Upon moving to Spain, one of the first things you need to do is open a bank account.

You will need it for several things, most importantly for paying your monthly rent. A foreign bank account is not that useful in Spain as many institutions rely on direct debits to a local account. For example, if you make a gym subscription, or if you sign up for private health insurance, you will need to provide your bank details, and you need to give a Spanish IBAN number.

See also: Best broker for buying stocks in Spain

The same thing applies if you have an iPhone and want to use the Spanish app store; you need a Spanish debit or credit card.

When I arrived in Spain, I had a list of criteria that I used to search for the best bank here. Let me share them with you:

- Commission-free.

I’m giving money to the bank and they will use it to gain money, I shouldn’t be paying them. If anything, they should be compensating me for providing the capital. - Straightforward to open and operate.

I didn’t want to jump through too many hoops to open a bank account, and I expect a modern web and mobile interface to operate on a daily basis. - English-speaking staff and multilingual website and contracts.

Not so much of a deal-breaker as I’m fluent in Spanish, but it’s always a plus. - Stable and highly-regarded bank.

I don’t want nasty surprises in the future, so let’s keep to the top banks and avoid going with the lesser-known ones.

See also: Best apps for trading cryptos like Bitcoin and Ethereum

Here are some of the typical bank fees charged by banks here that I was not prepared to pay:

- Maintenance fees

There is usually an average fee for having your bank account and this is anything from €40 year and upwards - Transferring money

If you use your bank account to transfer money, even to another Spanish account, you may be charged. The transfer cost is usually around €2 or C3 for every transaction you make. Online transactions are usually free. - ATM

If you use a cash machine that is not linked to the bank you use then you will be charged a fee. This varies but is likely to be at least €2. - Credit and debit cards

Some banks may charge a small fee per year for maintaining your card and can be around €8 and €10 per year.

After spending many hours in online research, speaking to people and visiting bank branches, these were my shortlisted banks:

Currency Conversions

Before we delve into details about each of these banks and my top pick, I’d like to make a special note for those who will be transferring money from other countries. The most common cases are GBP and USD but this applies to any other non-Euro currency.

I suggest that you use Wise for your conversions as you will save a ton of money versus any local bank. You can also set up a Wise Borderless account which gives you a debit card in multiple currencies that is perfect for travel.

Ok, now that you now know how to do currency exchanges the right way, let’s move on to Spanish banks. If you have any questions about currency exchange, leave a comment and I’ll try to help out.

