Contents

Note: If you have any questions after reading this and the several other articles relating to PayPal on this site, please leave a comment or contact PayPal directly. Unfortunately, due to time constraints, I am unable to offer any advice over email so all emails I receive that are related to PayPal will remain unanswered.

Choosing a PayPal account structure is not straightforward fare for most people, so in this post, I’ll attempt to demystify the whole process of signing up with PayPal and choosing an account type.

Before we start, a quick note:

If you are looking to send money as cheaply as possible then Wise is usually going to be cheaper than PayPal.

Wise does not make money off the exchange rate and only charges a small percentage of the overall transfer as its fee.

Have a look at my comparison between PayPal and Wise Borderless as well as my full review of Wise Borderless. N26 and Revolut might also be good options depending on your needs.

Now back to PayPal accounts.

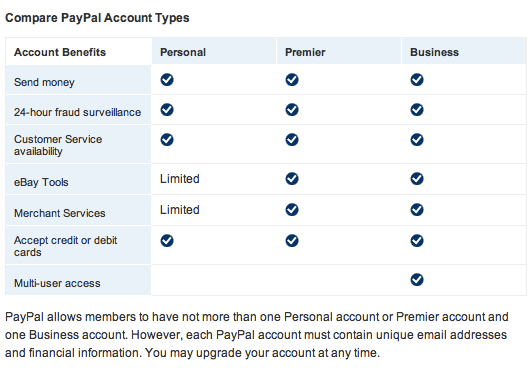

You start out with a Personal account, but you can then upgrade to Premier or Business accounts.

PayPal offers two different account types; PayPal for your personal use (Personal and Premier), and PayPal for your business (Business). It’s free to sign up and each account type offers different features and capabilities. To decide which one is right for you, read on.

An account for personal use is ideal if you shop online. You can:

- Shop on eBay and merchant websites using your credit card, debit card or bank account

- Send and receive money from friends and family

- Accept debit card, credit card and bank account payments for a low fee when you sell on eBay and/or on your own website

Make the right choice for your online business. With a Business account you can:

- Accept debit card, credit card and bank account payments for a low fee

- Operate in your company or business name

- Manage Users, allowing you to give separate access rights to each of your employees

- Consult the Business Setup guide

Buying Crypto with PayPal

Did you know you can now buy crypto with PayPal? That’s right, you can use Binance since it accepts PayPal deposits. Just hit the links below to get started.

You can also read my full review of Binance to learn more about this crypto exchange.

This withdrawal method is extremely popular at the moment, as people worldwide seek to get themselves some Bitcoin or Ethereum due to their extremely bright future price prospects.

If you decide to go ahead with the upgrade, you’ll get this confirmation screen:

There is no good reason to have a Premier account if you are going to use PayPal for business. The fees are similar to or same as Business but some of the features not available.

- You don’t need to have a properly registered “business” to have a Business account. It can be a DBA (“doing business as”).

- You can have several Business accounts (just remember that each one should be linked to a different bank account/credit card).

- There are no monthly fees for any of the accounts.

- Additional services cost $35/month for all of them. You need to get approved to get them. You may get approved for one but not the other.

- Additional services include:

– Website Payment Pro (allows you to link PayPal to a shopping cart and charge credit cards without taking your customer to PayPal).

– Recurring Payments

– Virtual terminal (may be handy if you run live events or work with offline clients).

- If you have various ventures and want to have a separate PayPal account for each one, now you can set up a “child” account that is linked to your main one. The benefit is that the money will be swiped from it daily and put into your parent one automatically and with no fees involved. Also, you don’t need to link a child account to a bank account. To set up a child account, create a new PayPal account then call PayPal on the phone and ask them to link the new account to your main PayPal account.

The concise comparison:

- Personal: Recommended for individuals who shop and pay online.

- Premier: Recommended for casual sellers or non-businesses who wish to get paid online, and who also make online purchases.

- Business: Recommended for merchants who operate under a company/group name. It offers additional features such as allowing up to 200 employees limited access to your account and customer service email alias for customer issues to be routed for faster follow-ups.

Since my business is based in Malta, I’ll be describing the PayPal fees for this situation. Other European countries should have similar fees, but do check the PayPal website for your country for more accurate details.

Click this link to check the standard rates for receiving and sending money with PayPal.

The standard rate for receiving payments for goods and services is 3.4% + 0.35 EUR.

