Contents

Amongst all the online investment platforms available today, European peer-to-peer lending sites are the ones that offer the highest returns.

Let’s have a look at how P2P lending works and which are the best European P2P lending sites.

Why do I focus on Europe? Simply because I am European and currently based in Europe. Most US lending sites, as well as some UK lending platforms, prohibit European citizens from investing, so this post focuses exclusively on those platforms that are available to all European citizens. The nice thing is that the majority of European P2P platforms accept international investors.

Another reason for focusing on Europe is that currently, the European platforms offer higher returns than those in the United States or Asia.

Without further ado, let’s jump straight into a list of what I consider the best platforms available nowadays. I will then proceed to talk about the P2P lending space in general for those who are new and want to learn more about this asset class.

The Best European P2P Lending Platforms

- Mintos – read my review

- Lonvest – read my review

- Swaper – read my review

- Peerberry – read my review

- LANDE – read my review

- RoboCash – read my review

- Bondora – read my review

- Profitus – read my review

Now let’s explore each of them further.

If you’re unsure which platform to invest in, one of the best things you could do is to check the platforms’ ratings on multiple channels. I’ve analyzed most of the platforms out there, used several, and taken a look at their Facebook, Trustpilot, and Google scores, so here’s the list of top P2P platforms in Europe at the moment.

I also keep an eye on the market data on European P2P lending every month, as this is an important indicator of whether any of the platforms are in trouble or whether they are in a healthy growth and profitability stage.

Mintos

Mintos is undoubtedly the powerhouse of European P2P lending platforms. Founded in 2015 in Riga, Latvia, Mintos has quickly grown to become the largest and most trusted platform in the region. It offers a plethora of investment opportunities across a wide variety of loan types, including personal loans, business loans, and mortgages. With more than 340,000 investors and a stunning €7 billion in funded loans, Mintos has established itself as the go-to platform for P2P lending enthusiasts.

The interface is great; everything is understandable and you don’t need to fish around for data. You get a daily report in your inbox and you can also use the auto-invest functionality, which I always do.

See also: My full review of Mintos – I invested €150,000

Mintos has a solid secondary market which provides investors with liquidity. If you want to sell off your loans at any point, you can put them on the secondary market, choosing whether to apply a discount (making them more attractive) or add a premium (less attractive). If you want to sell quickly, applying a discount is the best way to do this.

The minimum investment in any single loan on the primary market is EUR 10, DKK 80, GEL 25, PLN 50 or CZK 300. There is no minimum for investments in the secondary market.

You have to be careful when setting the auto-invest parameters on Mintos. Check out the Mintos lender ratings post on Explorep2p as well as the Mintos loan scanner to see which are the most trustworthy lenders on the platform.

The income earned at Mintos is taxed for each investor based on the legislation of the respective country where the investor is a tax resident. Each investor can receive extensive information necessary for tax returns when logged into their Mintos investor account.

You can add funds safely via your online banking directly in the app, by bank transfer, or with a debit/credit card. I recommend using N26, Wise or Revolut when doing deposits and withdrawals as you avoid fees altogether.

Companies can also invest through Mintos without any problem. There are specific documents that need to be provided in order to comply with AML legislation, but it’s pretty straightforward.

During the past three years, Mintos experienced significant growth, making it the peer-to-peer lending market leader for continental Europe with a 38% market share according to AltFi Data. Since their establishment, they have exceeded EUR 660 million in cumulative investments by investors and they expect the number of loans funded to reach EUR 1 billion by the end of the year.

Over the past years, Mintos have made considerable investments in technology, people and the marketplace, making the service even more convenient for investors. The number of investors has been growing in exponential numbers year on year. As an investor, this is reassuring, as I know I’m not alone using this platform, but I’m joined by tens of thousands of others like me.

On Mintos, you can expect returns between 6% and 18%, and the minimum investment per loan is €10.

Lonvest

Lonvest is a promising newcomer in the European P2P lending space, offering investors an opportunity to earn passive income through carefully selected loans. Despite being a relatively new platform, Lonvest has positioned itself as a serious player by focusing on transparency, investor security, and attractive returns.

The platform provides investors with access to loans that are backed by a reputable loan originator, ensuring a layer of protection against potential defaults. With a straightforward and user-friendly interface, investors can easily navigate their portfolios, set up automated strategies, and track their earnings in real time. Lonvest also offers competitive interest rates, making it an appealing choice for those looking to diversify their investment portfolios beyond traditional assets.

