Back in 2020, I wrote a comparison of N26 and Revolut and concluded that N26 was the better bank. At the time, I stood by that call — N26 felt more like a real bank, had cleaner design, and Revolut was still finding its footing.

A lot has changed since then. I still use both, and I’ve been meaning to revisit this for a while. The honest answer in 2026 is that my conclusion has flipped. Revolut has become my primary account for most things, and I think for the majority of people comparing the two, it’s now the stronger choice — though N26 hasn’t stood still, and there are still specific situations where I’d recommend it.

This is a full rewrite, not a refresh. Let me walk you through how I see it now.

Quick Overview: Where Each Bank Stands Today

N26

N26 was founded in 2013 in Berlin and has around 8 million customers. It holds a full German banking license regulated by BaFin, which means your deposits are protected up to €100,000 under the German deposit guarantee scheme. That’s real, solid protection.

The headline story for N26 over the past few years has been retreat rather than expansion. It exited the UK market in 2022 and shut down its US operations the same year. It’s now focused exclusively on select European countries. If you’re outside Europe, N26 simply isn’t an option for you.

Revolut

Revolut was founded in 2015 in London and has grown to over 65 million customers across 48+ countries — including the US, UK, EU, Australia, and Japan. It operates as a global financial super-app, and that description is more accurate than ever.

In Europe, Revolut operates through Revolut Bank UAB, a fully licensed European bank based in Lithuania, regulated by the Bank of Lithuania and the European Central Bank. EU deposits are protected up to €100,000 under the Lithuanian Deposit Guarantee Scheme. In the UK, Revolut’s full banking license has been in progress but delayed due to regulatory concerns — something worth keeping in mind if you’re UK-based.

The scale difference between the two is striking. Revolut has grown roughly eight times over since I last wrote this piece.

Deposit Protection and Licensing

In 2020, this was a clear win for N26. Revolut wasn’t a licensed bank in the EU, which meant your money wasn’t covered by a deposit guarantee. That was a legitimate reason to be cautious.

The gap has narrowed significantly. Revolut now holds a full EU banking license and offers the same €100,000 deposit guarantee as N26 for European customers. If you’re in the EU, deposit protection is no longer a differentiator — both banks offer it.

The remaining asterisk is the UK. Revolut’s full UK banking license has faced delays, with regulators citing concerns about risk management controls keeping pace with the company’s rapid expansion. N26 isn’t available in the UK at all anymore, so this comparison only matters to UK residents choosing between Revolut and something else entirely.

For European customers: this section is now essentially a draw.

Plans and Pricing

Both banks follow a tiered freemium model. Here’s how they compare:

N26 Plans

- Standard — Free

- Smart — €4.90/month

- You — €9.90/month

- Metal — €16.90/month

Revolut Plans

- Standard — Free

- Plus — €3.99/month

- Premium — €7.99/month

- Metal — €13.99/month

- Ultra — €45/month

Revolut’s plans are slightly cheaper at most tiers. The Ultra plan at €45/month is clearly aimed at heavy travelers and power users — it includes perks like airport lounge access and higher-tier concierge services. The Standard plan on both is genuinely usable without paying anything, though Revolut’s free tier has more built into it.

If you’re comparing like-for-like tiers, Revolut wins on price and feature density at almost every level.

Foreign Exchange and Travel

This was one of the original reasons both banks became popular, and it remains a strong point for both.