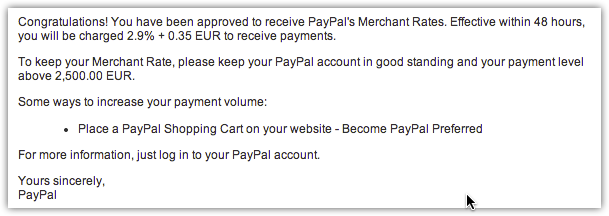

If you receive more than 2,500.00 EUR per month, you’re eligible to apply for PayPal’s Merchant Rate – which lowers your fees as your sales volume increases. Your fees can be as low as 1.9% + 0.35 EUR, based on your previous month’s sales volume. For receiving money for product or service sales at the merchant rate, these are the prices:

| Monthly Sales | Price Per Transaction |

|---|---|

| €0.00 EUR - €2,500.00 EUR | 3.4% + €0.35 EUR |

| €2,500.01 EUR - €10,000.00 EUR | 2.9% + €0.35 EUR |

| €10,000.01 EUR - €50,000.00 EUR | 2.7% + €0.35 EUR |

| €50,000.01 EUR - €100,000.00 EUR | 2.4% + €0.35 EUR |

| > €100,000.00 EUR | 1.9% + €0.35 EUR |

Here’s the e-mail you get after you apply (manually) for the Merchant Rate:

Note that the rates in the table above are for domestic transactions. If you have customers offshore then you will incur what is known as a cross-border payment charge.

See also: Understanding PayPal Cross Border Fees

Click here to view the higher cross-border transaction fees. You will still benefit from lower rate bands with cross-border payments once you apply successfully for the Merchant Rate.

The accounts we’ve mentioned till now don’t have any monthly fee, but PayPal also offers the PayPal Pro solution, which costs $30 per month.

See also: Should you withdraw from PayPal to a credit card or to a bank account?

The Pro solution is for heavy PayPal users, and allows you to benefit from lower rates among other services. Click this link for more information about Pro. Go for Pro if you need full payment gateway functionality, as this system will allow you to create a fully customized checkout process that will enable customers to complete the purchase from your site rather than being transferred to PayPal as is the standard procedure.

Here’s Pro in a nutshell:

- $30.00 USD monthly

- No set-up fees

- No cancellation fees

Transaction fees 1.9% to 3.4% + 0.35 EUR

Choosing a Checkout Service

If you are using PayPal to collect payments for products and services that you are selling online, you will also need to choose a checkout service. All e-commerce solutions such as Shopify, WooCommerce, and Easy Digital Downloads will allow you to select one out of several e-commerce checkout business solutions offered by PayPal.

See also: Should you open separate PayPal accounts for each of your e-commerce stores?

The choice is between the following:

- PayPal Website Payments Standard

- PayPal Express Checkout

- PayPal Payments Pro

Read my separate post about the pros and cons of each and then decide accordingly

Managing Multiple Currencies

You can choose what currencies to accept and how you would like to accept them. When a buyer sends a payment in a currency you hold, the money will automatically appear in your account in that currency. When a buyer sends a payment in a currency you don’t hold, you can:

- Open a new currency balance to accept the payment.

- Convert the payment to a currency you do accept.

- Block the payment.

You can choose a primary currency as the one you use most often for sending and requesting payments. It’s also the currency that is used for your withdrawal limits.

If you convert a payment into your primary currency, PayPal offers conversion rates that are pretty bad. You can read my guide on PayPal currency conversions for more information about that. You can always preview conversion rates on currencies you don’t hold before accepting payments.

You might also want to change your PayPal withdrawal currency before you withdraw money to your credit card.

An Example

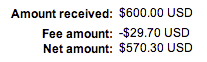

So how do PayPal transactions look? Let’s say I have a client from the US and charged him $600 for some web services I rendered. When he pays me via PayPal here’s what I see in my account:

Now what’s important here is to know exactly what that $29.70 fee stands for. Since this is a cross-border payment (US to Malta), it can be broken down as follows:

- Base fee (3.40% + $0.30 USD) = $20.70 USD.

- Cross-border fee consisting of a fixed (0.50% and 1.00% depending on between which countries the transfer is made) = $3.00 USD and $6.00 USD respectively.

As an average, be prepared to pay around 5% in transaction fees for every offshore payment you receive via PayPal.

If I remember correctly, with a Personal account you can accept or deny payments. Before you accept the payment, you can see the estimated transaction fee on the ‘Transaction Details’ page. If you deny the payment, the fee is not charged. With a Premier or Business account, there is no such option to accept or deny payments.