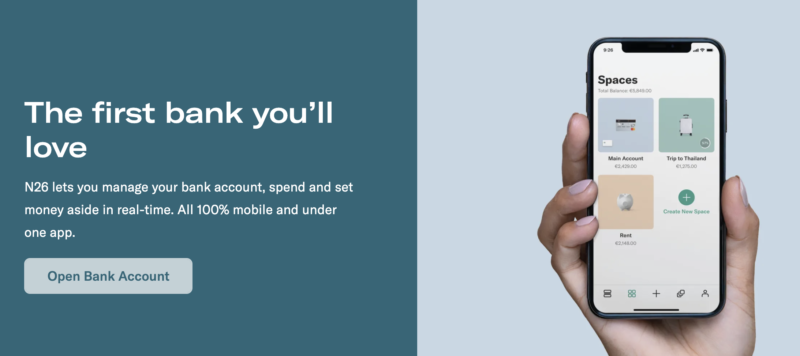

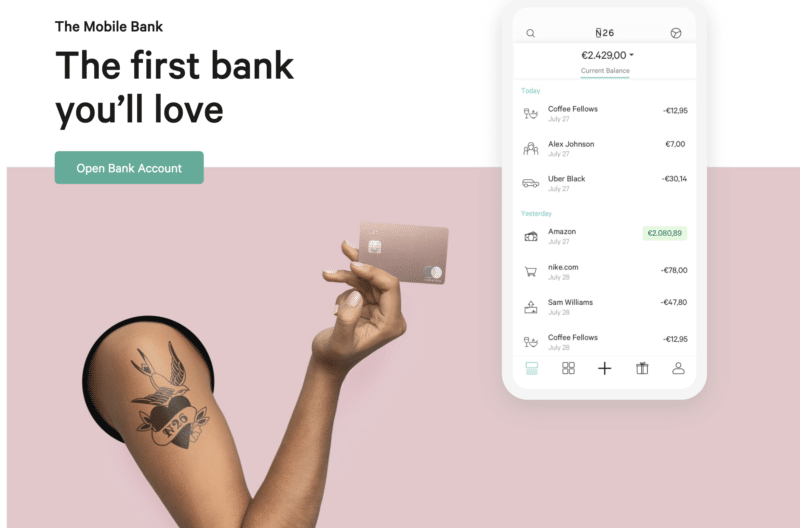

N26 – Best Low-Cost Bank in Spain

Unfortunately, I haven’t been very impressed by banking in Spain. It’s decent enough, don’t get me wrong, and most banks have very good online systems and apps, however, support and compliance can get very frustrating.

That is why I would recommend N26, a German bank with the very latest technology and an amazing mobile app through which you manage your account.

N26 gives its Spanish users a Spanish IBAN account, so you will be able to use the bank for any direct debits as you would use other Spanish bank accounts.

N26 give you best-in-class digital facilities such as an app and website to go with it, while also helping you track your expenses.

I use DEGIRO as a stockbroker in combination with N26 as a bank account, and I have zero hassle with local branches and any other issues.

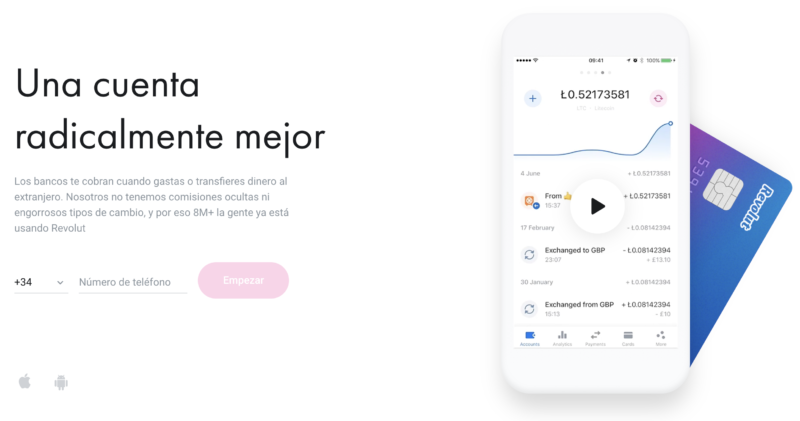

Revolut

The famous online bank Revolut is also available to residents of Spain. Revolut is a digital banking app and card that focuses on technology, low fees and premium features. It’s designed for those who travel a lot and offers ways to spend abroad, including international money transfers with no hidden fees.

When you sign up, you will need to choose between three account tiers, starting at €0 per month for the Standard account.

For all account tiers, Revolut gives you a free IBAN account, a free UK current account and a bank card so you can spend your money. You can spend in over 150 currencies at the interbank exchange rate and exchange 29 fiat currencies. There are a number of features that come with each account tier, such as free ATM withdrawals plus exclusive features that come with the Premium and Metal accounts.

Revolut has three tiers: Standard, Premium and Metal. The Standard account is €0 per month, the Premium account is €7.99 per month and the Metal account is €13.99 per month.

One of Revolut’s most appealing features is that it lets you spend fee-free at the interbank rate in over 150 currencies.

Using it abroad is much like using it in Spain. However, don’t forget that while there’s no spending limit for card payments, free ATM withdrawals are limited to €200 per month with the Standard account (higher for Premium and Metal), after which you’ll be charged a 2% fee.

Revolut received its European banking license from the European Central Bank in December 2018. This means that if you open a current account with Revolut in the future your funds will be protected up to €100,000. However, at the time of writing, this was still being put into place. For now, Revolut still has obligations to safeguard your funds in a separate bank so you can get them back should anything happen to Revolut.

Revolut stands out from its competitors in cryptocurrencies. In 2017, it became the first challenger bank to let customers buy cryptos within the app.

What’s more, it’s incredibly easy for anyone to use cryptocurrencies such as Bitcoin with Revolut. Revolut’s aim is to make cryptocurrencies accessible. Customers have access to five different cryptocurrencies: Bitcoin, Litecoin, Ether, Bitcoin Cash and XRP. However, you have to hold a Premium account or higher to access the cryptocurrency feature automatically. Otherwise, you will need to invite three or more friends to use the app to unlock the feature.

