PayPal is one of the most widely used payment processors in the world, especially for freelancers, e-commerce businesses, and creators. But when it comes to withdrawing money—particularly in USD from European PayPal accounts—things get complicated quickly. PayPal’s default behavior is to convert your balance into your local currency (usually EUR) before withdrawing, and their exchange rates are notoriously unfavorable. In this updated guide, I’ll show you the most efficient ways to withdraw your funds while minimizing or avoiding unnecessary fees and bad conversion rates.

As discussed in previous posts, once you’re using PayPal to sell your stuff online, you will also want to eventually withdraw the money you make into your bank account so that you can actually use it. Here’s where things get a bit nasty, unfortunately.

If you have a US bank account and a US PayPal account, you can stop reading right here. You’re in luck. All you have to do is attach your bank account to your PayPal account and withdraw USD from your PayPal account to your bank account. There are no currency conversions to worry about, and the transfer itself is free from PayPal’s side.

If you are the owner of a non-US PayPal account and you don’t have a US bank account, things are not so pretty.

You are given two options (depending on your home country, it might even be just one option):

- Withdraw to a debit or credit card

- Withdraw to your local bank account.

If you sell online you probably use USD as the main currency on your store and hence your PayPal balance will be in USD. What happens is that since your local credit card or bank account are not in USD, an automatic currency conversion takes place on PayPal’s end as the money is on the way out. The conversion rates are bad, to put it mildly. Hence you’re going to lose a lot of money on that conversion.

Withdrawing your funds from PayPal to a debit or credit card can be annoying if you have significant funds. The reason is that you can only withdraw a limited amount ($2,500 – $10,000 depending on your account status) at one go, and every time you make a withdrawal you are charged $2,50.

So let’s say you need to withdraw $50,000. You will need to go through the withdrawal process 20 times (with a limit of $2,500 set for your account) for a total cost of $60. This sounds ridiculous; a time-wasting activity and also a money-grab by PayPal. It is, there’s no other way of looking at it.

The other way of withdrawing is to send the funds directly to your bank account. There are no limits when compared to withdrawing to a card. Sounds like we solved our problem right?

Well, not so fast.

If your bank account is in a different currency than the funds you have stored on PayPal, be prepared to lose a significant amount of money due to PayPal’s horrible exchange rates. PayPal does not let you send, say, USD directly to a EUR-denominated account. This is a limitation on their end, and I suspect an intentional one to fleece their users. There are no such limitations when using other payment gateways such as 2Checkout.

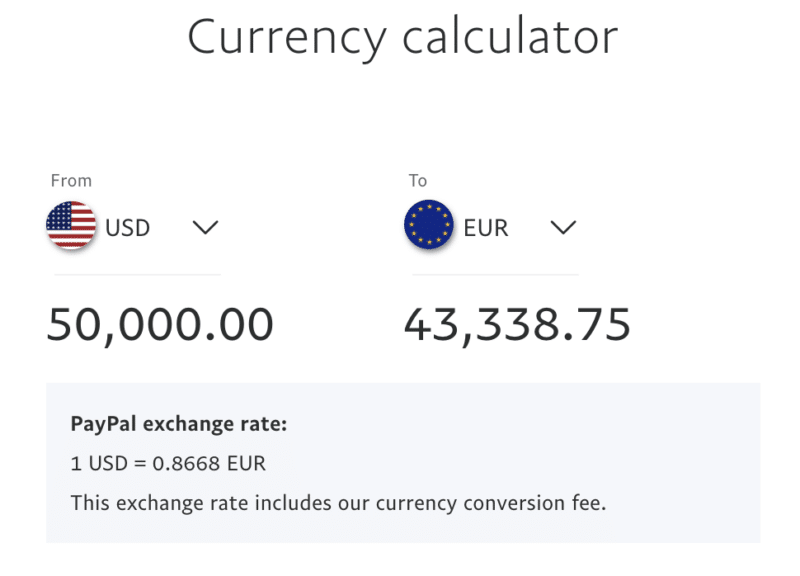

So let’s get back to the $50,000 example. Let’s see what PayPal is ready to offer us in Euros:

So for $50,000 PayPal will offer us €43,338. On the other hand, using the rate from a local bank, I get a significant difference: €43,775. And that’s just a local old-fashioned bank, not one of the dedicated currency conversion companies like Wise.

