for over a year now, but in truth, I only need it to receive payment from a US company from time to time. I live in Panama City, Central America and I would like to know how I can actually get the money from my PayPal account to my Panamanian bank account. On the site it says US bank account, but I found a youtuber explaining how I can add an international bank account number.

Please help!

Thanks!

Not sure about that since I am based in Europe and here we have the option to add a local bank account, debit/credit card or US bank account, that’s it.

Hi Jean, i have an indian company and i sell in USA. I am loosing lot of money on conversions. Paypal- indian linked to indian bank account. All my transactions are in USD. I pay my suppliers in USD. Any easy way out?

I have the same problem with a business in Cambodia. 80% of income is via Paypal in USD but Paypal won’t send USD to or Cambodian bank – has to go via Australian a/c (converted to AUD) then back to Cambo bank re-converted to USD. Horrible loss of $$☹ Paypal won’t send USD to Payoneer so that’s no help.

Anybody got a solution to this?

Sure, check out my other post about PayPal’s exchange rates.

can I withdraw my $50 to my bank account?

Yes 🙂

Just Open A Virtual US Bank Account And Receive Payments In US And Then Transfer It To Your Bank Account Whenever You Need. Try Payonner They Offering Virtual US Bank Account For Everyone.

In the post it says that they are not transferring to Payoneer anymore..

That is correct, you might want to see if other services such as Revolut or Transferwise would do the job, although last time I checked they didn’t. Basically PayPal disallows virtual bank accounts being added as a destination for outgoing funds.

Hi @Sasheera. Open an account with FNB bank in south Africa and link it to your paypal acct. It will work for you. Paypal has a joint agreement with FNB bank..

But I don’t think paypal support withdraw to card on south African paypal anymore…..

Pls I need your help too on south Africa stuff. Am working on a little power project.. Pls mail me My mail is [email protected]

I have a problem with withdrawing money in Paypal to my Visa card linked to it. I live in Kazakhstan, debit card I have issued by a local bank.

Should be simple but the money just stuck in Paypal.

When I try to go through the withdrawal process it fails and give me ‘cannot be processed at the time. please try again later’.

Of course I wrote to Resolution Centre, pending their answer.

Meanwhile surfing for other resolution in case I can’t go through with it conventionally, i.e. withdraw through linked Visa debit card.

Hate to think that I would have to go and buy something online to just get those money out of Paypal in some form (and I am not talking about large sums of money, thank god).

You can always withdraw to the card itself, that’s what I use since it works out cheaper for me than withdrawing to the bank account directly.

How are you able to withdraw to card? My card from payoneer is linked but I do not see an option in the transfer window to send to it. Only an option to draw a check. Please explain what you mean by using the card. Also I spoke to customer care and they say the card is useless when linked – they just ask you to link the card as a verification method. Is this so? Thanks