Revolut shows you real-time cryptocurrency graphs which shows you current rates. You can also set up price alerts to hear when your cryptocurrency hits a certain value.

Revolut applies a markup of 0.5% on major currencies and 1% on other currencies over the weekend when markets are closed.

You are charged at least a 1% markup for currencies such as the Thai baht, Russian rouble, Ukrainian hryvnia and the Turkish lira. This rises to 2% on weekends.

You can make fee-free currency conversions up to €6,000 per month, after which a 0.5% fee applies.

The big disadvantage of using Revolut at the moment is that you don’t get a Spanish IBAN. Although according to EU rules, businesses here in Spain should accept European IBANs for direct debit purposes, in practice there are some big companies that still refuse to do so. You might want to check which companies you will need to work with and decide accordingly.

Having said that, since there is no cost to signing up to and maintaining a standard Revolut, I would still recommend having it, especially since you like to travel. Having more options is always better than less options. If you’re worried about managing multiple cards, have a look at the solution I found for that further down in the article.

Wise

Before you move abroad consider opening a TransferWise multi-currency account. You get your own free local bank account details in Europe, UK, US, Australia and New Zealand so you can have a local bank account before arriving.

It comes with a debit card so you can pay and withdraw money at ATMs once you come to Spain with much lower fees than with your bank.

Read my full Wise Borderless review or go ahead and open an account using the link below.

BBVA Cuenta Online – Best Spanish Bank

BBVA is a Spanish bank with an excellent reputation, and their mobile app has won numerous awards.

You can open a Cuenta Online with no commissions in 10 minutes using the mobile app. Their website is available in multiple languages including English.

You can’t really go wrong with BBVA if you want the extra peace of mind of having your money in a Spanish bank. BBVA is consistently rated among the top 3 banks in Spain.

This is now my favorite local bank in Spain. I am very happy with the service they provide and the application is excellent, even allowing you to aggregate other banks’ accounts into the BBVA app for your convenience.

Banks to Avoid

Banc Sabadell

I don’t recommend this bank due to the various reports of multiple charges that are now associated to having accounts with them (see comments section).

Ing Direct

ING Direct used to be my favorite local bank, but as of April 2019, I would recommend N26 above ING Direct. They have a weird policy of letting all incoming transfers in, then suddenly asking for documentation about all incoming international transfers months later. It’s quite maddening because they typically don’t even know what they need, they just ask you for documentation for everything, which of course can be incredibly time-consuming to retrieve given that some transfers might have been done years ago.

They have also blocked many clients’ accounts even during the sensitive Coronavirus crisis times, piling more difficulty on families when they should be helping alleviating the burden. I find these practices extremely insensitive and unprofessional and cannot recommend this bank any longer.

Their customer support is only available via phone (long waits) and usually turns out to be quite incompetent, barely able to answer basic questions.

In short: Stay away from this bank.

Wrapping up

You will no doubt have your own requirements for bank accounts. Perhaps you are already thinking of a loan or mortgage, or you’re interested in finding a bank with great stock brokerage facilities, or even other products such as life insurance or deposit accounts.

Make sure you make a list of things that are most important to you, then start your search by visiting all the sites of the local banks. You will usually get a gut feeling about certain banks that will allow you to narrow things down. You can then proceed to visit the local offices of the shortlisted banks and get a feel for the kind of people that work there and get more information about their products.

Finally, you can make an educated decision on which account to use. Remember that you can always close an account without any hassle or cost if further down the line you understand that the bank is not well aligned with your needs.

When you open a bank account at any entity, be aware that they will usually ask for your passport and your NIE at the very minimum. They might also ask for things like your rental contract, statement from your foreign bank, tax statements from your previous country of residence etc. Banks are on the lookout for money launderers and have very strict parameters within which to operate. All the banks I mentioned above are very reasonable in what they require and will not make things difficult for you. Others may have stricter policies, and they might reject your application without providing any specific reasons.

Over the years, I’ve come to prefer online banks, so here would be my favorite options:

Accounts for traveling outside the Eurozone:

- Revolut (Personal or Business)

- Wise Borderless

Good luck with opening a bank account in Spain, and if you have any questions feel free to ask in the comments section.

Curve – Managing multiple cards

It’s a hassle having many cards in your wallet. You might lose one without even noticing, not to mention the inconvenience of a fat wallet in your pocket.