Wise would, in fact, give us €44,378, more than a €1,000 difference compared to PayPal, while Currencyfair would give us ¢44,332, which is also significantly better than PayPal.

I personally find it unacceptable to drop a thousand euros like that. This is why I will continue to withdraw using the silly method of withdrawing $2,500 at a time, simply because the total cost is still much lower. Using that method, as I showed you in another post, you can get PayPal to send USD directly to your credit card, whatever its currency.

Before we continue, it would be a good move on your end to check whether other services like Wise or Revolut would be an even better fit for you than PayPal. In general, I recommend trying to find an alternative to using PayPal for whatever you are trying to do, since PayPal has terrible customer support and charges high fees.

Withdrawing to Cards

In the case of cards, you can ask PayPal to switch off automatic currency conversion, and have the conversion happen on your bank’s side, which will give you a better rate. I wrote about how to do this in my earlier post on currency conversion and PayPal.

The funds arrive at your bank in USD, bypassing PayPal’s currency conversion entirely. This means your bank performs the conversion (if needed), often at a significantly better rate.

The earlier $2,500 limit no longer appears to apply universally. With my Wise USD Visa, I was able to withdraw up to $3,000 in a single transaction. With my local bank’s card, the limit was $10,000 per withdrawal. These amounts may vary depending on account age, history, and the card issuer, so your experience might differ slightly.

While there is still a $2.50 fee per card withdrawal, avoiding PayPal’s FX rate more than makes up for it if you’re moving substantial sums. This method is currently the most cost-effective way to preserve your PayPal USD earnings within the European banking ecosystem.

If your bank does not provide good conversion rates, consider using digital banks such as Revolut, Wise, and N26, which often offer much better FX rates and USD balance support. Opening an account with these platforms is free and typically very fast.

Withdrawing with no currency conversion at either end: I have lately been successfully withdrawing USD from my European PayPal account directly to my Wise USD Visa card. The funds arrived in full, in USD, with no currency conversion applied at either end. This confirms that it’s possible to preserve the original currency entirely when withdrawing to a properly configured USD card, making Wise one of the best options currently available for this use case.

Buying Crypto with PayPal

Another compelling strategy in 2025 is to buy cryptocurrency directly using your PayPal balance instead of withdrawing to a bank account or card. This approach avoids both withdrawal fees and PayPal’s unfavorable currency conversion altogether.

Several crypto platforms, including Binance, now support PayPal deposits. That means you can use your USD PayPal balance to buy Bitcoin, Ethereum, or other crypto assets instantly. This method is ideal for those looking to stack crypto over time and bypass the traditional banking layers completely.

As always, be cautious when converting large sums and use reputable exchanges. But if you’re crypto-savvy and bullish long-term, this route can be both profitable and efficient.

You can also read my full review of Binance to learn more about this crypto exchange.

This withdrawal method is extremely popular at the moment, as people worldwide seek to get themselves some Bitcoin or Ethereum due to their excellent future price prospects.

Withdrawing to a Local Bank Account

Withdrawing to a local bank account does not present any limits, so you can pull out that $100k without any problems at one go, however, you will be hit by PayPal’s bad exchange rate plus currency conversion charges. It is usually easy to open a USD account with your local bank, the big problem is that PayPal will not allow you to transfer USD from your PayPal balance into your local USD account if you are based in Europe, as they consider all European bank accounts as Euro-based.

Note that in April 2020 I was able to add a USD account to my PayPal business account, so there seems to be a way to get a non-Euro bank account added. I had to ask PayPal to add it manually, as the link in the dashboard did not let me do it. I will be testing a few withdrawals with this method and will update the section below if I see that it becomes more advantageous to withdraw to the USD bank account instead of the debit card.

Real Example – Withdrawing to Card vs Local Bank Account

As an example at the time of writing this article, if you transferred $10k out of PayPal via a bank transfer to a local bank in Malta (the country where my bank is account is located in), you would have ultimately received €8,839 in the bank account. My bank does not charge any fees for currency conversion.

On the other hand, if you were to withdraw that same $10k out of PayPal to a debit/credit card linked to the same account, you would get €8,911. That amount is after deducting PayPal’s card withdrawal charge ($2.50/€2 per withdrawal, up to a max of $2,500 per withdrawal; hence four withdrawals would be needed in this case to get $10k out).

The local bank was using 0.8921 as the exchange rate between USD and EUR.