See also: In-depth review of Lonvest

One of the standout aspects of Lonvest is its commitment to building a sustainable and secure lending environment. The platform implements rigorous due diligence processes to assess loan quality and borrower credibility, ensuring that investors are exposed to well-vetted opportunities. Additionally, with buyback guarantees in place on many loans, investors have an extra layer of confidence when deploying their capital.

For those seeking a fresh yet reliable P2P lending option in Europe, Lonvest is certainly worth considering. Its combination of solid returns, transparency, and security features make it an attractive addition to any investor’s passive income strategy.

Swaper

Swaper is one of the latest entries into the P2P lending space in Europe, having started operations in May 2019. They have found success pretty quickly though, amassing more than 4000 active investors, 160m euro in investments and 2.1m euro in interest paid back to investors.

See also: In-depth review of Swaper

I really like this platform and the team has been extremely pleasant to deal with whenever I contacted them.

PeerBerry

Launched in 2017, PeerBerry has been gaining quite a lot of popularity among peer-to-peer platforms recently. As with many crowdlending platforms, PeerBerry originated in the Baltics – specifically Riga, Latvia.

This platform has an average annual investment return of 11.51%, a solid return for most platforms. With more than 18,000 investors and over €212 million in funded loans, PeerBerry is certainly making some waves in the peer-to-peer business.

See also: My in-depth review of PeerBerry

As with many peer-to-peer platforms, PeerBerry offers an Auto Invest function and a BuyBack guarantee. Unfortunately, however, no secondary market is available yet.

I really like this platform and its website. PeerBerry has the potential to be one of the big players in European P2P over the coming years.

Open an account with Peerberry

LANDE Finance

LANDE was started in 2019, when two experienced professionals from the secured lending sector Ņikita Gončars and Edgars Tālums became aware that there is a niche in the crowdlending market, as none of the existing market players offered low-LTV investment deals.

LANDE is going after the agricultural loans niche. There is currently a big gap between the financing needs of farmers in Eastern Europe and what’s available to them from banks and other lending providers.

Read more: My full review of LANDE

All projects are first rank mortgage, which is the most secure type of mortgage you can get. Other platforms offer second-rank mortgages which are riskier, but can have higher interest rates.

I would recommend having a look at LANDE as it might be one of the most innovative players in the space going forward. It’s worth mentioning that LANDE also has skin-in-the-game for every project launched.

Bondora

Bondora is one of the oldest peer-to-peer lending platforms, and I joined early on in my P2P lending journey, around 2016.

While this platform has been criticized by investors in the past, my portfolio has been chugging along quite well over the years, and my only complaint would be about the graphics and UI of the platform, which I find really ugly.

Read more: My in-depth review of Bondora

I’ve obtained a return of 17% while investing on Bondora.

If you’re looking for a reliable platform I would recommend taking a look at Bondora, as they have one of the best track records in the industry.