The solution to that is to use the Curve app and card. Basically, Curve allows you to load all your cards into its app, then use just one card (the Curve card) to make your payments. Before you make a payment, you can use the app to choose which bank card you want to take the money from. Incredibly useful for those of us who have many debit and credit cards.

Savings and Investment accounts

None of the banks mentioned in my article are great places to earn any interest on your money. As you know, banks nowadays offer very low interest for leaving your money in their accounts. However, there are some good online options if you’re seeking some return on your money.

Raisin – Best Investment accounts

Raisin puts more than 70 savings products at your disposal. The platform collaborates with many European collaborator banks, all of which count on the European deposit guarantee scheme (up to €100,000). It is basically an aggregator of all the savings account offerings across Europe.

I find it extremely convenient to be able to access all these investment products in one place. The traditional way would be to actually sign up to a bank in order to be able to access its savings products, which is incredibly more laborious and harder for the customer to compare offers between banks. Check it out, I think you will like the idea behind Raisin.

P2P Lending – Mintos

If you’re interested in making the most of your money, don’t leave it sitting in your bank account where it generates low returns.

Take a look at my results (above 10% returns) investing through the Mintos P2P lending platform, it’s been excellent so far. If you’re not familiar with P2P lending, read my review of the best P2P lending sites in Europe, which includes a thorough guide on how this sector works.

Another option is to invest in property via online platforms. I have lots of content on that subject as well on this site, and a good place to start is my post on the best property investment platforms in Europe.

Documents needed to open a bank account in Spain

Before you even attempt to open a bank account, make sure you have the following documents handy as you will need them.

If you’re opening your first bank account in Spain with one of the local banks:

- A valid passport or national identity card

- Your Spanish Tax identification number (NIE)

- A document to confirm your address such as a utility bill or Title Deed

- A document to prove you have an income – this could be a payslip, tax return or an official form connected to your pension (optional)

Proof of income documentation is not always required. When I arrived in Spain I did not have any payslips to show, so instead, they asked me for statements from the bank account in my country, and that was enough to open the first bank account here in Spain.

If you already have another bank account in Spain and you’re opening another bank account in Spain with a local bank:

- A valid passport or national identity card

- Your Spanish Tax identification number (NIE)

- The IBAN number of your other bank account

If you’re opening an account with one of the digital banks:

- A valid passport or national identity card

The digital banks (Revolut, Wise, and N26) only require basic identification to open a bank account with them.

Banks trust each other, so if one bank has done its checks and opened a bank account for you, you can then open another account at another bank by just providing basic identification and the IBAN number for your other bank account.

Note that many traditional Spanish banks do not provide sign up instructions on their website in English, but it’s pretty self-explanatory in most cases.

Keep in mind that banks do discriminate openly against citizens of certain countries that they deem to be on their “blacklist”. My wife (Russian) was straight up refused consideration from various banks, while even myself (Maltese) was refused in one bank due to the manager claiming that Malta was on some kind of blacklist, which is very weird since it is in the EU.

See also: Should you buy Bitcoin?

Spanish Banking Glossary

Let’s talk about some of the most common words used in Spanish banking.

- Cuenta = account

- Cuenta Corriente = current account

- Tarjeta = card

- Seguros = insurance

- Saldo Contable = account balance

- Saldo Disponible = balance available

- Traspasos = transfers

- Inicio = Start

- Extracto = statement

- Cuenta para residentes = resident account

- Cuenta para no residentes = non-resident account

- Caja = savings banks

- Account number – usually a ten digit number

- Sort code – four digits for your bank reference and four digits for your branch

- Control number – a two-digit number

- BIC – Bank Identifier Code. It begins with letters that refer to the bank you are using. It is used in conjunction with the IBAN

- IBAN – ‘International Bank Account Number’ and is a standard way of identifying banks across different countries.

I would be interested to hear your recommendations for nonresident accounts/banks

Hey, so I see you don’t recommend the Sabadell bank anymore. Can I ask if you were using the Key account with that bank? I have been accepted to work in Spain and they want to open a Key account with Sabadell for me if I want. They showed the basic fees but left out the 40 euros quarterly fee of the account that I found on the bank site. But boasted about a bunch of other free services like card usage at different banks and stuff. Just want to know if it was the same account type that you used that had issues like charges for debit orders.

