Upon moving to Spain, one of the first things you need to do is open a bank account.

You will need it for several things, most importantly for paying your monthly rent. A foreign bank account is not that useful in Spain as many institutions rely on direct debits to a local account. For example, if you make a gym subscription, or if you sign up for private health insurance, you will need to provide your bank details, and you need to give a Spanish IBAN number.

See also: Best broker for buying stocks in Spain

The same thing applies if you have an iPhone and want to use the Spanish app store; you need a Spanish debit or credit card.

When I arrived in Spain, I had a list of criteria that I used to search for the best bank here. Let me share them with you:

- Commission-free.

I’m giving money to the bank and they will use it to gain money, I shouldn’t be paying them. If anything, they should be compensating me for providing the capital. - Straightforward to open and operate.

I didn’t want to jump through too many hoops to open a bank account, and I expect a modern web and mobile interface to operate on a daily basis. - English-speaking staff and multilingual website and contracts.

Not so much of a deal-breaker as I’m fluent in Spanish, but it’s always a plus. - Stable and highly-regarded bank.

I don’t want nasty surprises in the future, so let’s keep to the top banks and avoid going with the lesser-known ones.

See also: Best apps for trading cryptos like Bitcoin and Ethereum

Here are some of the typical bank fees charged by banks here that I was not prepared to pay:

- Maintenance fees

There is usually an average fee for having your bank account and this is anything from €40 year and upwards - Transferring money

If you use your bank account to transfer money, even to another Spanish account, you may be charged. The transfer cost is usually around €2 or C3 for every transaction you make. Online transactions are usually free. - ATM

If you use a cash machine that is not linked to the bank you use then you will be charged a fee. This varies but is likely to be at least €2. - Credit and debit cards

Some banks may charge a small fee per year for maintaining your card and can be around €8 and €10 per year.

After spending many hours in online research, speaking to people and visiting bank branches, these were my shortlisted banks:

Currency Conversions

Before we delve into details about each of these banks and my top pick, I’d like to make a special note for those who will be transferring money from other countries. The most common cases are GBP and USD but this applies to any other non-Euro currency.

I suggest that you use Wise for your conversions as you will save a ton of money versus any local bank. You can also set up a Wise Borderless account which gives you a debit card in multiple currencies that is perfect for travel.

Ok, now that you now know how to do currency exchanges the right way, let’s move on to Spanish banks. If you have any questions about currency exchange, leave a comment and I’ll try to help out.

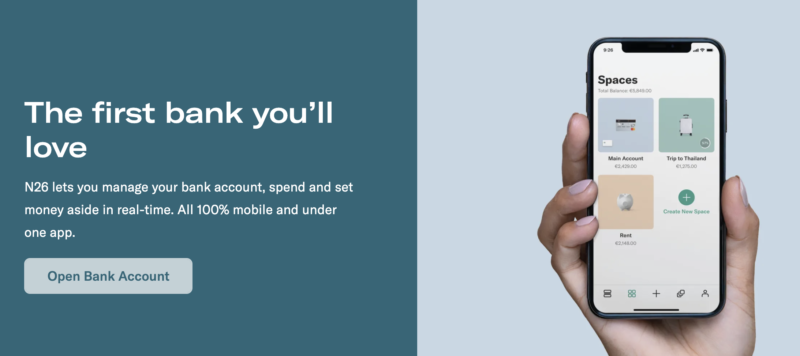

N26 – Best Low-Cost Bank in Spain

Unfortunately, I haven’t been very impressed by banking in Spain. It’s decent enough, don’t get me wrong, and most banks have very good online systems and apps, however, support and compliance can get very frustrating.

That is why I would recommend N26, a German bank with the very latest technology and an amazing mobile app through which you manage your account.

N26 gives its Spanish users a Spanish IBAN account, so you will be able to use the bank for any direct debits as you would use other Spanish bank accounts.

N26 give you best-in-class digital facilities such as an app and website to go with it, while also helping you track your expenses.

I use DEGIRO as a stockbroker in combination with N26 as a bank account, and I have zero hassle with local branches and any other issues.

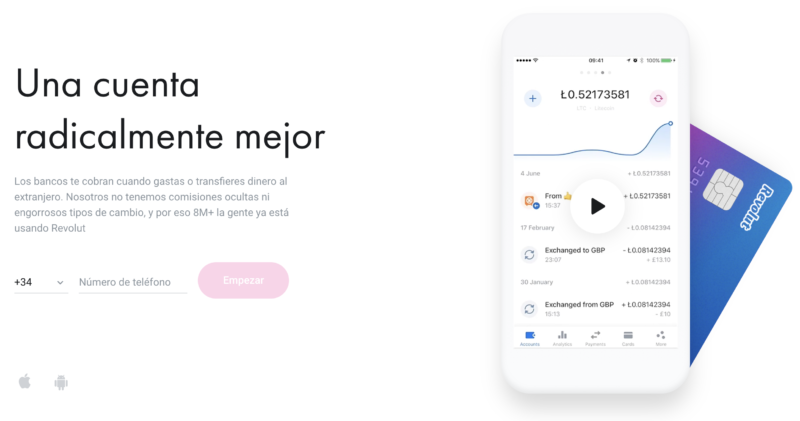

Revolut

The famous online bank Revolut is also available to residents of Spain. Revolut is a digital banking app and card that focuses on technology, low fees and premium features. It’s designed for those who travel a lot and offers ways to spend abroad, including international money transfers with no hidden fees.

When you sign up, you will need to choose between three account tiers, starting at €0 per month for the Standard account.