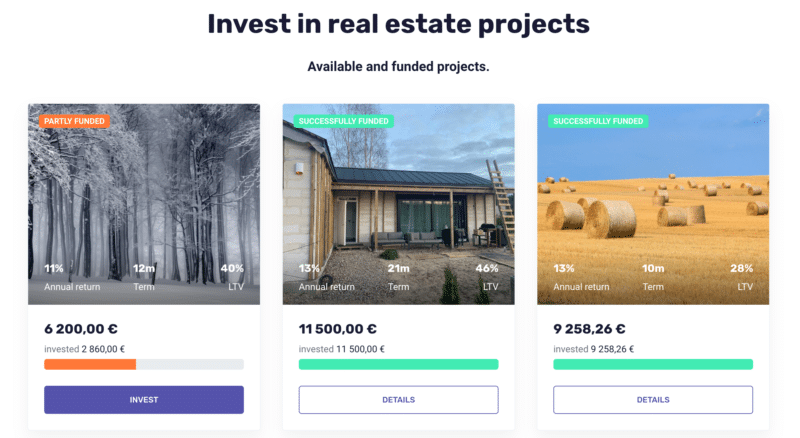

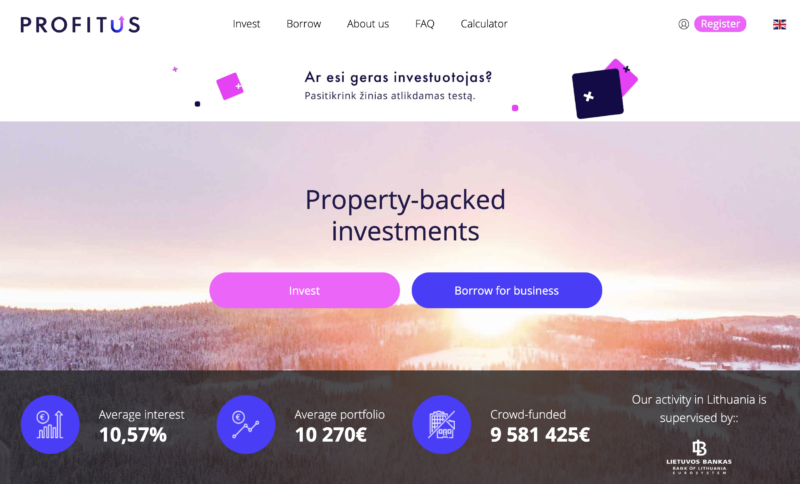

Profitus

Profitus is a Lithuanian real estate crowdfunding and investments platform that has been operating successfully since 2019.

Read more: My review of Profitus P2P lending

The platform acts as an intermediary between investors, who are looking to employ their free money and those who want to receive funding for business ideas and real estate projects.

What about Other Platforms?

There are several other sites that I consider either a scam or badly managed and on the course toward bankruptcy and loss of investor funds. Be very careful who you trust when investing in these platforms.

Many people just want to paint a nice picture for any platform just to take in commissions, and the platforms themselves all try to emphasize how safe they are and what great opportunities they are offering to investors. Don’t believe everything, and check out my list of worst P2P lending platforms before you proceed.

If you’re concerned about the safety of P2P platforms, make sure you also read my post on whether it is safe to invest in P2P lending.

🌍 Who Can Invest in P2P Lending Sites?

These European lending sites are open to all European investors, possibly even those outside of Europe in some cases. The only exceptions are the UK-based platforms, which are typically restricted to investors resident in the UK. CapitalRise is one such example. It’s been around since 2005 but is restricted to UK-based people.

The majority of platforms that are open to other countries are based in the Baltic countries.

Many of these platforms are available in more than one language, precisely to cater for the fact that in Europe people speak so many different languages and might not be comfortable investing their money if the site is only available in English.

From my experience, at the moment in Europe, the country with the most investors in P2P lending is Germany, leading by a long margin. German investors love P2P platforms. Germany is a country where people have a high purchasing power and they are looking for good returns on their savings, and hence P2P lending platforms are a great match for them.

What Returns Can Lenders Expect?

The returns that lenders/investors can expect vary depending on the economic climate. If interest rates are low in general, then we can expect that platforms will offer lower rates as well. This is the current economic outlook worldwide. But 15-20 years ago bank interest rates were very high, so it would not have made sense to invest in P2P platforms when your savings account already rewarded you with 10% returns guaranteed.

Nowadays, you barely find any bank accounts giving you 1% returns, so the returns of 10-15% offered by P2P lending sites are way better in comparison.

It is important to understand that such investments are to be considered alternative investments with a rather high-risk profile. You will most probably have loans that default, but the idea is that the overall returns will eclipse these minor defaults.

Risks of P2P Lending

For each investment class, and indeed every investment you make, you need to carefully consider the risks involved. There’s a lot to say about the safety of P2P lending and what risks you need to consider, so I wrote a separate guide on whether P2P lending can be considered safe that you should find interesting.

Alternatives to P2P Lending

If, like myself, you want to diversify beyond P2P lending, I would suggest you read up on real estate crowdfunding platforms as well as crypto interest accounts. You can obtain similar rates of return (usually 3-4% less than P2P lending) but these other types of investors tend to be safer as they involve collateral.

✅ Conclusion

If you’re interested in trying out peer-to-peer loan platforms, I suggest you start with Peerberry or Swaper.

If you have any questions about any of the platforms I mentioned, or how the model of peer-to-peer loans works, please leave a comment and I’ll do my best to answer your questions.

Before you make any investment decisions, I also encourage you to have a look at how your country taxes proceeds from peer-to-peer lending. You can check out my article on how peer-to-peer lending is taxed to get started on this topic.

You should also read about the risks of P2P lending before making any investments, and make sure you are comfortable with that level of risk for the money you are putting into P2P lending platforms.

Have you invested in p2p lending platforms? What has been your experience with these platforms?