Excellent website!, most informative!

I am a UK national with full residency in Tenerife, and I am disgusted with the service and costs with ( previously) my Sabadell account, and now with my Bancamarch account. The fees for the debit and credit cards are ridiculous and the service is appalling.

I have come to the conclusion that an online bank would be better for me.

However, I am reluctant to give up my credit card, as it gives me peace of mind when booking travel and car hire.

Would I be able to use a debit card in the same way ( I am thinking of a transferwise account for travel and accommodation and possibly an Open Bank account for everything else? I was not sure if I could book car hire without a credit card.

I don’t have my pensions paid directly to my spanish bank as I do not move money if its not a reasonable exchange rate. I keep around 60k euros in Tenerife. I would need to be able to continue paying taxes driectly from my bank account.

Any advice would be appreciated

For car rentals you do indeed still need a credit card (debit card won’t work). I once showed up without a credit card (expecting they would simply be able to block my insurance deductible on the debit card and then release it again once I returned the car but they wouldn’t do that. So the option they gave me was to walk away or pay for the zero deductible insurance (quite a bit more).

We have been using Transferwise since 2011 and have just got a debit card, we have found a problem with the IBAN number for the account as it is on a Belgian bank and is not accepted by some of the utility companies in Spain, especially Movistar.

Get N26 instead, they give you a Spanish IBAN.

One problem which many people have encountered is being able to pay income tax from their new account. Indeed, this is the reason why I left Self Bank and joined Open bank instead.

The following link provides a list of all banks with agreement with AEAT. I don’t know if the list is complete but if your bank appears on this list, you should be fine.

https://www.agenciatributaria.es/AEAT.internet/Inicio/Ayuda/Pago_de_impuestos__tasas_y_deudas_por_Internet/Listado_de_Entidades_Bancarias_adheridas/Entidades_adheridas_al_pago_de_autoliquidaciones_con_cargo_en_cuenta.shtml

Thank you for this article, its very helpful! 🙂

Hey Jean! Really enjoy your articles, thank you! As the other commenters, I’m also curious about your opinion regarding Openbank. Currently I have N26 for day-to-day payments. I also have Caixabank, but I am not happy with the overall experience and would like to change it to another spanish bank for more serious use cases. I have heard a lot of positive reviews about Openbank. What do you think about it? Thanks!

Hi Nik. I am an Openbank user and am pretty happy with the quality of service. They’re part of Santander, which means you can withdraw money from any Santander or Banco Popular ATM for free. The website is in English as well as Spanish; I use the former as it’s a perfect translation, even though I can read Spanish.

Muchas gracias,

Soy española residents en el extranjero y me ha ayudado mucho Tu post.

Thank you for providing so much useful information.

I need to open a Spanish account to pay bills relating to our property in Tenerife. I live in the UK. Having looked on the N26 website it looks as if they won’t accept British customers? The UK is not on their list! Which bank do you suggest as an alternative?

Thank you.

CAROLYN

Hi there

I’ve just received an email asking me to confirm my subscription. Is there any cost involved ?

Thank you

Jackie

No cost Jackie.

Hi there

I apologise if I have sent this message twice.

Thank you so much for all the valuable information provided.

I wonder if you can give me advice. We live in the UK and have an apartment in Spain. We banked with Banco Popular who as you know are now Banco Santander. Recently they have started charging us 12 euros a month even though we don’t have a credit card and only use them to pay about 8 direct debits to pay our bills.

I have set up a TransferWise account but don’t know how to transfer the direct debits over. I speak Spanish but I’m slow and Spanish people never seem to understand me very well on the phone.

I have asked our solicitors to transfer them for us and they have refused.

I would be so grateful for any advice you could give me.

Many thanks

Jackie

Thanks so much for the extremely helpful article!

What is the typical/recommended method for transfering funds from a current bank account (US) to a Spanish bank account? I plan to open an account with Banco Sabadell as my uni has a partnership with them.

Great article.

I’ve got a Sabadell account paying out 3 direct debits every month plus SUMA and other such bills on standing order and get charged €35 every three for the privilege.

From your great overview it sounds like N26 could be the solution. Do you know how easy it is to transfer DDs and SOs from one Spanish bank to another and are N26 likely to offer assistance?