For all account tiers, Revolut gives you a free IBAN account, a free UK current account and a bank card so you can spend your money. You can spend in over 150 currencies at the interbank exchange rate and exchange 29 fiat currencies. There are a number of features that come with each account tier, such as free ATM withdrawals plus exclusive features that come with the Premium and Metal accounts.

Revolut has three tiers: Standard, Premium and Metal. The Standard account is €0 per month, the Premium account is €7.99 per month and the Metal account is €13.99 per month.

One of Revolut’s most appealing features is that it lets you spend fee-free at the interbank rate in over 150 currencies.

Using it abroad is much like using it in Spain. However, don’t forget that while there’s no spending limit for card payments, free ATM withdrawals are limited to €200 per month with the Standard account (higher for Premium and Metal), after which you’ll be charged a 2% fee.

Revolut received its European banking license from the European Central Bank in December 2018. This means that if you open a current account with Revolut in the future your funds will be protected up to €100,000. However, at the time of writing, this was still being put into place. For now, Revolut still has obligations to safeguard your funds in a separate bank so you can get them back should anything happen to Revolut.

Revolut stands out from its competitors in cryptocurrencies. In 2017, it became the first challenger bank to let customers buy cryptos within the app.

What’s more, it’s incredibly easy for anyone to use cryptocurrencies such as Bitcoin with Revolut. Revolut’s aim is to make cryptocurrencies accessible. Customers have access to five different cryptocurrencies: Bitcoin, Litecoin, Ether, Bitcoin Cash and XRP. However, you have to hold a Premium account or higher to access the cryptocurrency feature automatically. Otherwise, you will need to invite three or more friends to use the app to unlock the feature.

Revolut shows you real-time cryptocurrency graphs which shows you current rates. You can also set up price alerts to hear when your cryptocurrency hits a certain value.

Revolut applies a markup of 0.5% on major currencies and 1% on other currencies over the weekend when markets are closed.

You are charged at least a 1% markup for currencies such as the Thai baht, Russian rouble, Ukrainian hryvnia and the Turkish lira. This rises to 2% on weekends.

You can make fee-free currency conversions up to €6,000 per month, after which a 0.5% fee applies.

The big disadvantage of using Revolut at the moment is that you don’t get a Spanish IBAN. Although according to EU rules, businesses here in Spain should accept European IBANs for direct debit purposes, in practice there are some big companies that still refuse to do so. You might want to check which companies you will need to work with and decide accordingly.

Having said that, since there is no cost to signing up to and maintaining a standard Revolut, I would still recommend having it, especially since you like to travel. Having more options is always better than less options. If you’re worried about managing multiple cards, have a look at the solution I found for that further down in the article.

Wise

Before you move abroad consider opening a TransferWise multi-currency account. You get your own free local bank account details in Europe, UK, US, Australia and New Zealand so you can have a local bank account before arriving.

It comes with a debit card so you can pay and withdraw money at ATMs once you come to Spain with much lower fees than with your bank.

Read my full Wise Borderless review or go ahead and open an account using the link below.

BBVA Cuenta Online – Best Spanish Bank

BBVA is a Spanish bank with an excellent reputation, and their mobile app has won numerous awards.

You can open a Cuenta Online with no commissions in 10 minutes using the mobile app. Their website is available in multiple languages including English.

You can’t really go wrong with BBVA if you want the extra peace of mind of having your money in a Spanish bank. BBVA is consistently rated among the top 3 banks in Spain.

This is now my favorite local bank in Spain. I am very happy with the service they provide and the application is excellent, even allowing you to aggregate other banks’ accounts into the BBVA app for your convenience.

Banks to Avoid

Banc Sabadell

I don’t recommend this bank due to the various reports of multiple charges that are now associated to having accounts with them (see comments section).

Ing Direct

ING Direct used to be my favorite local bank, but as of April 2019, I would recommend N26 above ING Direct. They have a weird policy of letting all incoming transfers in, then suddenly asking for documentation about all incoming international transfers months later. It’s quite maddening because they typically don’t even know what they need, they just ask you for documentation for everything, which of course can be incredibly time-consuming to retrieve given that some transfers might have been done years ago.

They have also blocked many clients’ accounts even during the sensitive Coronavirus crisis times, piling more difficulty on families when they should be helping alleviating the burden. I find these practices extremely insensitive and unprofessional and cannot recommend this bank any longer.

Their customer support is only available via phone (long waits) and usually turns out to be quite incompetent, barely able to answer basic questions.

In short: Stay away from this bank.

Wrapping up

You will no doubt have your own requirements for bank accounts. Perhaps you are already thinking of a loan or mortgage, or you’re interested in finding a bank with great stock brokerage facilities, or even other products such as life insurance or deposit accounts.

Make sure you make a list of things that are most important to you, then start your search by visiting all the sites of the local banks. You will usually get a gut feeling about certain banks that will allow you to narrow things down. You can then proceed to visit the local offices of the shortlisted banks and get a feel for the kind of people that work there and get more information about their products.

Finally, you can make an educated decision on which account to use. Remember that you can always close an account without any hassle or cost if further down the line you understand that the bank is not well aligned with your needs.

When you open a bank account at any entity, be aware that they will usually ask for your passport and your NIE at the very minimum. They might also ask for things like your rental contract, statement from your foreign bank, tax statements from your previous country of residence etc. Banks are on the lookout for money launderers and have very strict parameters within which to operate. All the banks I mentioned above are very reasonable in what they require and will not make things difficult for you. Others may have stricter policies, and they might reject your application without providing any specific reasons.

