If you’re looking to invest online – whether that’s in the form of stocks, ETFs, or other asset classes – you need to ensure that you are getting a good deal for your money. In other words, you’ll want to pick an online broker that offers competitive fees and commissions.

One of the most notable low-cost brokers active in the space at present is that of DEGIRO. Put simply, this broker allows you to buy US shares at a cost of just €0.50 + $0.004 and ETFs on a fee-free basis. But, are these low trading fees what they seem, or are they simply too good to be true?

That’s exactly what my in-depth Degrio Review intends on finding out. Not only will I explore the broker’s fee structure from top to bottom, but I’ll also cover other important metrics. This includes everything from tradable markets, supported payment methods, user-friendliness, eligibility, customer service, and of course – regulation.

What is DEGIRO?

DEGIRO is an online stock broker that is based in the Netherlands. With that said, the platform is now home to over 600,000 investors in 18 countries. This includes much of Mainland Europe and the UK. By opening an account with DEGIRO, you will have access to a highly extensive list of assets.

As we uncover in more detail later, this includes everything from shares, ETFs, bonds, futures, and leverage products. All in all, this online broker covers over 50 marketplaces across 30 counties. As such, if there’s a specific financial instrument that you’re interested in, there is every chance that you will find it at DEGIRO.

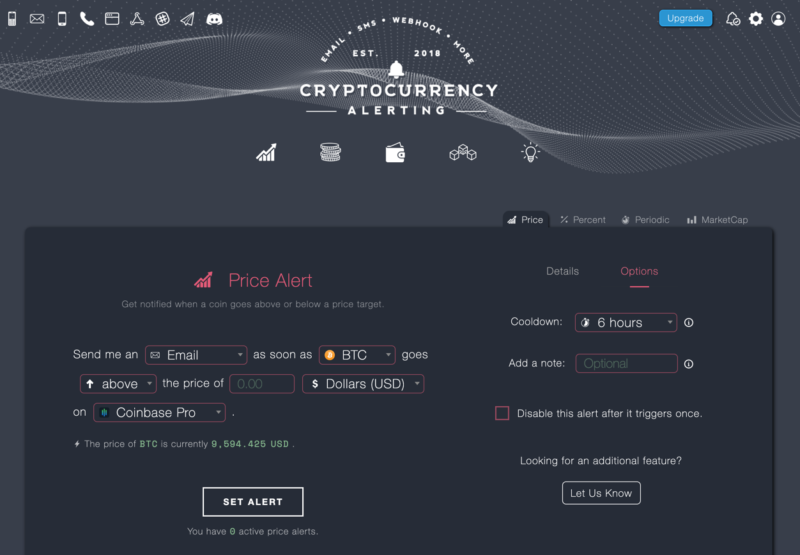

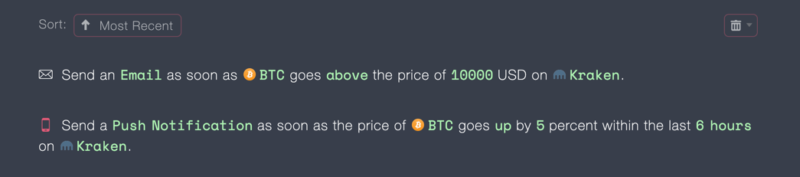

Crypto assets can go through weeks of flat price action, and then suddenly go into a frenzy in a few hours. It is not practical for investors who are not professional traders to keep on top of the crypto markets themselves, also because the market is open 24/7.

Crypto assets can go through weeks of flat price action, and then suddenly go into a frenzy in a few hours. It is not practical for investors who are not professional traders to keep on top of the crypto markets themselves, also because the market is open 24/7.