PayPal, on the other hand, was using 0.8839, a significantly different rate.

PayPal includes the charges within the exchange rate, so if you accuse them of having a really bad exchange rate their excuse will be that it includes the currency conversion fees.

At the end of the day then, we would be better off when withdrawing to a card by €72.

Not that small of an amount, especially if you start considering transferring higher amounts. The difference would be around €700 on a $100k transfer, which is ridiculous.

Other Options

The difficulties detailed above affect every country in the world except for Canada. In Canada, users have found a loophole that allows them to perform USD to USD transfers without any charges. See here and here. Once again I had this confirmed by a PayPal support agent, as can be seen in the email excerpt below:

While not being familiar with all of our 200+ countries’ user agreements, I am fairly confident saying that Canada is the only country we have with an exception that allows a local USD denominated bank to be added and used.

I believe this is also related to how the US and Canadian bank network is cooperating. Regardless, this is not something we offer to a Maltese account, other than if you had an actual bank account registered in the US to withdraw USD to.

There are some other options one could explore:

- Open a non-resident Canadian bank account with RBC

- Open a Canadian PayPal account connected with an HSBC bank account in Malta

- Use Etrade

- Open a US bank account

Opening a Canadian bank account with RBS is easier than opening a US bank account. I don’t have much experience in this area except checking if it’s possible and confirming that it is. What one would do then is use the routing number of that bank account to add it as a US bank account within PayPal and withdraw money into the RBS account. Then one would use Wise to transfer the funds to a Maltese bank account. I am still checking to confirm 100% whether PayPal would allow this setup on a Maltese bank account or not.

Opening an Etrade account and withdrawing money to it is also another option that I’ve seen being discussed, and again I need to look into it in more detail.

The last option would, of course, be to open a USD account with a US bank, something that is easier said than done. Usually, a Social Security Number (SSN) is required, however, some banks allow you to open an account without it when visiting the branch in the US. There might still be limitations though (for example, no bank transfers possible) which would limit the practicality of such an account for my particular desired usage. Some people have also asked me whether it is possible to open a US bank account for their non-US company. As far as I know this is impossible unless you are going to deposit a few million dollars into that account.

If you have found a solution I’d love to know how you managed, please go ahead and leave a comment!

Hi

I’m a Nigerian and I want to link my credit card.but I want to know if I can withdraw funds from pay pal to my account.and how many days does it takes the transfer ?

I have a paypal account in Czech Republic and in Austria, a few months ago I realised that it is possible to link the Czech paypal to a us bank acount, so I opened a transferwise account and was able to withdraw usd for free. this option is not available in the Austrian paypal. Now paypal is going to change its fees, from December 16th it will charge 3% of the withdrawal amount for usd withdrawals…. Does anybody know if there will be still cheaper methods left to withdraw usd from paypal? None of my two paypal accounts offer the possibility to withdraw money to card. I also have Payoneer, but that does not help me with getting the money out of my paypal.

I brought a PayPal account from here. PayPal is not available in Bangladesh, so I had to. Now can I add Payoneer’s USA account and withdraw?

Please what is the minimum amount i can withdraw from my paypal account to my Credit card ???

Why can’t I link my Nigerian account to my PayPal account

Am not a us I want to link my Nigerian bank account in to my paypal

I have a Nigeria PayPal account, but it doesn’t receive money from other countries.

Is there any solution to that.

Hello guys,

Please is there any possible means I can create a Nigeria PayPal account that receives money from other countries.

Urgent reply please.

Thanks.

Yes there is a way, just create a PayPal business account

Why in rwanda can not reveive money????we ate not required to receive money why???

Dear. I have a tbc 009 coin wallet. end I have a pay pal wallet I’ll like to add from my tbc Wallet to pay pal wallet. how to do that transmission?

kind regards

pheko moeng

call ( 0736064716 )

This is stupid. Why does Paypal make it hard for US$ in Canada. The 2 currencies allowed in Canada are Canadian and US$ but banks make it hard to move US$ for some stupid reason. Doesn’t make sense. I have seen so many of these online with how to hook it up but it seems Paypal keeps changing and blocking them so have to keep doing something different. I am trying a third time and 3rd different routing # in order to make it work.