Over the years, I’ve come to prefer online banks, so here would be my favorite options:

Accounts for traveling outside the Eurozone:

- Revolut (Personal or Business)

- Wise Borderless

Good luck with opening a bank account in Spain, and if you have any questions feel free to ask in the comments section.

Curve – Managing multiple cards

It’s a hassle having many cards in your wallet. You might lose one without even noticing, not to mention the inconvenience of a fat wallet in your pocket.

The solution to that is to use the Curve app and card. Basically, Curve allows you to load all your cards into its app, then use just one card (the Curve card) to make your payments. Before you make a payment, you can use the app to choose which bank card you want to take the money from. Incredibly useful for those of us who have many debit and credit cards.

Savings and Investment accounts

None of the banks mentioned in my article are great places to earn any interest on your money. As you know, banks nowadays offer very low interest for leaving your money in their accounts. However, there are some good online options if you’re seeking some return on your money.

Raisin – Best Investment accounts

Raisin puts more than 70 savings products at your disposal. The platform collaborates with many European collaborator banks, all of which count on the European deposit guarantee scheme (up to €100,000). It is basically an aggregator of all the savings account offerings across Europe.

I find it extremely convenient to be able to access all these investment products in one place. The traditional way would be to actually sign up to a bank in order to be able to access its savings products, which is incredibly more laborious and harder for the customer to compare offers between banks. Check it out, I think you will like the idea behind Raisin.

P2P Lending – Mintos

If you’re interested in making the most of your money, don’t leave it sitting in your bank account where it generates low returns.

Take a look at my results (above 10% returns) investing through the Mintos P2P lending platform, it’s been excellent so far. If you’re not familiar with P2P lending, read my review of the best P2P lending sites in Europe, which includes a thorough guide on how this sector works.

Another option is to invest in property via online platforms. I have lots of content on that subject as well on this site, and a good place to start is my post on the best property investment platforms in Europe.

Documents needed to open a bank account in Spain

Before you even attempt to open a bank account, make sure you have the following documents handy as you will need them.

If you’re opening your first bank account in Spain with one of the local banks:

- A valid passport or national identity card

- Your Spanish Tax identification number (NIE)

- A document to confirm your address such as a utility bill or Title Deed

- A document to prove you have an income – this could be a payslip, tax return or an official form connected to your pension (optional)

Proof of income documentation is not always required. When I arrived in Spain I did not have any payslips to show, so instead, they asked me for statements from the bank account in my country, and that was enough to open the first bank account here in Spain.

If you already have another bank account in Spain and you’re opening another bank account in Spain with a local bank:

- A valid passport or national identity card

- Your Spanish Tax identification number (NIE)

- The IBAN number of your other bank account

If you’re opening an account with one of the digital banks:

- A valid passport or national identity card

The digital banks (Revolut, Wise, and N26) only require basic identification to open a bank account with them.

Banks trust each other, so if one bank has done its checks and opened a bank account for you, you can then open another account at another bank by just providing basic identification and the IBAN number for your other bank account.

Note that many traditional Spanish banks do not provide sign up instructions on their website in English, but it’s pretty self-explanatory in most cases.

Keep in mind that banks do discriminate openly against citizens of certain countries that they deem to be on their “blacklist”. My wife (Russian) was straight up refused consideration from various banks, while even myself (Maltese) was refused in one bank due to the manager claiming that Malta was on some kind of blacklist, which is very weird since it is in the EU.

See also: Should you buy Bitcoin?

Spanish Banking Glossary

Let’s talk about some of the most common words used in Spanish banking.

- Cuenta = account

- Cuenta Corriente = current account

- Tarjeta = card

- Seguros = insurance

- Saldo Contable = account balance

- Saldo Disponible = balance available

- Traspasos = transfers

- Inicio = Start

- Extracto = statement

- Cuenta para residentes = resident account

- Cuenta para no residentes = non-resident account

- Caja = savings banks

- Account number – usually a ten digit number

- Sort code – four digits for your bank reference and four digits for your branch

- Control number – a two-digit number

- BIC – Bank Identifier Code. It begins with letters that refer to the bank you are using. It is used in conjunction with the IBAN

- IBAN – ‘International Bank Account Number’ and is a standard way of identifying banks across different countries.

With a Santander 123 debit card you can withdraw €’s cash commision free at the basic Mastercard exchange rate, but only at Spanish Santander ATM’s. But do make sure you opt for a € transaction: don’t select £ transactions when offered at the ATM – that would be costly!

Also, using a UK Santander debit card for any other transaction in Spain would be costly.

You can check all UK credit and debit card charges at moneysavingexpert.com.

Hi, I have just purched a bungalow on the coast and bought it through a reputable estate agent. So far i can’t fault them as they bave dealt with everything. The only problem i have is the bank account. They took me to Bankia where we opened an account as required. We have been told that we have to deposit €450 per month or average €5000 over 3 months so as not to incur any bank charges. I have read the above and now wondering if this is a error or have fallen into a trap. We are non resident’s and would like some advice on now to avoid bank charges.

Thanks

Slips

That sounds quite normal to me; it’s not a scam or trap, just the way they do things. If you could avoid having a bank account in Spain in the first place it would be easier to avoid all charges. Banks have little incentive to open accounts for non-residents so they put some conditions like the one you mention.

Thanks Jean for your quick reply We wish we didn’t have to open one but have been informed we must to complete our purchase. The most annoying thing is, back in the UK we have two Sandander accounts. Apparently although Santander is spanish the don’t recognise each other in Spain. I will enquire about this when i return to the UK as they have told me i can use my UK Santander card in Spain without incurring any charges.

Sent from Samsung tablet.

Hello Slips,

I have an account with Bankia, I know how they work.