Refunds

When you issue a refund, you don’t lose any money and the purchaser gets all his money back. Click here to see the full refund policy together with a worked-out example of how refunds work.

PayPal has recently changed its policy, stiffing sellers, unfortunately.

Withdrawing funds from PayPal

Not all countries offer the same facilities for withdrawing funds from Paypal. For example, in my home country Malta, we used to be able to withdraw money only to a credit, debit, or prepaid card as well as a US bank account, but no local accounts.

This was then changed to allow withdrawals to EUR based local accounts, but unlike with other payment providers, we are not able to withdraw to local accounts in other currencies. This is a big disadvantage if you are making most of your sales in another currency such as USD.

So right now I have to accept all USD being converted automatically by my bank to my card’s currency which is always EUR by default since we’re based in Malta.

Read the following posts on this topic as it is critical that you get this right:

- Withdrawing from PayPal to online bank accounts like Wise or Revolut

- How to change PayPal’s withdrawal currency for credit cards

Paypal provides a handy checker where you can select your country and see which withdrawal options are available for that country.

What about PayPal Alternatives?

There are many PayPal alternatives, two of which are Payoneer and Stripe.

Payoneer

It’s worth looking at some PayPal alternatives that might be better suited to your needs. I’ve already mentioned Wise earlier in this article, but Payoneer is another widely used PayPal alternative, especially in India.

Launched in 2005 and headquartered in New York, Payoneer is a payment services provider that allows users to send and receive money online. The platform currently services more than 4 million customers located in more 200 countries.

Cross-currency transactions cost in the region of 2% above the mid-market rate, although this can be lowered if you hold a VIP account. If you obtain the Payoneer pre-paid debit card, then you’ll pay $3.15 per ATM withdrawal.

Payoneer is also a notable PayPal alternative due to its highly rated customer support. You have the option of contacting support via telephone, live chat or through a support ticket. However, response times are somewhat slow over the weekend, so you’re best off calling them if your query is of an urgent nature.

Stripe

Stripe is recognized worldwide as the most painless way to accept credit cards online as a merchant, and it was created with developers in mind, making integrations easy. Fees are on the low side, and you can also get the first $20,000 of transactions with zero fees if you follow my method.

Further notes

Please be aware that there are two different types of payments that can be sent using PayPal – Purchase Payments and Personal Payments. With a Personal payment type, the sender of the payment can choose who pays the fee which is incurred. However, it is not free to send the payment. Either the sender or the receiver must pay. It is possible to receive personal payments to a Personal or Premier PayPal account.

If you are planning on receiving payments for a business you are running, you may need to upgrade your account type, as a Personal account is not suitable for receiving large amounts of payments. However, if you are only receiving a small number of payments, you are free to do so.

In case you are into gambling and want to make a deposit using Paypal, you should be aware that the payment platform has a strict policy about casino transactions.

See also: How to change ownership of a PayPal account

It is possible to have two PayPal accounts, however only one can be for personal use, and must be either Personal or Premier type. It’s not possible to have a Personal and Premier account at the same time.

You can downgrade from a Business account to a Premier account, but not back down to a Personal account.

PayPal users can have one Personal account and one Premier or Business account. Each account needs to have a unique email address, bank account and credit card.

Hopefully, that helps to make your choice easier. If you have any questions, fire them off in the comments section.

My husband has a published book. He lectures all over the world. I handle his book sales. He is lecturing in London in a couple of weeks. I’ve never handled international sales. I know the London universities don’t take Venmo or Square card reader. I’m hearing they take Paypal International? I have to open a business account or upgrade his personal account? If I figure that out, how do I translate British currency into American? The funds are held in an American bank. Thank you.

Hello,

I’d like to know as well what is the recommendation for writers. I write under a pen name and will be receiving funds from different sources like Createspace, Kindle, Smashwords, and even my website…

I would also like to do payments from there, to editors, designers, and others. So I’m undecided of what account to open.

At the moment it isn’t a lot, but one day this will change. It’s good to know that I can always upgrade.

Should I then start with a personal account??

Hi Jean, thank you so much for writing this article. I found it to be really informative. I have a question that I can’t seem to find a good answer for, maybe you can help!

I’m a young college student trying to make a little money by selling art commissions. I’m not expecting to make more than a hundred dollars or so at the most. Do you think I would be best off using my personal PayPal account for this or should I upgrade to business? Thank you!

