Contents

Real estate crowdfunding is one of the easiest ways to invest in property and one of my favorite forms of investment together with P2P lending.

Until recent years, the only options to enter the real estate market were to either buy property directly or to invest in a REIT.

Now, we have real estate crowdfunding sites, which are somewhat between those two forms of investment. If you want to learn more about the differences between these types of investments in the property market, check out my article on REITs vs Crowdfunding VS Private Investing.

Here’s a quick list of my favorite European real estate crowdfunding platforms:

- Raizers – best for French real estate – my Raizers review

- Fintown – real estate in Prague – see my Fintown review

- LANDE – agricultural real estate – see my LANDE review

How Real Estate Crowdfunding Works

So let’s explore what real estate crowdfunding entails.

There are three basic ways of buying a stake in a real estate crowdfunded property: secured loans, unsecured loans, and equity investment.

Here is a short recap of what each of these means for the investor:

- Secured loan (senior debt) – collateral is offered to secure the loan. The collateral can be real estate or some other asset, including a personal guarantee. With this type of loan the investor is the first in line to receive their payout, and in case of any problems the collateral can be sold to minimize losses. However, the existence of collateral means that the risk (and therefore the yield) is lower and one should definitely investigate the asset that is offered as collateral.

- Unsecured loan (mezzanine loan) – while mortgage holders are usually first in line to receive payments, an unsecured loan means exactly that. It is not secured by collateral. This means that the interest rate offered should be higher than for a loan that is secured. If the project is unsuccessful, there are no assets to sell to recover any funds (i.e small loans). In this case, one should pay a lot of attention to whom they are loaning their funds in and how well the platform is equipped to handle problematic customers.

- Equity investment – with this type of investment one should note the structure of liabilities – the company will pay debts to employees and creditors first and only then investors may receive their payments from the remaining assets of the company. In case of failure, there is a real possibility that the earnings of the investor are reduced to a 0. When the project succeeds, however, employees and creditors usually receive a fixed interest rate while the equity investor earns more. So, in this case, one should make sure that they assess the probability of failure. Is the project understandable? Are the numbers presented in the project realistic?

As a rule of thumb, it is good for an investor to remember – the lower the risk of the project, the lower the expected yield. And if you are considering investing in real estate that offers a 20%+ yield per annum, be sure to be very critical about the contents of the project before investing. Most likely it is not a secured project meaning a significantly higher risk level for the investor.

So, be sure not to look at just the yield but rather the investment. It is important to always know what you are investing in, who you are trusting your money with and to be realistic in terms of expectations.

My Experience with Real Estate Crowdfunding

Before we talk about my favorite real estate crowdfunding sites, let me remind you that I’ve been investing in real estate through online platforms since 2015, and I’ve used many platforms targeting various geographical regions.

On average, my returns have been around 5-7% per year.

The Spanish investments have been my biggest disappointment, largely due to either the incompetence of the platform team or the horrible government legislative changes.

Investments in the UK have also not provided me with much joy, but apart from the Lendy scam, the other platforms have been quite well managed and the big issue with property in the UK has been the Brexit event which was quite unexpected and threw everything off the rails.

On the other hand, the Baltics have provided some excellent returns, and this is what I consider to be the hottest real estate market in Europe at the moment. The German and Austrian markets have also provided me with stable returns – these are mature markets and the platforms in these countries tend to be run by serious and ethical people.

Investing in real estate online can be a daunting prospect to many new investors, as they might not be used to mixing an offline asset like property, with the technology and intangibility of the internet. And that is why I’d like to guide you towards what I feel are the best and most trustworthy platforms.

See also: How to evaluate private real estate investments

Keep in mind that within each platform there are different modalities of real estate investments. I’ve written briefly about these in my article about risk vs yield in real estate investment.

I would love to also invest in the US via top platforms like Fundrise and RealtyMogul, however, unfortunately, these platforms are not open to European residents. Nevertheless, here are the best European alternatives and top platforms.

1. Raizers

Raizers is the platform of choice if you want to invest in French real estate. It’s a platform that has been operating for 5 years with zero defaults. Go ahead and read my Raizers review if you’re looking for investing options in France specifically.

I’ve had the pleasure of discussing Raizers and the French real estate market with Raizers co-founder Maxime Pallain on my podcast, check out that episode if you want to learn more about Raizers. I found Maxime to be very open and knowledgeable and I have no problem trusting this platform based on their track record and solid team.

2. Fintown

Fintown is an investment platform powered by the Vihorev Group, which boasts over a decade of experience in the Czech real estate market. The platform offers investors the opportunity to invest in real estate developments across Europe, with a particular emphasis on Prague, the capital city of the Czech Republic. Fintown’s mission is to make real estate investing more accessible to individual investors, enabling them to diversify their portfolios and benefit from the potential high returns associated with property investments.