As you have got a mortgage with them, you could send a transfer every month to them from your UK account, in case your mortgage quot is smaller than 450 €, you could transfer back the rest of the money to your UK account.

It really important you tell them to set your transfer as a regular income in your account , if not charges will carry on.

regards

Hi, thanks for the info. As i dont have a mortgage do you know if i send say €500 from my UK bank to Banka then say €300 back fto my UK bank. Will i get charged by either bank for these transactions as they will be converting pounds to euros and then euros to pounds?

Thanks again for you reply Slips

Sent from Samsung tablet.

Hello Slips,

Bankia have got the account called Cuenta ON, for digital customers (no charges), included a debit card( free comission). You could open it on line , change the standing orders, and close the old one.

Recently I opened one in BBVA on line, and they look quite smart, even they go to your house to check your identification card in case you would like, although you better send it by email with a picture taken by your mobile. It is free of charges, included a debit card.

I give some information quite interesting. In a question of a month, in Spain banking customers could be willing to transfering our account to another bank quite quick with all direct debits included. The bank which you would like to go with, will be do all work for you. You dont have to do nothing.

THX

I opened a Bankia one too but I don’t like their interface as much as Ing Direct’s. BBVA seems like a more modern alternative so I might give that a shot once the portability facility you mention becomes a reality in a month’s time.

In case you have got a normal account (transfers, direct debits, debit cards,…) all main Spanish banks got a sufficient interface mobile service.

Bankia is too slow, jajaj but I could coup with ING Direct is a very fresh bank and thet were the pionners in Spain about these types of services, I love them BBVA have got several prices about their technologies invesment quality last five years (good job). They got future.

Hugs

Thanks for the research Jean. I have my nomina account with Sabadell and until a couple of weeks ago I also had my Non-Profit Association with them. However the T&Cs apparently “changed” since I opened the account 3 years ago and since January they have charged me over 300€ in bank charges and commissions – when asking for a detailed explanation I was told they were “bank charges and commissions”!!! All the donations I had received were eaten up in bank charges so I closed the account. I have left my nomina account with them but am still looking for an alternative for the non-profit.

You’re welcome Deborah, I’m sorry about that. I had something similar happen to me recently and I can understand the feeling. Hope you manage to find a good bank for the non-profit. Do let us know who you end up going with.

They charged me too. Sabadell is a disappointment for me. Charged me commissions that even by T&C were not supposed to charge. And now I am trying to get that money back. They also blocked my account for a unknown reason, I had money there. Untill today they didn’t explain me a reason. And when I called to their 24/7 number for a help, later I found out I was charged 37€ fir that few minutes phone call.

Jean,

You have created an extremely informative website. I looked again at your opening paragraph and I guess this insistence by some organisations on their customers using only Spanish bank accounts is quite common. I found that it’s often the local staff trying to enforce outdated rules, but when pressed, and after referring the matter to their head offices, €-accounts from other countries are accepted. But there remains a hardcore of organisations, like Movistar and Apple, whose automated systems block attempted payments from non-Spanish bank accounts!

I believe the law on these matters is clear. I found this statement on my bank’s website:

“Pursuant to EU legislation on cross-border payments in the Single Euro Payments Area (SEPA), bank accounts and IBANs from all member states must be accepted for transfers and direct debits both on a national and cross-border basis. Regulation (EU) No 260/2012 of the European parliament and of the council.”

So, what can we do about those Spanish organizations who flout European law?

When I found serious resistance, from one of my Spanish utility providers, to transferring my direct debit from a Spanish to a German bank account, I took the easy option of switching utility provider! But I appreciate that such an alternative is not always available!

Perhaps we should ask offending companies for their complaints book and register an official complaint about their refusal to accept a non-Spanish account in contravention of European law. I must admit that when I tried that in one local office, I was told that it was a sub-office and that I’d have to go to their regional office 50Km away for their complaints book: that in itself was possibly a breach of Spanish law, but again I gave up and found an easier alternative solution!

I’d love to know what others have done to try bringing Spanish companies into line with European law.

Hi again Alonso (I’m assuming that’s not your real name although Alonso Hamilton would be a cool name anyway), thank you for taking the time to leave some excellent comments so far.

The law, as you state, is very clear. There will always be organizations that flout the law, and ultimately it’s the customer that votes with his money. I think many of us live under the false assumption that everything should be fair, but in practice it rarely is. Although such laws exist, in practice companies have the power to flout them at will, unless a group of customers actually invest the time and money to go after them. After all, even the government itself sometimes isn’t exactly in line with European law. The Modelo 720 saga is one such example of the Spanish government going into very grey areas.

Ultimately I therefore agree with you, the first step should be to politely but insistently ask the provider to abide by the rules, and if they refuse, change the provider where possible. I’m assuming you’re from a smaller town in Spain; perhaps in bigger cities such as Barcelona or Madrid it would be easier to get this type of uncommon request dealt with efficiently.

The only similar issue I’ve experienced was when renting apartments and buying private insurance. Apartment owners typically ask for a Spanish bank account, presumably because they think it makes things simpler for them. I think that with the modernisation and harmonisation that has happened in banking in recent years, this is no longer a real concern. I was able to convince my landlord to use my foreign bank account, at least until I got a local one a few months later. I also managed to convince Sanitas (private insurance) to set up direct debits with my foreign account rather than a local one, and I only changed it to the Spanish account a year later out of personal preference.

Jean,

An excellent response. I can see that you had already experienced these issues well before I’d even thought about them. I really like the way you handled everything.

You’re also correct about my cool name and my Andalusian rural holiday home base. Indeed I imagine there would be far fewer issues in Madrid.