“Note that in April 2020 I was able to add a USD account to my PayPal business account, so there seems to be a way to get a non-Euro bank account added. I had to ask PayPal to add it manually, as the link in the dashboard did not let me do it. I will be testing a few withdrawals with this method and will update the section below if I see that it becomes more advantageous to withdraw to the USD bank account instead of the debit card.”

This is super interesting, were you able to avoid the currency conversion within Paypal?

We’re a UK company and are looking for a way to add EUR and USD bank accounts to our PayPal business account.

I am from Israel and I can’t withdrawal more than 2500$ through my visa.

Someone is having the same experience?

What can I do about it?

Thanks for the help!

Hey Jean, great article. I plan to setup an ecommerce business from UK, however I will charge customers based in the US in USD via PayPal. Can I transfer the earned amount without hassle to a UK bank account and withdraw from here!

Thanks in advance.

Rgds

Kumar

Hello, So I send money from my PayPal to my Bank account for the first time this month. On the 7th, I put in 5 euros to make sure everything was going through fine. The 5 euros went into my bank account fine the next day. So the next day I went to transfer a larger sum into my bank account, and it’s been over two weeks and I have not received my money into my bank account. On the PayPal site it says everything is complete, But I haven’t received my money into my bank account. It is the 23rd today, I have written PayPal twice asking what’s going on with no response. I’m not sure if I should call my bank? I’m not sure if everything is taking longer because of the Coronavirus? It’s a large amount that I need, and I’m freaking out.

Am in the same shoes as you. I made a huge transfer to my bank on April 1st, it’s been 3 weeks and still nothing. In February and March, the money showed up within 14 days(Paypal automatically make transfers to my bank on 1st day of each month). It could be the Coronavirus issue maybe, I must be honest am a little relieved knowing am not alone. I don’t know what to do but to keep waiting. I doubt my bank will help, my last transfers have been successful, I haven’t changed anything in my PayPal nor my bank, am thinking Covid-19 could be the reason for this unusual delay. It is also my first time having a huge transfer, perhaps big transfers take some time to clear? I guess we will see.

Hi I belive my question is slightly different. I have money in a US paypall account but no longer live in the US or have an US bank account. I have been talking to on line chats for months and each agent has a different idea but I know from trying nothing works.

I live in the UK and have a UK paypall account

Does anyone know how I can get my money?

Thanks Sally

Hello

I’m new to paypal, I have a US PayPal account and I’m unable to link my local bank with it ,I tried Payoneer and its displaying an error. Please what can I do so I’ll be able to withdraw from my PayPal to my bank account here in Nigeria ??? Love to read back from you …..

I have local bank account in EUR and paypal account in EUR aswell. I need to pay to my landlord $1750 onto his paypal account. What is the best way to get EUR from my bank account into $ on his paypal. Paypal exchange rate is like 4% worse compared to mid rate.

Thanks

Mate, thnx

I am in Malta as well and I am losing a lot of money in this way.

When I was a self-employed I solver this issue with a Revolut VISA card and converting with Revolut.

Now I have a LTD Company and Revolut is not supported for Maltese Companies. So I am still struggling

PS: Revolut currency exchange rates ar much better than TW and everybody else, plz try that out

Yes, unfortunately I haven’t found a way to withdraw to a Maltese company without suffering the automatic currency conversion. Let me know if you do!

The comments section has become too big, most of the time information is missing (such as which PP subsidiary people are referring to when they say PP). In addition, it is not always clear what the current state of affair is, since some deeply nested posts sometimes indicate that “no, that no longer works”.

Is it not time to create a slack with pinned posts linking to a google doc to see which withdrawal work for which combination of PP country / Bank country / Method(bank or card)? I’ve been looking for such a USD withdrawal mastermind for some time, and this one post is the closest I’ve come to it. Let’s scale this up…

Hi guys, I just want to find out if I can still “RECEIVE” payments into my paypal account, even though the account is not yet linked to a CARD or a BANK ?

Please reply if you’ve been receiving payments on your paypal account in this condition.

Hello Jerry,

Yes, you can easily RECEIVE the funds or payments in your PayPal account without linking the Bank and Credit card. Though, you will have some limitations on how much you can receive in your account to remove which you need to add your Bank account.

Regards,

Rahat

Jean, I am avoiding Paypal as everywhere says it’s so bad but when I withdraw I only get charge 5 US for any amount, how is this possible? I mean, is very good to be true. I have a Chilean Bank that gave me a credit card in USD so I withdraw there, Paypal only charge me 5 US and there is no currency conversion, what I did good? I don’t know but could be useful for other people, would love to know your comments on this!