You can start with personal and switch to business if things take off.

For a business paypal account do I have to send a paypal invoice to get payment from my customer or can they just pay me with my email address? I am a freelance designer I have a client that has my time owed logged on a group work site – so i don’t usually send them an invoice they just pay me every two weeks for the hours I have logged at my rate.

They can pay you with your email address.

Jean, thanks to your article I know the difference between the two accounts. But I have a different question,can you help me? Can I use a saving account of banking to start a business account on PayPal ?

Hello Jean, I want to do a little investment in which I need to send and receive money abroad. I don’t have a legal business name. Which PayPal account do you think I should use? Can I receive money from others other than friends/family with PayPal personal account?

Good morning, I am in the process of setting up a wix website and wanted to have a way for clients to pay me for a service. I was wondering if I can use a personal account for this?

You should use a Business account.

Hi, I jus opened a Paypal business account but Im just finding out that PP business is mainly for for register businesses, and I don’t have a register business. So, my question is, can I use the business account as a personal and If I do is there any cons, other than they having my SS#?

You should use a personal account if you’re not using it for business.

Can you use a personal account if you are just using the account to collect money for class reunion fundraisers, e.g someone wants to purchase a raffle ticket?

Any idea what happens when you Upgrade from Personal to Business? I know the features you get are different.. but is there anything else I should be aware of like change of address or I have to convert my profile entirely to a “Business” profile? Can friends and family still send me personal payments?

Business accounts are designed for business use only and I do not recommend to open one when you intend to use it only for personal payments.

With a Business account you can:

There are two types of payments you can send using PayPal. When you send money, you can select either a ‘Personal’ payment or a ‘Purchase’ payment option.

Some examples of why you would send a personal payment are:

Hi,

Good article. I am having real problems with PP just now. I have a business account with PP but my money comes from my marketing site through affiliate sales so have no “Business Document” to show as its all online.

I am British but live in Croatia so this is my full time income, that I get through Paypal.

I also have a info product launch coming up soon but am very worried that if it goes well that they can freeze my account.

Have you had any experience in this type of situation?

I think that tomorrow Im just going to have to call them as this submitting random documents and then being told that they are not good enough is getting tiring…

Surely I cant be the only person with a profitable online business IE. A site that makes affiliates sales…???

Best,

Marc

I’m not sure what the problem is Marc, is it PayPal asking for certain documents?

Hi,

Since I left that last comment I now barely use Paypal. One of my main affiliate platforms have started direct bank transfers (They used Veem for a while but as I predicted Veem stopped working with them due to their TOS plainly stating that they don’t work with affiliate or MLM platforms…)

For CB (clickbank) I use Payoneer which works fine as otherwise I would be getting checks sent to me, paper cheques in 2019….I mean come on!

I still have my main Paypal but cant withdraw to my bank directly so use them to pay my VA or for other outsourcing or for bills or occasionally using to send to my offline company and sending to the bank from there!

The World of the affiliate marketer in the MMO niche is changing and if you can’t change with them you are getting left behind.

The other reason for Paypal and keeping it is the passive income that gets paid every Month (Mid to high 4 figures, not a lot but nice to get when you want a bit of breathing room)!

Again keep up the great writing style,

M

Hello, I have a few questions.

I want to use my personal PayPal to receive money for content creation on blogs, does that count as business? Note the incoming funds may run into 10k plus.

2.if I have a bank account in USD from a local bank in Hungary can I receive funds?

1. Yes.

2. No, they only send to the Hungarian Forint currency accounts.

nice article and easy to understand, thanks for sharing this information my friend, keep up the good work.

hi

Got issue my paypal account has limited.and that’s personal account and paypal service told me wait 180 days to withdraw my fund in paypal.So its possible can upgrade my account to premier account.Any option? please help.

That’s a particular case you’d need to discuss with PayPal themselves, I can’t help you unfortunately.

Hi Jean,

Thanks very much for the detailed information. I wanted to ask your advice on the account I need, as I myself am based in Malta too!

As I am from England, I have a few contacts with a few UK suppliers of particular products you can’t get in Malta. We have an agreement with these suppliers to send out some samples to promote here and then I make commissions on the amount of people here that purchase from their website. Currently I have a personal account so I can send an invoice to the supplier for the commissions due, which is registered to my UK bank account and my old UK billing address.