My latest problem was trying to top up a Movistar PAYG phone while in the UK. Movistar’s automated system rejected a UK credit card, a GB € debit card, and a German € debit card. I had to resort to using my Spanish bank account which I’m about to close permanently! I’m not sure how to deal with this in future apart from remembering to top up before leaving Spain, or asking a friend to top up with their Spanish bank account (but that rather defeats the purpose of my mini-crusade!).

Has anyone got any ideas?

The only idea I can think of is to buy a virtual debit card and use that to pay such items. Tarjeta Spark could be such an option. In the US you can buy prepaid debit cards at Walmart etc but I don’t think they are available in Spain.

Thanks Jean. I’ll keep that in mind for when I next visit Spain. I also believe that I still have a free OpenBank account which I’ve not used since opening 2 years ago. The OpenBank debit card is in Spain so, if it’s still active, I’ll try that for topping up my Movistar mobile!

You’re welcome, that should work!

I am surprised that so many ex-pats, especially non-residents, are still paying fees to Spanish Banks, when free banking is available from N26!

N26 now do the account switching for you, ie N26 will transfer all your Direct Debits from your existing Spanish bank.

You get a € debit card which is free to use for any purchases and permits five free ATM withdrawals/month from any bank ATM in Europe (there are charges for any withdrawals made in excess of 5/month).

Does the Spanish direct debit work with N26 ? Revolut ? (Have you tried that?)

No I haven’t tried that since I have a local bank account (ING)

Great post. Thank you! Ludicrous costs and commissions at sabadell are forcing me to change to ING and bummer… they just stopped their sin nomina offer 😥

Hello, I really appreciate this page, but want to add an update:

ING just discontinued their ‘cuenta sin nomina’ …

I wrote their support this morning about not being able to find it on their web page. This was their response:

“Estamos en un proceso de simplificación de productos y ya no es posible contratar la Cuenta SIN NÓMINA.”

So now they only have the “nomina” account which requires you to make a monthly deposit of at least 700€ into it.

So ING are out of the picture for me.

I have also tried OpenBank. The website looks good and there’s an English version of their online banking. But for the past 3 weeks I have received an error message every time I have tried to open an account online. Support’s reply is that “there is currently an error!”. No mention of when this may be fixed. If ever.

I am a resident and currently with Sabadell, but I want to leave as my income is currently irregular, so they’ll soon roll in the fees – including for every time I use you debit card to pay something.

It’s not easy …

That’s really unfortunate, sorry to hear about that change. Bank tellers have told me that there is a way to “cheat” their deposit system by withdrawing the 700 and then depositing it back in, this will keep the system from flagging you as not having made a deposit. It’s an option, but I just thought it was too much of a hassle in any case, and I’d rather go to a bank that is ready to service me without playing silly games.

Absolutely. I’ve heard about the cash-out, cash-back-in cheat too, but prefer spending my time on something a little more constructive and a little less silly.

And, like you, I would prefer to have my money in a transparent, no-nonsense bank. But they’re pretty hard to come by in these parts …

It’s easily set up with a recurring payment of 700€ from a Revolut account (for which there are no charges) into your ING account. And a standing order dated, say 4 days later in the month, from ING to your Revolut account.

Once set up (and it would only take minutes to do so), you can simply forget about it and it would take up no more of your time. It would cost the lost interest on the 700€: perhaps 10€/annum at worst with current UK European interest rates!

If you’re not particularly bothered about banking with ING, you could just have a Revolut or N26 account. Both are free to operate, with free to use debit cards, and both can handle all your direct debits in Spain: but N26 allows more free cash withdrawals from European bank ATMs.

Good luck with your choices…

Clever solution, thanks Alonso!

In my opinion and experience the Banking system of Spain is perhaps one of the worst in the EU. Information about opening an account is pretty vague and funnily same Bank having different branches have different requirements for opening an account. The process is pretty tiring, lengthy and too many questions.

I think if Spain really wants to recover from its abysmal economic downturn, just a small reminder that youth unemployment is above fifty percent and would like to build a prosperous future, then leniency and logical policies should be implemented rather than making things difficult for investors, foreigners and even themselves to refrain from opening a bank account and future investment.

In terms of opening a bank account yes, I agree with your analysis. With regards to banking services the bank I use (Ing Direct) is pretty good especially with its online system and app.

Thanks Jean for your opinion and prompt reply. After having physically visited different Banks in Spain, I have to admit that Ing Direct, Bankia and OpenBank are all strong contenders. The process is rather comfortable and less time consuming. Not too many silly questions asked and less hassle in terms of documentation.

In addition, Bankia employees are somewhat very friendly and customer-focused but more importantly they can communicate in English. The same worked well with OpenBank (over the phone) as well. The communication with Ing Direct was rather not too appealing, although a friend of mine accompanied me which helped solve the communication barrier, but we understood each other finally, lol. Ing Direct have a lot of foreign and local clients but ironically their website is in Spanish and do not have the option to view in English, which is somewhat unusual.

Agreed Nathan. Bankia’s online system is quite old-fashioned and I prefer Ing Direct’s, but the branch employees were friendly when I went there to open the account. Sadly, most bank employees nowadays are trained to be very clinical in their approach, so that doesn’t make for a very nice experience for the customer.

I only went once to the Ing Direct branch to get some information about their offerings. They were very professional and even offered refreshments at the entrance. I ended up opening the bank account from the comfort of my own home, as all documents are brought to your front door to sign and the whole process is done online.

Thanks again Jean for your reply. I would request you to please provide a few details about Ing Direct.