What is your opinion about Iuvo Group?

I’m not too impressed by Iuvo Group; the website is old-fashioned and given the number of good alternatives there are I don’t see the point of investing there. I’d rather put my money in Mintos or Peerberry.

Hi Jean,

Thank you for the knowledge and the great Mintos article.

I am considering investing with Mintos as my first P2P experience and I was wondering how the designation of investments is decided by Mintos for example using auto-invest custom strategy there are 6000 loans matching my criteria is then just a random allocation of matching loans added to my portfolio. ?

Thank you and regards

Martin

I reached out to Mintos directly about this to make sure I get the right answer, here’s their reply:

Hi Jean,

great post! Thanks for your review. I was wondering if you come across TFG crowd, and if so, what is your opinion about this platform. Thanks!

Hi,

Was thinking of investing in Mintos but considering recent circumstances and impending recession , wouldn’t you agree that the default risk would increase as probably these borrowers would first choose these unsecured loans to not pay?

Have you liquidated some of your loans just because of the recent crash , or have you actually increased your interest rate ??

Thinking whether I should wait or just invest now (but make use of money back guarantee).

Hi Bernard,

Please read my thoughts on the COVID-19 circumstances and the effects on P2P lending.

I advise against knee jerk reactions to market sentiment when investing, hence I have not changed my positions much. I have certainly explored other more interesting areas such as stocks and cryptos, because in such conditions there might be bigger gains to be had in those asset classes.

If it’s your first dip into P2P lending, consider using the best platform (Mintos) and putting in an amount of money that won’t hurt if you lose it. The upside would be that you get to learn how P2P lending works (skin in the game always beats any reading on blogs or books) and benefit from higher interest returns. Once the market conditions stabilise and the future is clearer, you would have already built up a good degree of knowledge that will enable you to either double down on this investment class or seek other alternatives.

In short, it’s always a good time to start learning, but perhaps it’s not the best time to go all-in on P2P lending.

Hope that helps.

Hi, thanks for the article!

I’m new to p2p landing and I’m willing to give it a try, I will check this platforms that you mentioned.

Do you know which of this p2p sites accept investors from UK? I know that Mintos doesn’t.

Thanks again

You’re welcome, try Flender.

Which P2P lending platforms in Europe accept investors from Malaysia ?

Thanks.

Mintos is the top one I would recommend.

Mintos is the top one I would recommend.

Thanks for sharing this article.This will definitely help me to choose the right Peer-to-Peer Lending Platform for me. This gives me a lot of ideas.

You’re welcome Lauren

Gracias Jean!

About Viventor :

– you they still offer interest rates around 15% ?

– do the loans come with buyback guarantees ?

– are there short-term loans ?

– do you still consider it as a good platform diversification option to Mintos ?

Gracias !

Hi, I’ll be doing a deep dive on Viventor soon and publish a full review of the platform.

Great ! Have a nice day 🙂

Thank you for your post

One question arising: how come Twino is your second favourite platform and you were discouraging to invest there just two months ago?

https://jeangalea.com/p2p-loan-platform-diversification/

Hi Gonzalo, thanks for pointing the discrepancy out. Twino was one of the initial platforms I invested in and I had a great run on it until it kind of fizzled out in several ways. I still consider it a decent platform with a good team behind it, but I am concerned that they have not been able to update the website and have been left behind by their competition. They also went through a rough patch financially, but they are now profitable again and have a new CEO, so I’m hopeful that they can get back on track.

I would temporarily not invest there until they show clear signs of recovery. The platforms listed on this post are not necessarily in order of preference. With all the things I have going on, I might sometimes fail to update one post or another, leading to such apparent discrepancies as you pointed out.

Once we’re at it, it’s good to reiterate that you should not rely on my choices or that of any other online publication, for several important reasons, as I listed on this other post. This is my personal blog where I note down what works for me and what doesn’t, mostly for my own benefit and record keeping. My financial situation is different than that of each reader, and we all have different monetary and life goals.

It’s also good to keep in mind that it is tough work to keep on top of a blog with so much content, so I might miss certain updates. Luckily I have keen readers like you who point these out and help me out, so thank you again for alerting me.

Hi Jean,

Thank you for your interesting article about the best P2P lending platforms in europe! It helped me significantly, but still had some questions where I would like to receive your insights:

– How much (%) of your monthly recurring income (an employee salary) would you invest in P2P lending platform?

