As an owner of a successful business, you will sooner or later amass a good amount of retained earnings in your business.

Retained earnings are what remains of the net profit after all dividends to shareholders have been issued. These retained earnings are usually kept in the business to re-invest into new products or expansion. However, even after those are taken care of, there might still be considerable funds sitting idle in bank accounts, and that’s almost never good, as inflation will eat away at the real value of those funds.

The key to maintaining the real value of those retained earnings, is, of course, to find stable low-risk investments with high liquidity.

Here are my top places to invest retained earnings:

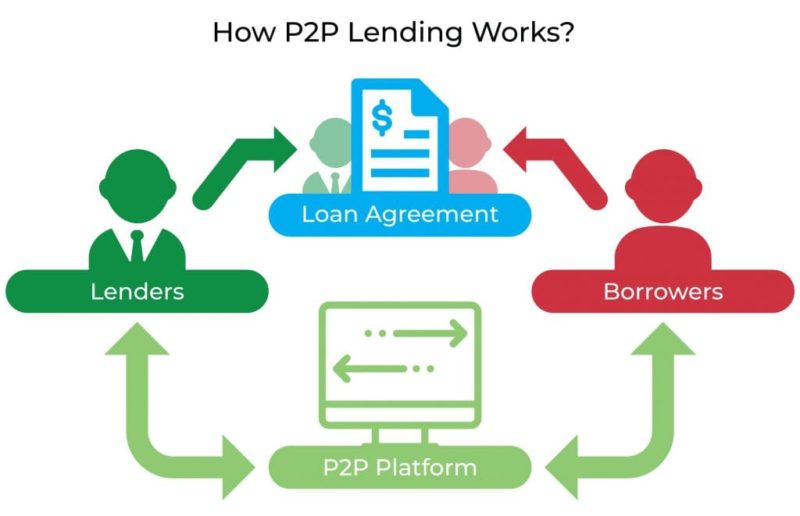

YouHodler – This is a platform where you can lend money to borrowers who put up their crypto as collateral, while you earn a yearly return of up to 9%. You can withdraw the money at any time, giving you full liquidity.