I have plans to work with a number of Maltese suppliers here too in the future, but I’d like to stick with my UK account for these businesses after receiving terrible service in the past from bank of Valletta. I just wanted to check that I am OK to do this and not breaking any laws by doing business with my UK account registered at my parents address when I am based in Malta. And would you advise me upgrading to business from personal for this?

Thanks Jean

You’re welcome Jason, if you would like to make sure that you are not breaking any laws with this particular setup I would advise you to check with a lawyer in Malta, but it does look to me that it should be no problem at all to proceed in this way. If you are using the PayPal account for business then I would definitely recommend that you upgrade to Business.

Hi, Jean!

I forgot to ask you about difficulties upon withdrawal from a personal paypal account. Thank you.

I haven’t encountered any difficulties Regel.

Thank you Jean. This is helpful for me as I started monetizing my website, MainbarOnline. Thanks again, Jean.

You’re most welome, glad to be of help.

Hi Jean, love your posts. I have one question. Do i need to have a business bank account? Or i can just link my paypal business account to my personal bank account? Will that affect anything?

Thanks Caroline. You don’t need a business bank account. It won’t affect anything.

I am located in Bangladesh and I know paypal isn’t supported here. I was wondering if opening an account in a different country would be a good idea?

If you can manage to do that it would be a good idea. Many Bangladeshis have friends in other countries open accounts for them, then send them the money through other channels.

Hey ,thats a really good about paypal to clear the all facilities in personal,pro,Business.But i have facing a problems i live in Bangladesh i can not create personal account in Bangladesh that no option.

In case i am confusing do i Business account are open In Bangladesh ?

Take me note that cost of benifiet of personal and Business account. Or i other than i create personal account in other country address.Email is varified but phone unvarified ca i tranazation money.

Thanks you.

Hi,

I have a personal account.

I have started to rent out my vacation home. I am getting money in my personal account. Not more than $2500 maximum in a given month.

I am setting up a website . As some persons get frustrated when I ask them to transfer money to my paypal account.

What’s the best thing to do with the least possible cost based on low margin of profitability?

It looks like your biggest problem right now is with customers feeling frustrated about paying via PayPal. Do you know why that is the case? Perhaps you need to add a credit card payment processor such as Stripe or Braintree.

Hello Jean,

Thanks for your awesome post and clarification.

Currently I have one personal account linked my bank and credit card.

I plan to add some employees as child accounts into my paypal account.

In this point, whenever they get the payments from third party through child paypal account, third party will receive the email notification regarding the transaction against them.

At this time, third party receive an email including my business information or one including employee’s information (ex: billing address or shipping address, name etc..)?

I look forward your kind response.

Best regards

If I’m understanding this correctly, you will be adding alternate emails to your main PayPal account. I am not aware of the possibility of adding child accounts in PayPal, so perhaps you meant adding alternate emails. If that is the case, the details the third party receives are your details, not the employee’s.

Many thanks for these very handy tips Jean! Based on your recommendation I have upgraded my personal Paypal account to a business one.

I now have one query and I am hoping you could guide me accordingly:

Upon upgrading I was reading through the Paypal user agreement and I found the fee structure to be a bit confusing. I would like to link my website receipts to a Maltese bank account.

Firstly upon trying to link a bank account to my website I only get the option to link to a US bank account which I obviously do not have. Am I missing something?

Secondly should I be able to link to a Maltese bank account, what I gathered so far is that if I receive money from another Maltese bank account there will be zero fees and also upon withdrawing the e-money from my Paypal balance into the bank account there will be zero fees. Fees start applying upon receiving money from other countries.

I just want to make sure that I do not need to raise my prices to cover these fees.

Thanks in advance and keep up the great content. You’re a star 🙂

Welcome Andrew. In Malta there is no option to link to a bank account unfortunately.

You can only withdraw to your credit card. You will incur a fee of around 2 euro per withdrawal, and you’ll have a maximum of $2500 per withdrawal.

It’s very inconvenient but there’s nothing one can do about it short of changing the location of your PayPal account to another country which is better integrated within the PayPal system (Spain is one example).

The fees can vary from transaction to transaction due to the location of the person paying you. If you want to be safe and cover all your PayPal fees, I would suggest you raise your prices by 5%. At the end of every month you can also see the total amount of fees charged in your PayPal account, so you’ll be able to adjust things better from then onwards.

I also suggest you go through my other posts about doing business with PayPal.