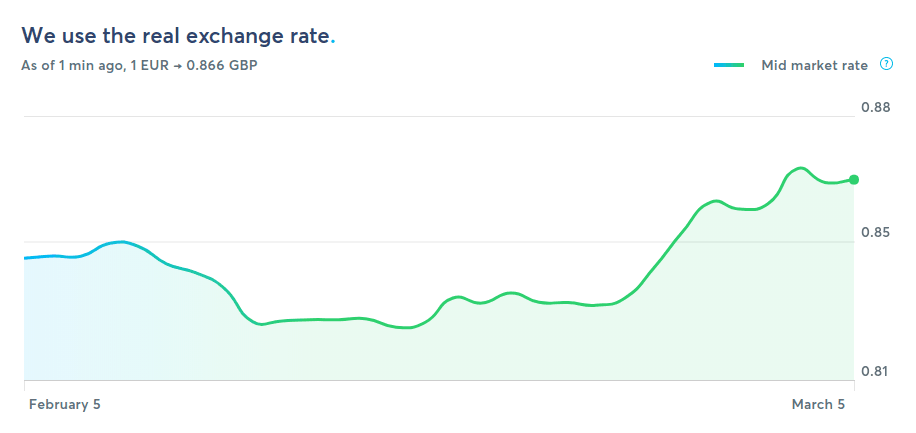

Revolut exchanges currency at the interbank rate during weekday market hours, which is about as good as it gets. On weekends and for some exotic currencies, there’s a small markup — typically around 1%. For the currencies most travelers actually use, the rates are excellent.

N26 uses Mastercard exchange rates for card spending, which are competitive but not quite at the interbank rate. Still much better than a traditional bank, but Revolut has the edge on raw exchange rate quality.

For travel more broadly, Revolut has built out a much more comprehensive suite of features. Higher-tier plans include travel insurance, airport lounge access via LoungeKey, and the ability to purchase travel eSIMs directly from the app so you’re connected the moment you land somewhere new. N26’s higher plans also include travel insurance, but the breadth of Revolut’s travel-specific features is in a different league.

If you travel frequently, Revolut is the more useful companion.

International Transfers

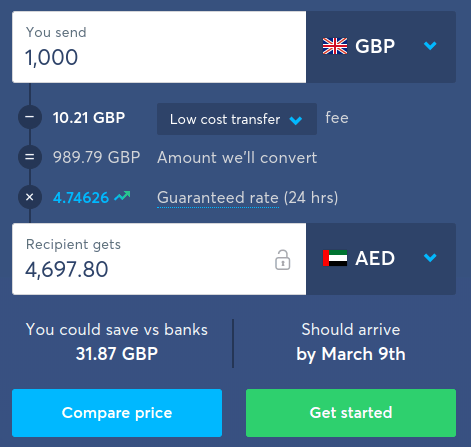

N26 uses Wise (formerly TransferWise) for international transfers outside SEPA. That’s a solid choice — Wise is one of the best services for cross-currency transfers, offering transparent fees and competitive rates. The integration is seamless from within the N26 app.

Revolut handles international transfers natively, with competitive rates and broad currency support. The experience is smooth, and for most transfers you’re getting a good rate without needing to leave the app.

Both get the job done well. N26 essentially delegates to the best third-party service, while Revolut handles it in-house. For the end user, the practical difference is minimal. I’d call this roughly even.

Features and Tools

This is where the gap is widest, and it’s not close.

N26 keeps things relatively focused: Spaces (virtual sub-accounts for saving toward specific goals), shared spaces for splitting expenses, basic savings accounts, and a clean spending overview. It’s a solid set of features for day-to-day banking. What you don’t get is much beyond that.

Revolut has become a financial super-app in the most literal sense. On top of standard banking, it offers:

- Crypto trading — buy, sell, and hold a range of cryptocurrencies directly in the app

- Stock trading — invest in individual stocks and ETFs

- Savings vaults — earn competitive interest rates on money you set aside (check the app for current rates)

- Group vaults — shared savings goals with others

- Junior accounts — accounts for children with parental controls

- Travel eSIMs — buy mobile data for your destination directly in the app

- Stays — book accommodation through the Revolut app

- Salary advance — access part of your salary before payday

- Robo-advisor — automated investing based on your goals and risk tolerance

- LoungeKey access — airport lounge entry on higher-tier plans

Whether you use all of this or not is beside the point. The fact that it’s there — and works well — means Revolut is capable of replacing more financial apps and services in your life. I’ve found myself using it for things I never expected to handle from a neobank.

N26 isn’t trying to be a super-app, and that’s a deliberate choice. But when comparing features head-to-head, Revolut wins by a significant margin.

Desktop and Browser Access

Here’s where N26 has a genuine, practical advantage that I think gets underreported in most comparisons.

N26 has a full web interface. You can log in from any browser, see your transactions, manage your account, and do most of what you’d do in the app. If you’re on a laptop, working from a desktop, or just prefer managing finances on a larger screen, that option exists.