The account opening process with Fintown is user-friendly and efficient, requiring basic personal information and identification documents for verification. Once verified, investors can deposit euros—the sole currency accepted on the platform—with a minimum investment threshold of €50. The platform’s dashboard is designed to be clean and intuitive, facilitating easy navigation and management of investments. Key features include daily interest accrual, zero commissions on deposits and withdrawals, and no fees for participating in investments, enhancing the platform’s flexibility and appeal.

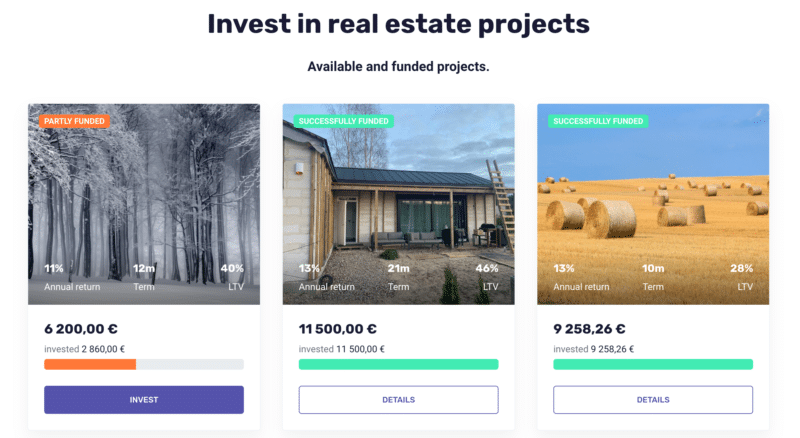

Fintown primarily focuses on real estate investments, offering a variety of opportunities in European property development projects. The platform meticulously vets and selects projects based on factors such as location, potential returns, and overall risk, instilling confidence in the investment opportunities presented. Many projects involve rental apartments in Prague’s Smíchov District, allowing investors to gain exposure to this burgeoning market. The platform requires a minimum investment of €50, with available investments generating annual yields between 9% and 12%, accompanied by monthly interest payments. Notably, the Fintown team invests at least 20% of their own funds in every project, ensuring alignment of interests with investors.

The short-term rental market in Prague has experienced significant changes in recent years. Following the global pandemic in 2020, the market faced a substantial drop in demand due to lockdowns and travel restrictions. However, as restrictions have eased, the market is rebounding, bolstered by Prague’s enduring appeal as a tourist destination and the city’s thriving startup scene. These factors contribute to the attractiveness of investing in short-term rentals in Prague, and Fintown offers a convenient avenue for such investments.

While some may view Fintown’s promotion of its own projects as a potential conflict of interest, this approach can be advantageous for investors. By promoting its own ventures, Fintown ensures it has a direct stake in the success of each project, aligning its interests with those of the investors. This active management and investment in the projects offered create a higher level of accountability and transparency.

The investment process on Fintown is straightforward. After reviewing available projects and selecting one that aligns with their investment objectives, investors decide on the amount to invest and complete the transaction. The platform provides updates on project progress, keeping investors informed about their investments’ performance. Fintown offers two investment formats: mezzanine loans and participative loans, both carrying higher risks compared to loans secured by a mortgage.

Fintown projects typically offer attractive returns, aiming to provide investors with a combination of capital appreciation and rental income, depending on the project’s nature. Each project has a specified minimum term, ranging from 9 to 24 months, indicating the lock-up period for funds. After this period, investors can withdraw their funds at no additional charge. Early exit is possible through a request on the platform, subject to an exit fee based on the remaining term duration.

3. LANDE

LANDE was started in 2019, when two experienced professionals from the secured lending sector Ņikita Gončars and Edgars Tālums became aware that there is a niche in the crowdlending market, as none of the existing market players offered low-LTV investment deals.

LANDE is going after the agricultural loans niche. There is currently a big gap between the financing needs of farmers in Eastern Europe and what’s available to them from banks and other lending providers.

Read more: My full review of LANDE

All projects are first rank mortgage, which is the most secure type of mortgage you can get. Other platforms offer second-rank mortgages which are riskier, but can have higher interest rates.

I would recommend having a look at LANDE as it might be one of the most innovative players in the space going forward. It’s worth mentioning that LANDE also has skin-in-the-game for every project launched.

The real estate market is in constant flux due to the numerous factors that affect it, and you, therefore, need to do your homework properly before deciding on an investment. For example, the duration of the investment can be the main differentiating factor between a successful investment and a disastrous one. Some markets offer time-limited but very lucrative investment windows, while other markets have certain properties that make them really stable and thus ideal for long term investments, perhaps at lower rates of return.

I also recommend that you check out my article about the taxation of P2P and real estate platforms in Spain. Although I wrote that article with Spanish residents in mind, the same concepts apply to most other countries in Europe.

Do you know of any other platforms that I have not mentioned? Let me know in the comments section.

This summer I discovered a new sport that I love to play on Barcelona’s beaches. It’s called Frescobol.

This summer I discovered a new sport that I love to play on Barcelona’s beaches. It’s called Frescobol.