Thanks for your prompt reply Jean, very helpful indeed. So if I get you correctly, the indicative EUR 2 withdrawal fee is a % of the withdrawal amount capped at a maximum of EUR 2,500.

My other query relates to whether apart from the withdrawal fee mentioned above, PayPal withholds some other fee on every receipt. Any idea about this?

Welcome Andrew. The EUR 2 withdrawal fee is fixed. You can only withdraw up to EUR 2,500 in one withdrawal. Of course you can hit refresh for multiple withdrawals, so it’s quite ridiculous but there’s no way to change that, I’ve tried already. So if you make 10 withdrawals at one go, each of EUR 2,500, you will pay EUR 20 in withdrawal fees.

In addition to the withdrawal fees, as detailed above there is a fee for every transaction that passes through PayPal. This is really the major fee that you will have to take into account, way more than the withdrawal fee. The fee charged depends on your monthly volume of transactions. There is also a cross border fee that may sometimes be applicable.

Thanks again Jean. My bad in mixing up the withdrawal fee and the transaction fee as clearly distinguished in your article.

Thank you for taking the time to write this article – I was getting confused and frustrated at the lack of a clear and concise explanation of why I would prefer one account over another (I’m in Australia by the way). Many thanks again – Jaye

Hi, I’m looking to upgrade my personal account to a business account, but I need to know if I can still use my personal bank account to verify my newly upgraded account? Does it stay verified when I upgrade to a business account? I don’t have a business bank account yet, but I need to be able to accept credit card and debit card payments. Any help will be appreciated.

As far as I remember there is no need to verify again, You don’t really need a business bank account. It’s basically a click of a button within your PayPal account.

Thanks for the reply Jean.

hi jean

nice information i like it. can i open paypal personal account and then transfer money in my business bank account ? and one another if i have professional account in paypal and i want transfer money in my personal bank account ?

please let me know if you have any idea

Thank you

Yes you can do both.

Hi

I want to set up a business (similar to eBay) where buyers can pay sellers directly through my website. I want to charge a 5 % fee that would automatically be taken when the buyer makes the payment to the seller. How is this possible to work? Does it work with a PayPal business account? If A is paying B directly, is there a function for me to automatically “Take” 5 %? Or do I need to claim the 5% after?

Please let me know if you have any idea or solution.

Many thanks

Maria

Hi Jean,

I’d say this is the most informative post on the subject. I’d like to ask though if I’m required to upgrade to premier account if i’m doing PTC site @ $5 a month. I’ve been paid for the past 5 months and before I ask for the next payout, I’d like to know if I need to upgrade. What do you think?

Hi Jean,

Very useful article indeed, thank you.

I´m planning to open a US business account, and I heard that there are daily limits to transferring money from PP to the linked bank account. Is it so ?

I couldnt find this info anywhere in the PP web.

Thank you.

Hi Rodolfo, I’m not sure about that as I don’t have a US business account.

Hey Jean

Wonderful article. I have a question relating to my blog. I sometimes which is like once every month or two do sponsored posts on my blog and would like to know which PayPal account I should sign up for where brands can send there payment. I do these posts rarely so I would like to know which one I you think I should go for. Thankyou.

Hi Anam, start out with Personal, then if you hit any limits it’s easy to upgrade.

Hi Jean and Anam,

Which ones charged less when receiving money, personal or business account? Thanks

Hi Jean and thanks for the useful information.

I have spent more than three hours trying to understand Paypal´s mystery reading through their website however I couldn´t understand almost anything. Luckily after browsing online I came across your post and I must admit that all the necessary information are mentioned clearly in your post. I want to know your opinion though about my specific case. I live in Spain and I am working on a new classifieds ads website where users can publish their ads for free and they also have the possibility of making their ads more visible by paying a small fee between 2€ to 5€. I don´t have an established business yet and I would like to know which PayPal account you would go for if you were me. Thanks a lot again for all the good info.

Hi Musta, you’re welcome. I would go for the Business account.

Hi Jean,

Thanks for your excellent summary of how PayPal works. One question I have is what is the cheapest way to withdraw funds from a PayPal account to a Maltese bank account? I know you can do it by transferring to credit card or to a linked bank account but its hard to find exactly how much it will cost you.

Thanks

Aaron, you need to transfer to a credit card (bank a/c transfers are only for the US) and it will cost you around 2 euro per transaction. There is also a limit of how much you can transfer per transaction, I believe in the region of $2,000.