Revolut is app-only. There is no web dashboard. You manage everything from your phone. For most people most of the time, this isn’t a problem — but there are moments when it’s a real frustration. Trying to copy an IBAN from your phone to a laptop, reviewing longer transaction histories, or doing anything that benefits from a larger screen requires you to work around it.

This is a meaningful win for N26, and one that Revolut still hasn’t addressed after years of users asking for it. It tells you something about where Revolut’s priorities are — they’re focused on the mobile-first demographic — but it does create friction for users who live across multiple devices.

Customer Support

Both banks have had a rocky history with support, and both have improved. The honest answer is that neither is exceptional, though both have gotten better at resolving issues through in-app chat.

Revolut has significantly expanded its support team as it has grown. Response times through the chat are generally faster than they used to be, though they can still vary depending on the complexity of your issue and the time of day. For anything genuinely urgent involving account access or a blocked card while traveling, the experience has improved from the early days when support was nearly nonexistent.

N26 has similarly invested in support infrastructure. The in-app chat is the primary channel, and they’ve added phone support for certain account types and situations.

Neither bank has cracked this fully. If you want to call someone immediately and speak to a human being, you’ll likely find both frustrating at times. That said, for the kinds of issues that actually come up day-to-day — a chargeback, a question about a transaction, updating account details — both handle it adequately.

This is roughly a draw, with a slight nod to N26 for having a less chaotic support reputation historically.

Security

Both banks take security seriously and offer a comparable baseline of protections.

Standard on both: biometric authentication (Face ID / fingerprint), instant card freeze, real-time transaction notifications, and the ability to set spending limits. Both allow you to disable and re-enable contactless payments, online transactions, and ATM withdrawals directly from the app.

Revolut adds a few additional layers: the ability to create single-use virtual cards for online shopping (which limits exposure if a site is compromised), and more granular controls over which transaction types are permitted at any given time.

N26 offers a strong default security setup with a slightly simpler interface for managing it. For most users, both provide more control than they’d get from a traditional bank.

Revolut has a slight edge on security features, mainly because of virtual card functionality and additional controls, but N26 is not lacking in the essentials.

Who Should Use What

After spending years with both accounts, here’s how I’d break it down:

Choose Revolut if:

- You want the best exchange rates for travel and international spending

- You want one app to handle banking, investing, crypto, savings, and more

- You’re based outside Europe and need a neobank option (N26 simply isn’t available)

- You travel frequently and want travel insurance, eSIMs, and lounge access in one place

- You want junior accounts for your kids

- You’re comfortable managing finances entirely from your phone

Choose N26 if:

- You prefer desktop/browser access for managing your finances

- You want a focused banking experience without the complexity of a super-app

- You value the German BaFin regulatory framework and find the Revolut Lithuania setup less reassuring

- You primarily want a clean, simple bank account without lots of adjacent features

There’s also a third option worth considering: use both. That’s what I do. N26 for situations where I need desktop access or want a simple, separate account for specific purposes. Revolut for day-to-day spending, international travel, and anything requiring currency exchange.

My Verdict: Revolut is Now the Clear Winner

In 2020, I picked N26. The main reasons were the stronger regulatory standing, the more established banking feel, and Revolut’s uneven reputation at the time for customer support and transparency.

In 2026, the landscape looks different. Revolut now has a full EU banking license with deposit protection matching N26’s. It has 65 million customers and operates in 48+ countries. The feature set is in a completely different category — crypto, stocks, eSIMs, savings vaults, junior accounts, travel insurance, robo-advisory — and the app is genuinely polished.

N26 has focused and refined rather than expanded. That’s not a bad strategy, but it means the gap in features has widened significantly. The company has also pulled back from markets rather than pushing into new ones, which limits who can even use it.

The one area where N26 still has a clear edge is desktop access — and I do use that. But it’s not enough to make N26 the better overall recommendation for most people.

Revolut has earned the top spot. If you’re starting fresh and choosing one, start with Revolut. If you’ve been using N26 and are wondering whether to switch, the features and exchange rates alone make Revolut worth trying — you can always keep both running while you decide.

If you want to sign up for N26, you can do so here. And if you’re sending money internationally, Wise is still worth having alongside either bank for larger cross-currency transfers where the rates and fee transparency really matter.