Don’t think so. I would rather go to BBVA maybe as they are a more traditional high street bank in Spain and will offer this kind of assistance. Their account is also completely free of charge (at the time of writing) without any strings (such as minimum balance or income) attached. Also bear in mind that N26 is not suitable for you if you are self employed in Spain as the Spanish Agencia Tributaria cannot collect your taxes from an N26 account. At least they are not listed here: https://www.agenciatributaria.es/AEAT.internet/Inicio/Ayuda/Pago_de_impuestos__tasas_y_deudas_por_Internet/Listado_de_Entidades_Bancarias_adheridas/Entidades_adheridas_al_pago_de_autoliquidaciones_con_cargo_en_cuenta.shtml (thanks to Adam Simmons for posting this useful link above).

Hi, I need to open an account in Spain to pay rent, as I am still in the UK I do not have NIE. I have euros ready to transfer and will need to set up a DD; don’t really want charges. Please advise

N26

Hi have created a N26 account with a ES IBAN. I also have a euro Revolut account. Both have free ATM withdrawals with limits. But both have free ATM withdrawals.

But won’t all Spanish banks charge a fee for using these cards at their 🏧?

I’m not sure which ones charge a fee as I don’t usually use these cards for withdrawals. I’d be interested to know if you do try it.

I believe I tried once at one of the big banks and was charged around 2 euros but it’s been a while now.

I´ve been using transferwise to transfer, it doesn´t matter the bank you have. you recieve as a sepa transfer and only pay few comission on platform

Hey Jean,

You really have incredible info. Thanks for sharing.

Do any of these banks (preferably the online ones) offer a Business Account, for income, and where Taxes, Social etc. can be paid from, and tax refunds paid into as well?

Also, do you know what age it is legal to open a bank account?

My son is 16 and would like to open his own now.

Thanks

Hi Olivia, the big banks will all offer business accounts, although they will probably not be free.

The legal age for opening an account in your own name in Spain is 18.

You saved my life!!! Thank you so much.

This is the best article I’ve come across on this subject so far. Thanks very much, Jean.

hello.i am a costumer of Sabadell bank wich I don’t like anymore and I wanna to change.wich bank you can tell me that is better then Sabadell.

I have an account with the BBVA. They are apalling. I am a very low earner & because I cannot put enough money through the account they charge me 96€ per year just to have an account. They also charge me 28€ per year to have a debit card (over 4 years until expiry that means that piece of plastic costs me 112€). They have blocked my account twice; once for a small amount of money (50€ birthday gift) entering my account that they couldn’t quantify as earnings, & once because they decided the proofs of ID I had opened the account with 3 years before were not good enough. They changed my address without informing me, because they saw my passport address was different to the one I had previously given them & proven. They charged me for a duplicate card after they sent a new card out to an address I had changed two years previously. And when they take out their fees it is randomly & without warning. As an earner under the accepted income poverty threshold this has just today put me in debt & without money for food, as I have not been able to work sufficiently the past 3 months due to the pandemic. I have never been treated so poorly & felt so robbed by a bank in the 40 years I’vev had accounts.

Agree with all said here for BBVA.

I just received a 119€ ‘maintenance fee’ charge, owning just a debit card account (so no minuses ever, y basically no international transfers) -is that normal? I called them and they said they will make a revision and get back to me with explanation. is there an explanation for a charge of 119€ to maneuver your earned money?

Next step is to get out from there and sign with some more fair bank.

So in that context, thanks (Jean) for this article and the discussion here

Welcome Lalin, that’s a strange one indeed. Did you manage to get it sorted?

Basically the BBVA charge the poorest people the most service charge. I think you have to move 800€ per month through your account to waive fees, except the cost of the debit card itself. Which is 28€ per year I think. The card is valid for 4 years, & so that little bit of plastic costs 112€!

Not if you open an online account. Then it’s free. Follow my link.

The online account advantages are available only to new customers.

I am a non-resident here in Spain at the moment, can I use n26 online bank to receive lottery benefits or which bank to you suggest as a non-resident

Yes that is perfectly fine as N26 is available in many countries not just Spain. As long as N26 is available in your current country of residence you can use it.

