Working remotely is becoming more and more popular, with lots of European companies outsourcing part of their workloads to labor in the Philippines. The big question is how to pay these remote workers at the end of every month.

Working remotely is becoming more and more popular, with lots of European companies outsourcing part of their workloads to labor in the Philippines. The big question is how to pay these remote workers at the end of every month.

The current methods I know of are:

- PayPal

- Bitwage

- Payoneer

- Bank transfer

There are many other services but they mostly seem to cater for US companies rather than European ones. For example, Xoom does allow economical transfers of money, but the source bank account or debit/credit card should be in USD, else you will be hit by a conversion fee from EUR to USD, apart from the eventual fee to convert to Philippine Pesos.

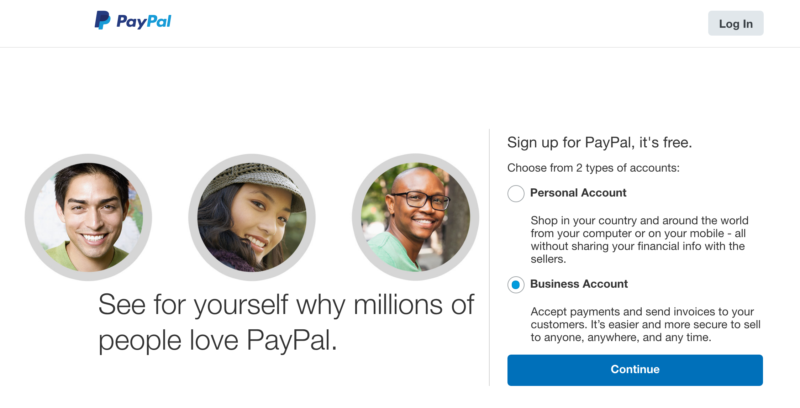

So far, the most straightforward service remains PayPal. It is possible to have both a USD and a EUR balance within PayPal accounts, so this gives the best level of flexibility when paying remote workers in the Philippines.

On the other hand, Payoneer is a strong competitor, with the slight disadvantage that you will have to sign up for a Payoneer account and supply some company documents for them to verify the company before being able to put payments through.

To test things out, I sent a payment of around $1000 to the Philippines with both PayPal and Payoneer. I used USD for the PayPal transfer and Euro for the Payoneer transfer, but the value was the same, I just calculated the Eur value using that day’s exchange rate. After calculating all fees, conversion to currencies and receiver’s bank fees, Payoneer comes out the winner as long as you send in Euros. Compared to PayPal, the receiver saved at least $35-45 after all is said and done with a Euro payment. If I had done it in USD the receiver would only save about $8-10.

Have you found any great services for transferring money from Europe to Filipino remote workers? Let me know!