– How efficient and lenient are they in terms of International Bank Transfers and inside the EU as well ? For example, the commission or fees that may occur for 5000 euros ? What documents are required and in terms of filing a tax, how that works having an online account ? The procedure ?

Thanks in advance and keep up the good work.

You’re welcome Nathan. I’ve only done EU transfers with them and they were painless and fast. They also provide documents related to tax at the end of the year, so you just forward those to your accountant. For other questions I’d rather you contact them directly so that you’ll get the most up-to-date and accurate information; after all I’m just another regular customer of theirs and not a banking expert.

Thanks Jean and Nathan, very useful information there. I haven’t been keeping up with the thread, apologies – was any consensus reached regarding non-resident accounts?

Hello Richard,

There some conditions a client should get to have free comissions account, as having a regular transfer coming every month to your Spanish account or your pension. All traditionals have got an special non comissions account free in this case. However I prefer contracting to an on line banking account as ING Direct or BBVA or even Bankia.

In case you like traditional banks the best is Bankinter although they dont have plenty branches around . It is a mix bank, half on line,and half traditional.

All traditinal banks they have got bad customer service so that many Spaniards like to visit the bank every day and they are collapsed so the staff feel quite streased.

Caixa should be the option , they tried to get them out with some comissions and they are incorporating some technology for customers so the branches are smarter.

Great insight, thanks Trudy.

Hello,

Very good article however trying to open an online account with Bankia and ING.

Google translate gets me two pages in then Spanish only without a translate option.

What Am I doing wrong.

Thankyou.

Jeff.

We left Sabadel last year because of the ridiculous every transaction charge…(added up nearly 200 euros a year)

We are now with BankInter as we looked around and their charge is the most reasonable: 45 euros a year without debit card (20 euros more with card i think, we didn’t want to know as we don’t really need a card) and 50 euros every 2 year, worked out 70 euros a year, still a lot cheaper than Sabadel.

Will make an inquiry with Cajamar and Bankia next time we are in Spain as we heard there is no charge.

Does anybody know what the legality is of these extortionate bank charges?

I’m sure they’re detailed in the small text of the agreement or their website, so they would be perfectly legal.

Thanks Jean, why I meant was are there banking regulations that govern bank charges?

Understood. Unfortunately, I haven’t done any research on that particular facet of things. The quickest way to solve these issues is to move your money to another bank; it’s not worth the hassle to go against a bank even though they might not be acting correctly against you.

I worked in BMN and Bankia the last 12 years. The banks normatives are regulated by the Bank of Spain and they could change the comissions every 3 months. Banks lobby is quite close to the politians in Spain so the legal structure are done for them to gey as much profits as they can.

I’m stuck with Sabadell and their now 35 euro/qtr charges. They also charged me(no prior warning) a huge 300 euro to transfer 78K from my marbella account, to my lawyer in Spain….don’t get caught on that scam. As a non resident I have found it impossible to get an online account with any of the recommended banks. BBVA just ignores you after a certain online set up point(despite sending all documentation and visiting a BBVA bank branch), the others reject applications with a resident/non resident box early on. I have N26 and revolut accounts for normal use, but I’m not sure if these allow DD’s from Spain utilities. Any ideas?

SEPA requires organisations to accept any European bank with a € IBAN account for DD collections.

N26 now offer to do the switching for you.

While it is true that SEPA rules REQUIRE spanish utilities and other suppliers to accept payments from other non-spanish banks by own experience has been that this is a mixed bag in practice. Had no trouble with internet and electricity suppliers and eventually water and rates got sorted out but our gas company (art of Repsol) have steadfastly refused to accept DD’s from my dutch bank. The bank of my water suppliers (not a local authority) have told them the same thing. In both cases I have to “push” the payments on receipt of bills. DD’s do not work with them!

N26 Bank

I gather that there may be some interest in free banking with N26 in Spain.

I find that it provides all I need, but you should be aware that there are no cheques and there is no way that you can credit your account with cheques or cash. All transactions are electronic, except they do provide you with a debit card which you can use, without charge, for purchases and up to five cash withdrawals per month at ATMs.

I hope that helps.

I think that’s good enough for most people. Thanks for your feedback on this.

Judt to confirm Alonso , as seeing a few banks with just online checking account ie openbank . So when you say can not credit account with cash you mean can only credit it with transfer from say another bank electronically.

Sorry but i can ask as well . Most of these banks are saying no fees / account maintenance , free debit card . When i read more i still think they are saying yes free card but if used ie in mercandona or to pay for goods there will be a Fee.

So if anyone can clarify no maintenance fee / commissions means no fee on every transaction .

Again sabadell say free withdrawels no charge at atm , yes no charge there but still o.65 inhouse when used . Not sure if thats illegal advertising !

Sorry Elaine for taking so long to answer your questions: I hadn’t looked at this site for some time.

N26 have no branches in Spain, so there’s nowhere to deposit cash or credit cheques into your account. It is online banking and you can transfer electronically in and out for free as often as you wish. There are no fees for 5 bank (that’s any bank in Europe) ATM withdrawals/month: but there are charges for those ATM cash withdrawals in excess of 5/month. There’s no fee for debit card purchases whether in Mercadona or anywhere else in Spain!

It seems you can deposit cash and cheques into an Openbank account at any Santander branch in Spain, but I believe there are restrictions on the frequency of such deposits.

Sabadell is another Spanish Bank!!!

Interesting comments.

I’ve just opened an account with N26 using my Spanish address. It is a German bank so I have had difficulties getting my direct debits changed to them: not the bank’s fault, just a few ignorant yokels employed by Spanish organisations, I need to pay regularly, who are unaware of SEPA and European law on direct debits in the Euro zone!