Problem is that he wants a Spanish IBAN, but as non-resident. I have the same situation. I do have a NIE, Spanish address and spanish mobile, so I can apply for N26, but officially this mean that you are lying because N26 expects you to be a Resident in Spain if you open a Spanish IBAN account. I have asked them for advice, and they said you can change address (as residency) later on, and keep your Spanish IBAN, as long as you move to a supported N26 country (as legal address). At least for 18 Months, after which they will contact you.

Just an update on Bankia if you want to do a money transfer from your account to an English account you will now be charged 31 euro as the UK is no longer in the EU even though it still in the transition period

Bankia may not charge commissions on their pensions account but do insist you take out their insurance. Caixa Bank have a no commission account for pensions advertised but transfers from the UK are not recognised so you do have to pay the commissions.

Santander are promoting their online “Open bank”, do you have any comments about them?

Hi there

Thank you so much for all the valuable information provided.

I wonder if you can give me advice. We banked with Banco Popular who as you know are now Banco Santander. Recently they have started charging us 12 euros a month even though we don’t have a credit card and only use them to pay about 8 direct debits to pay our bills.

I have set up a TransferWise account but don’t know how to transfer the direct debits over. I speak Spanish but I’m slow and Spanish people never seem to understand me very well on the phone.

I have asked our solicitors to transfer them for us and they have refused.

I would be so grateful for any advice you could give me.

Many thanks

Jackie

My advice is forget that bank. Change to revolut or N26. They are great and sooo easy to use

Hi, I have Salary in USD, what bank would you suggest for receiving USD and converting to EUR with the best option. I have now in Sabadell but it become more and more expensive. I’m resident of Spain.

N26 or TransferWise Borderless without a doubt. Then if you wish you can transfer the Euros to a local bank account in Spain if you need to.

Definitely don’t used Sabadell to receive the USD though, as their conversions are worse than N26 or TransferWise, plus you will automatically have to convert to Euro.

Thank you for such fast reply. I will follow your advice. Thanks again.

As of March 24, 2020, BancSabadell is charging a minimum of 15€ per trimester for an expansion account. 30€ if you ever have a negative balance.

We are a small company based in Spain. Our clients are in the Uk. We need to open a Sterling account in Spain to receive payments from Uk and also make payments in Sterling. Can you suggest a bank? Thanks

You mention Open Bank at the top but no details further down, is there any reason for this? Was it deleted?

Very curious about this too! Do you have any experiences with Open Bank?

Great article. However it should be noted Bankia are now adding requirements to their Cuenta ON accounts to avoid fees. This is part of the Por Ser Tu programme.

If you don’t meet the requirements, you are charged. One of the requirements is to take out a credit card and make two payments a month

https://www.bankia.es/estaticos/Portal-unico/Servicios/Servicios/Adjuntos/POR_SER_TU/Bases_Por_ser_tu_Particulares_febrero2020.pdf

A very helpful article, thanks Jean.

One question – my partner has an N26 account with a Spanish IBAN but when she tried to set up autonoma payments for Spanish social security last week, the gestor claimed that the account was not recognised / valid for SS purposes! Has anyone else had this problem and found a solution?

Much appreciated

Hmm, I still have a DE based N26 IBAN in Spain and waiting for the switch to Spanish one, but the whole point of N26 giving Spanish IBANs is to better options for use with things like SS! See their blog

Basically: “EU law states that no matter which country your IBAN comes from, it should be accepted anywhere within the EU.”

Contact N26 and let them know as I was told they are working with authorities to get this changed.

https://n26.com/en-es/blog/local-iban-spain

Regarding N26 and state payments (benefits/social security/etc.) they are not recpgnised by Spanish authorities for these purposes so you cannot receive payments into an N26 account.

I have been discussing this issue with their support team today and basically they are unlikely to change – this has been a known issue since March, as you point out, and still ongoing.

I am due to possibly go on ERTE soon which means I must open a standard Spanish bank account to receive this payment from social security.

An article about the issue: https://spainsnews.com/n26-the-german-neobank-leaves-its-spanish-clients-lying-without-charging-unemployment/

See details about this on N26 website:

https://n26.com/en-es/blog/letter-from-our-general-manager-customers-are-top-priority

They say they are making it a top priority – but it doesn’t look promising as this issue has been going on for 3 months with little sign of any change – according to their support.

N26 do not have an operating agreement with TGSS, without which you can not use the N26 to make or receive SEPE payments. Apparently to join TGSS, a physical branch is required.