I have a payoneer card which has a Bank of America virtual account attached. Payoneer gave me this option some years ago. My Bank of America account is linked to Paypal. I withdraw and funds appear in my Payoneer account. I use my Payoneer mastercard to make payments or withdraw cash at any atm. The exchange rates are minimal and most paypal withdrawals are free. However, there is a high charge for withdrawing cash, so I try to make only one withdrawal a the charge seems to remain the same regardless of the amount. I usually access the money within a day.

When I first started working online I withdrew from Paypal to my local account and the charges were ridiculous on small amounts! I also waited up to 8days for every transaction.

Payoneer is the best! I’m in South Africa.

Hello

Can you help or tell me how I can get a Payoneer account accepted by PayPal?? I have a Payoneer account, I tried connecting it to my PayPal ,it’s displaying an error, what should I do ???

What if I receive EUR and want to withdraw to transferwise etc? I checked and the US PayPal will convert to USD before sending it to transferwise. I have a US PayPal, any idea how I can solve this? I know I can open a PayPal account in eu but then I also need to have proof of address and business…

I think PayPal hates us in Nigeria.

I’ve been a freelancers for years and I have not for once seen a good thing in using it.

To avoid story that touches, I would advice you to create a payoneer account in Nigeria, where you can get your own MasterCard delivered to you.

That’s what I’ve been using so far.

But if anybody now a possible way out to create a PayPal account that can withdraw to bank or card in Nigeria, I will be grateful because most of my clients comes from USA and they always offer to pay with PayPal.

Thanks

Still wondering if This PayPal withdrawal Method still works fine especially in Nigeria

Yes, I have a method

Hi. I am actually having a hard time linking my UAE bank account in PayPal, Along with this I cannot withdraw my funds using my personal account. Can somebody help me with this one. Thanks in advance.

Hello,

I have a question regarding my PayPal account. I created an account in the Philippines. All the information in my PayPal are Philippines (address and phone numbers). I also linked my Bank in the Philippines and have been transferring money to my local bank. Now, I opened a bank account in Croatia. My question is, Is it possible to link my Croatian bank to my PayPal account and transfer money from PayPal to my Croatian bank?

So as of now, May 2019, can anybody confirm they successfully linked a TransferWise card to their EU based Paypal account and successfully transferred US$ from their EU based Paypal to their TransferWise card, and the dollars arrived without any conversion whatsoever?

If so, please share, and which country you’re in.

I’m currently in the process to try this, but have to wait for my TransferWise card to arrive yet (a few weeks, apparently). The comments that i read elsewhere on this website don’t promise any good, but i’m keeping my fingers crossed. I will share the result.

Hi! I plan to try this.. my transferwise account will hopefully not convert the dollars into pounds. Any luck doing this?

Is it possible for me to open a PayPal account with a UAE bank account and transfer the received money to a USD account or standard chartered account of a country where PayPal doesn’t operate?

Paypal isn’t allowing me to transfer dollars into my Standard Chartered bank account Ghana.

For the eager minds I propose a solution, a business model

After 15 years suffering, I mean working with Paypal I have found that’s its a necessary bad. You can’t love it or hate it but like the USD you can’t trade without it.

There can be a community of Paypal users which we can ask bid different amount in different currencies.

Say you need to withdraw your PayPal USD dollars in Malta. You can make an offer. Some guy in Malta that needs to make a payment in PayPal will purchase from you with a local bank / mobile transfer in maltas currency. You will have your PayPal USD exchanged to your local currency without actually having exchanged them at all.

Seems cumbersome and it is. But think about connecting a lot of people needing a private car and a lot of drivers needing to work. And in several countries WITHOUT ACTUALLY BEING THERE. yes this is Uber.

So. Who will lead this “Uber Paypal” initiative?

Hi, I m Mahesh Gosh, new to paypal, how does paypal considers someone as NON-USA, what if I open an account with USA address from India. Then add a Payoneer Card to paypal account. Then withdraw money from Payoneer..

Actually you can do it

Paypal has some automated tools for chasing you like IP address phone and so on

But the definitive limit is when they ask you to write the social security number SSN

and upload the document

Then you realize you are not USA

“Then you realize you are not USA”

Ha ha ha ha ha