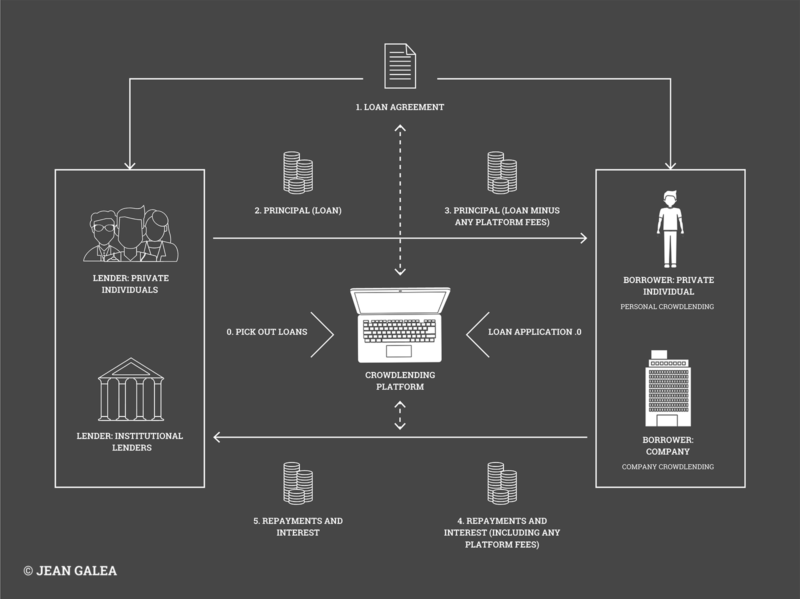

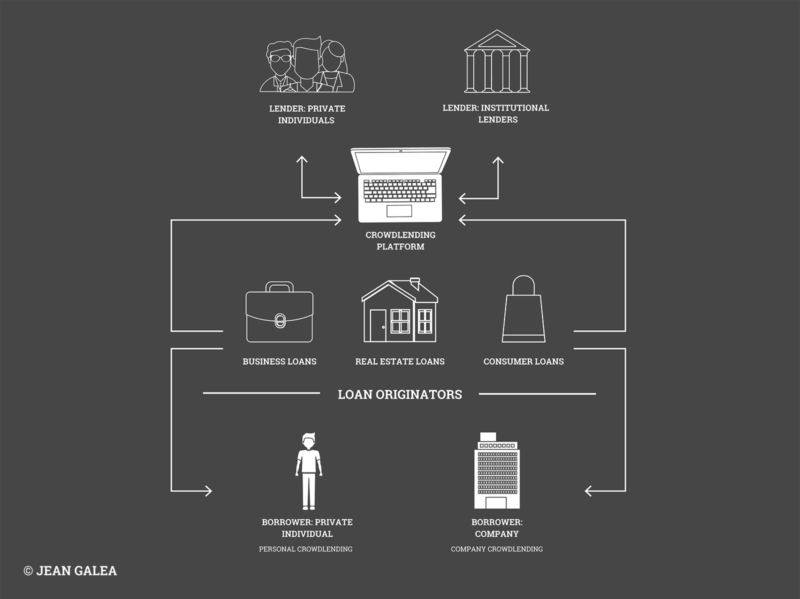

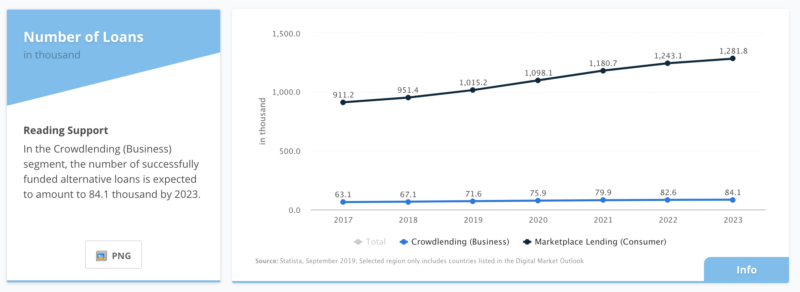

If you are ready to take higher risks, you could invest some of your company’s retained earnings into pure P2P lending platforms. I would suggest using systems like Mintos autoinvest or Bondora’s Go and Grow to maintain a high degree of liquidity.

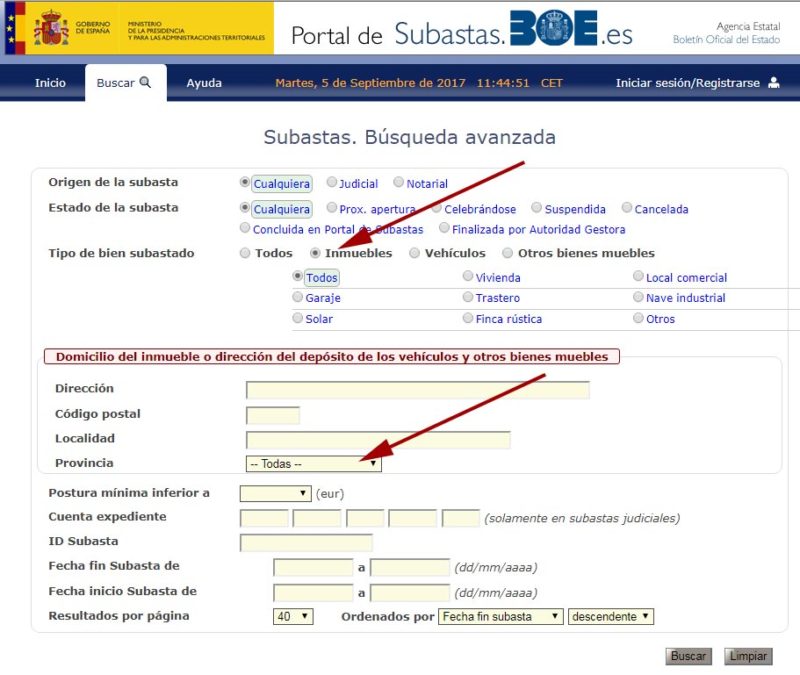

Real estate investments can also provide relatively safe places to park a company’s money, however, they can be more illiquid, especially if the platforms don’t have a great secondary market.

Tax Benefits of Investing Through the Company

Investing your company profits rather than withdrawing money as salary or dividends can offer significant tax benefits. This strategy allows you to take advantage of lower corporate tax rates in certain jurisdictions and defer personal taxation on investment returns.

In many countries, corporate tax rates are lower than personal income tax rates. For example, Malta has an effective corporate tax rate of just 5% in certain cases after tax refunds, making it an attractive destination for businesses looking to minimize their tax burden. By reinvesting profits within the company and compounding returns, you can leverage these tax advantages to maximize your overall wealth.

By keeping the profits within the company and investing them, you can defer taxes on the returns generated by those investments. This strategy enables you to compound your returns more effectively, as the deferred tax liability can be reinvested for further growth. When you eventually decide to withdraw profits as dividends, the taxes due on those dividends will often be lower than the taxes that would have been levied on a larger salary or regular dividends.

What are your thoughts on this? Do you have any other ideas on investing company retained earnings?