Never mind, the job is nearly done following threats of official complaints. Then no more non-resident bank charges and no more Spanish customs of suddenly freezing accounts without reason or notification!

Thank you Germany for saving me for evermore from the Bankers of Spain.

Excellent Alonso, very glad to see that you managed to do this. Some people here in Spain can be really inflexible and archaic with this stuff, and it takes a tough stance like that to get things moving.

Hi Alonzo

The only reason I opened a non-resident Spanish account is because Movistar said they only accept direct debits from Spanish Banks when I wanted home broadband and contract mobile phones for my partner and I. From your post you are suggesting that they are legally obligated to accept SEPA payments from any Eurozone bank account – is this correct? Thanks

Absolutely. However its only a few years ago that the rules changed, and it takes Spanish companies and their staff a while to get up to date. My electricity company was the only one to really resist my request to change DD. I was going to ask for their complaints book and pursue a case against them, but then life’s too short so I switched electricity company instead! The spin-off is going to be a saving of about 50€/annum in electricity charges.

Movistar might be more difficult: I don’t think they have any local offices, only agencies! So how do you register a complaint? Have you no other broadband provider you can switch to? As long as you’ve got broadband, you can set up your own VOIP telephone very cheaply (look up Sipgate for starters).

Good luck.

Hi Alonso,

How did you manage to set up direct debits with your N26 account? I also live in Spain and currently have a Sabadell acct, which is a bit of a nightmare and the fees they charge are not justifyable.

I was under the impression that I need a Spanish IBAN (ES) to have direct debits for utilities and insurance companies in Span.

Thank you in advance.

Juliya

Juliya,

You don’t need a Spanish IBAN. The companies you’re dealing with have to set up the DD’s: you simply need to give them your N26 IBAN and BIC. However you are likely to get some resistance through ignorance, particularly, if like me, you’re based in some backward rural area.

I found that if you keep pushing , but remain friendly, they will have a go. The first hurdle is convincing them that you have indeed supplied the full and correct data: the German IBAN comprises 22 characters compared with the Spanish 24 character IBAN which they’re familiar with! But then they’re always pleasantly surprised when the ‘DE’ IBAN works on their systems.

Good luck.

Just had notification from Sabadell, the 30 euro per quarter fee from June is going to be 35 euros per quarter

Also looking to move from Sabadell, 30 euros per quarter plus 65 cents for every transaction, not to mention the fees for non residents certificate. We have been customers for a few years and these charged keep increasing! There must be a cheaper alternative? Anyone have experience of bbva online account? Have sent message asking if it is available for non resident. I have also been looking at transfer wise borderless account but don’t think it allows dd’s. Any other ideas?

hi i have just been checking our account, very remiss. Its not just non residents we are being charged 24 euros a quarter just for having a debit card. On top of this we are then charged 65 cents on every single transaction . I am going to I scream as its bad enough if it was card transactions but this is for direct debits the lot .

I WOULD NOT RECOMMEND SABADELL AT ALL and hardly any english speaking staff in the branches

I also do NOT recommend Sabadell for the same reason. My first charge was in December for 40 euros, my second in March for 95 and my final charge was 141 euros!! That’s over 276 euros within 9 months. I closed my account with them today.

what about Bankia, can you open an account withiout a NIE? perhaps using a passport number?

For a resident account you need a NIE, the question is whether they offer accounts for non-residents. If you go to their site you can ask for a free callback, or just drop into any of their branches to ask.

You need resedencia to open a resident account. With just an NIE you are still non-resident.

There are different types of NIEs/residency cards. I am referring to the NIE which has a date of residency on it.

Hi Jean and thanks for your very informative report.

Like Richard above I have just arrived in Spain to work. My UK employer (I´m transferring to the Spanish subsidiary) has advised that I should remain as a UK resident (it´s a long tax story). However, I will get paid in Spain (hence I need a Spanish account) and I will do various activities such as renting an apartment, buying car etc. I also have a NIE card, rather than the paper version, from a previous employment for a Spanish company. I will also be paying taxes in Spain on income earned here (and then adjusted on my UK Self-assessment each year)

Following your recomendation, I contacted ING Direct to know what they need in order to open an account (I can do it with Nomina as I am employed here) but was told that I cannot open an account with them unless I´m a resident in spain – do you, or any other correspondent on here, know if that is the case and if any of the other accounts you recomend don´t have that restriction?

Many thanks

Michael

Hi Michael, you’re welcome.

ING Direct do not open accounts for non-residents as far as I know, so that is in line with your experience. Last time I checked, Sabadell had that facility if you paid something extra. La Caixa as well if I remember correctly, but I’ve never done it myself.

Hi Jean

I have opened a Sabadell account as a non-resident (I’m waiting for an interview for my residency application). Sabadell charge €30 quarterly for a non-resident account. Do any of your top 4 banks (other than Sabadell) charge this? This is extortionate and, frankly, to have to pay this to a bank for an account is reprehensible, so I want to change banks as soon as possible. Thanks.

I wish I read all comments and this part where “Sabadell charge €30 quarterly for a non-resident account” earlier.

Just looking at the information Sabadell gave me, it was hard to see that cost – and of course nobody said anything.

120 euro per year for basically automatic payments of water, electricity, and tax is pretty steep.

But with the Sabadell account, it seems easy to open an account with Bankia instead. No fees as far as I can see.

Very useful information. I am currently with BBVA but want better English speaking service and a good internet service. Never thought about having 2 accounts but that makes good sense, so I’ll try both ING and Self Bank and see which is best.

Thank you for doing all the research Jean. This is super helpful.

Other than Sabadell, do you know if any other banks will let you open an account without an NIE?

