Here are some notes on family inheritances. This can be a heavy subject for many families, and now that I am both a child and a parent, it makes sense to think about the topic and try to plan early.

We start off with the fact that parents owe nothing to their children financially.

Most parents would have given way more than their kids can ever hope to equal in terms of love, care, shelter and financial assistance while they were growing up. This is just the nature of things. It’s the role of a parent to do so.

Once the kids leave their parents’ house to start their own life, provided there are no obvious impediments (e.g. disabilities) they should be independent. Even if they don’t physically leave the house due to some reason or cultural norm, there should be a cutoff point around the 18-20 years old mark.

Parents should strive to teach their kids how to manage their finances from an early age. Ideally, they should also show them how they can make money and instill an entrepreneurial spirit – even if they eventually end up getting a job and not do their own thing.

The easiest way to manage an inheritance is to split it equally between the children. But it’s not always such an easy strategy. One obstacle is the fact that inheritances rarely consist of purely cash assets. With other types of assets, valuations can complicate matters a lot. There might also be items being passed on that have a big sentimental value to members of the family, so it becomes very tricky quite quickly.

One other option is to not leave any inheritance or to leave all assets to a charitable trust, possibly managed by the kids. Typically this kind of option is chosen by parents worried that an inheritance will cause issues between the siblings or that the sudden influx of money will somehow corrupt them. While I think these are perfectly acceptable options, they wouldn’t align with my way of thinking. I think money is a great enabler, and if children are well educated from an early age in the school of life, an inheritance (or living a childhood with no financial worries) will not affect them in a negative way.

100% of the negative cases I’ve seen concerning money and inheritances were because of the parents never really giving their kids a well-rounded education (typically because they were too busy working and amassing a fortune to actually spend time with the kids), so the end result was not surprising.

Another consideration is when not all siblings have been equally fortunate in life. What do you do when one child is objectively in a more needy state due to a disability, unfortunate event etc? In these cases, if all members of the family have a good relationship between them, it is quite understandable to make sure the more needy child has their needs covered as a first priority.

Communication between the parents and children about their inheritance plans is always essential and helps to avoid conflict down the line.

I’ll keep expanding this article over time, but if you have any input on this topic it would be great to hear for you in the comments section below.

Further Reading

- Family Wealth: Keeping It in the Family – Hughes Jr E

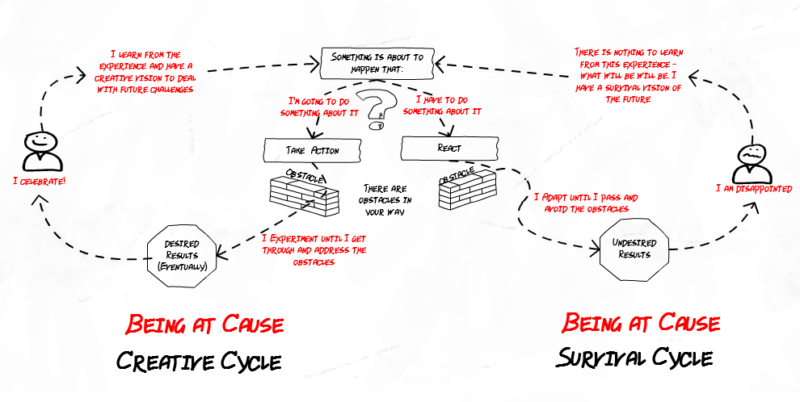

Many conflicts, arguments and disagreements tend to stem from the fact that we assume the offending party set out to harm us in some way. In other words, they have an evil agenda or negative intent.

Many conflicts, arguments and disagreements tend to stem from the fact that we assume the offending party set out to harm us in some way. In other words, they have an evil agenda or negative intent.

The first point of confusion for any prospective WordPress user is the differentiation between WordPress.com and WordPress.org.

The first point of confusion for any prospective WordPress user is the differentiation between WordPress.com and WordPress.org.