In this post I’ll explain PayPal’s cross border fee system. But first, a short recap on the fees that PayPal imposes in general.

PayPal charges fees whenever a transaction takes place. The one charge that is always present is PayPal’s own fee which goes towards paying off the processing of credit card payments.

Visa, MasterCard and American Express charge PayPal for every payment they process, and so they need to pass this fee on to sellers to cover their costs. They also need to make a profit on each transaction so part of that fee goes towards that purpose.

To recap, these are three instances that will trigger PayPal charges:

- When you receive money from a purchase.

- When you receive payments from outside your country or region.

- When you send personal payments using a credit card. The sender determines who pays the fee.

- When you withdraw money to your debit/credit card.

I am mostly concerned about the accepting payments for your business with PayPal, so I won’t be discussing the third scenario. I’ve also discussed the fourth scenario in previous articles on this site.

We’ve already talked briefly about the first scenario above, and to give you an idea here’s what you would be paying if you were based in the following countries:

- US: 2.9% plus $0.30 USD per transaction

- UK: 3.4% + 20p per transaction

- Spain: 3,4 % + 0,35 EUR per transaction

- Malta: also a Eurozone country, so fees are identical to those of Spain

As a side note, note that is very advantageous to have your PayPal account based in the US from a fee perspective, you get to pay 0.5% less than your European counterparts on the value of the transaction and also a lower fixed fee per transaction.

Moreover, if you are based in Europe but the bulk of your customers are based outside Europe, you will also be paying the cross border fee on top of paying more in basic fees.

On top of that, if you are charging everyone in Euros, you would also be hit by a currency conversion fee from, for example, USD to EUR. More on that later in this article.

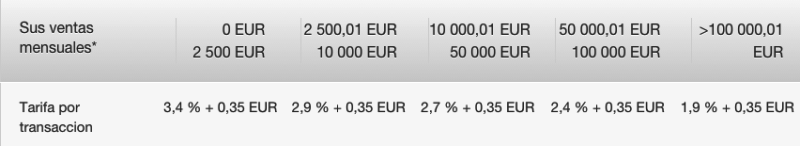

It is also worth noting that there are discounts based on volume, so lets take Spain as an example. The screenshot below shows the sales ranges and corresponding tariffs per transaction. It clearly pays to pass more transactions through PayPal every month.

As far as I remember, the bulk transaction discount won’t be automatically applied, you need to ask for it buy opening a support ticket with Paypal.

The above assumes that the sales were made within the same country that you have your PayPal account set up in. So for example a US seller selling to a US customer or a UK seller selling to a UK customer.

Cross border transactions, for example a UK seller selling to a US customer, trigger cross border fees, which is what I want to talk about in this article.

After spending several years traveling as a digital nomad in search of an ideal place to settle in, our choice fell on Barcelona.

After spending several years traveling as a digital nomad in search of an ideal place to settle in, our choice fell on Barcelona.