Thanks,

Juliya

Welcome, not sure about that unfortunately as I got mine soon after arriving.

Jean:

Very informative column.

We’re thinking of purchasing some property in Spain, but the bank where we opened an account (Bankinter) says they’re going to charge .4% for making a deposit from outside Spain. Sounds almost criminal. Any advise on how to avoid this charge?

Bill

Yes that sounds very fishy, I know from my experience or that of close friends that Ing Direct, Bankia, Sabadell and Caixa don’t charge for deposits from outside Spain.

After 20 years here and a (ex) CAM and BBVA customer I just stayed on with Sabadell and closed my BBVA account, that may have been a mistake. Sabadell has been going through some changes over the last year or two with money saving (for the bank) in mind. The last time I had to go into my branch they were incredibly forceful about not going into the branch and using the online system. Also you really do over estimate the number of English speakers in Sabadell. Ex-CAM employees yes, but these are becoming fewer every day. Sabadell? No. They also seem to now be charging for just about everything they can. Which is the reason I came across you post. I am researching a new account. I should say in fairness that I did used to work for both the CAM and BBVA. But that said I really do see an incredible (and not good) change with Sabadell. Bankia is sounding like the bank of choice, ING is tempting but I did used to have a Deutsche account and it was sometimes unwelcome with the Spanish. But think you for all your work and dealing with banks is hard work sometimes.

You can try N26 now as I suggest in the updated post.

Great information, thank yiu. As others, we were transferred to Sabadell from Lloyds/Halifax and are appalled at the seemingly regular increases in charges. Sabadell stopped sending us paper statements so as we aren’t registered for internet banking, we weren’t aware for quite some time how much we were being charged. Our Spanish bank account is there mainly just to pay for water, electric and council tax equivalent. We have now requested paper info and the latest info from them informs us that charges will now be 30 euros PER QUARTER! Also, I’m not sure what other charges are on top, other than they do charge us for the credit/debit card and it does cost us to transfer from the UK. All in all its costing us a fortune. We are retired and only visit our apartment 3 or 4 times a year and like the comfort of visiting branches. Do you have any advice for us?

Thanks a lot for this post. Very helpful.

Do you know whether the banks commission free do direct debits? We are with Sabadell, like Pat we were transitioned from Lloyds/Hailfax and went with the flow. However we do have 5 direct debits on the account as we are not resident here but come every 3 months for a month.

Yes, direct debits are a basic feature of practically all accounts here in Spain. I haven’t encountered any banks which don’t do it.

When our bank was taken over by Sabadell we just carried on with our account with them!

We realize now we should have gone into their dealings better, I am the prime account holder and my husband has a debit card on the account to.

We have just been away on holiday for a month so not used the cards consequently we both have been charged 30€ each as a fine, we also have to pay 20€ a year each for the priviledge of having a debit card. They never informed us that we should pay in 700€ a month either to have a commission free account.

Just thought you may be interested to hear this.

Thanks Pat, I can understand how annoying such fines can be. As you mention, it’s very important to read contracts carefully and ask all questions necessary. To their credit, all the banks I visited have been very clear about their terms and gave me the time to study their contracts and ask many questions.

As I mention in the article, both ING Direct and Bankia are alternatives that do not charge a monthly fee.

Hi Jean – thanks for writing this – as someone who’s just arrived in Spain (from UK) and looking for info – this is very helpful. I don’t have an NIE yet but went to speak to Sabadell today about opening an account.

He gave me two options: an ‘Expansion Account’ and a ‘Key Account’.

The Expansion account requires me to pay in a min of €700/month (as you mentioned) but he also said I would need to pay an annual ‘insurance’ fee of €40 (or transfer €10K to a savings account).

He said this was a safe guard incase I left the country with my account in debt.

Have you ever heard of that? As I’m currently studying rather than working I don’t have an employer.

I’m happy to pay this if it’s a genuine requirment – but I wanted to check whether it’s the guy trying to sign me up for something that’s not actually needed -or whether it’s legit?

You’re welcome Sam. I have only discussed the Expansion account with Sabadell, so I can’t comment on the Key account. When I had gone to the branch and also taken a look at the contract, there was no mention of an insurance fee. It could be something new that they introduced in recent months.

I honestly don’t like these clauses, they just rub me the wrong way. Many banks nowadays act as if they are doing you a big favour in opening an account. While I think Sabadell is a good bank, the 700 euro a month clause had driven me to look to other alternatives, and I’m very happy with ING Direct.

If you’re decided on Sabadell, I can suggest just going to another branch and asking the same questions, and you can thus verify if they mention anything about the insurance fee. Chances are that it is indeed a new requirement that they have, but that’s what I would do if I wanted to be 100% sure.

Hi Jean, thanks for the info!

Just an addition for ING Direct. There is a step when it asks for an IBAN number and it has to be a spanish account with your name. It’s a procedure apparently to confirm your identification.

It seems you can’t open it online as a first account.

In that case I suggest opening a bank account with Bankia first. They don’t have this requirement. With that bank account open you can just deposit a token amount and proceed to apply with ING Direct. I prefer ING Direct to Bankia and having two bank accounts is always a nice bonus just in case something happens with one of them.

Thanks! Have you tried their service?

Yes, they have helped me with a lot of good information. They are super helpful.

Hey Jean, great post.

One question: was it easy for you to get the NIE? I’m an italian citizen, I’ve been there last summer and their requirements for a NIE were a bit confusing and not clear.

Thanks.

Yes it was a straightforward but bureaucratic process. The best explanation on how to get it can be found on this site: http://niebarcelona.com/en/