– What would be your maximum total amount that you would invest in Mintos and IBAN?

– When and how often would you withdraw your profits/money from these platforms?

– Imagine you have 100K EUR available. How would you diversify it accross different investments? (Does not need to be only P2P platforms, can be shares, real estate, savings accounts, etc…)

– How much would you always keep in your savings account?

– Would you consider IBAN as a savings account?

Thank you in advance for sharing your insights!

You’re welcome Alexander.

Since I’m not your financial advisor (nor am I a financial advisor, period) I cannot suggest what percentage of your salary you should invest nor what total amounts you should invest on any platform.

I would not consider IBAN as a pure savings account, as it comes with risks that you wouldn’t have with a traditional bank’s savings account. On the other hand, the savings account at your bank will give you zero returns these days. So it’s a balance between risk and reward that you have to take.

I like to keep at least 6 months of savings in a highly liquid form, being in actual cash, current accounts or other. If possible, I feel more comfortable to have 1 year of savings, perhaps having 6 months’ worth as cash in a bank account, and the other 6 months invested in a highly liquid product such as Mintos’ Invest & Access account. The idea of having 6 to 12 months’ worth of money always available is that it gives you a nice cushion if you were to lose your job or have some other calamities happen in which you need quick and substantial cash to get out of a tough situation.

I am always seeking to invest more and more of my net worth, so the better question is not when to withdraw but when to rebalance. You will obviously need to withdraw if you have some big expense coming up such as a home purchase, but apart from those expenses I just monitor the market and see if it makes sense to move some of my money from one asset class to another. I do this roughly once a year. An example would be to move some money out of the stock market and into P2P lending.

As to your question about how I would diversify, as I just mentioned I like to be as diversified as possible, but I don’t currently have a fixed strategy I’m following. There are several strategies online that you can read about, but none of them are sure winners, so in the end, my belief is that each investor should come up with the strategy that best suits his current situation and future goals, then updated it every year at least to take account for changes in their lives. Here is a post I wrote about ways you can invest online, to give you some ideas of asset classes I am invested in or have been invested in the past.

Hope that helps.

Hi Jean,

Thank you for these insights and answers on my questions!

I agree with you that it is about the liquidity of your money that you need to consider when determining how much cushion you want to keep aside. I like your idea of 6mth/6mth split.

Great point about the rebalancing, instead of withdrawing, it is indeed about making your money do the work, and keep your net worth grow and grow. Whenever needed for some high expenses you just withdraw then.

Good tip on first determining your investment strategies and the goals you want to achieve with it. And especially to review this strategy yearly! In the beginning I would personally do it even more often, just to be sure if I’m on the right track.

Thanks for sharing your blog – I will read it.

One more question – do you know if it’s possible to chose eco-friendly or sustainable loans on Mintos?

Cheers

Alexander

You’re welcome Alexander!

I hadn’t thought about eco-friendly and sustainable loans and I don’t believe any platform focuses on that at the moment, however it’s quite interesting.

Could you explain to me how you would define such loans? I’d be happy to investigate further once I understand the concept better, and even talk to the platforms to see if they have any plans to that respect.

Hi Jean,

Eco-friendly loans – People receive only loans if they buy products or services that are ecologically responsible. (e.g. purchase of an electrical motorcycle, isolate your house, etc…)

Sustainable loans – Only companies or people receive loans if they do sustainable things for society (e.g. make sure girls can go to school, handicapped people can work on the shop floor, organize a festival for elderly,…)

thanks, Alexander

Got it, I think those kinds of loans will always be the domain of specialised platforms like Kiva.

Thanks for sharing this article. I think that Peer-to-Peer Lending is a great for business funding. This article is very helpful for me. I think that this will surely help me to grow my business.

Agreed, thanks for commenting.

Hey Jean,

thanks for this extensive review! I have been reading your blog for a while (even before I started to invest into p2p….basically as some sort of preparation 😉 ).

How do you generally judge investing into business loans, so p2b? Platforms like Envestio and Crowdestor are pretty big cornerstones of my p2p portfolio by now and give me an average return on investment of around 16%.

Have you been tapping into that investment sector as well? I know that you have been more critical towards e.g. Envestio in the past.

Thanks,

Marian

Hey Marian,

Thanks for your nice comments, appreciate it. I think business loans can be a good component of an investment portfolio, but I am critical of loans to businesses that are just starting out and have no real foundations. It’s like investing in a startup without the potential upside, since your return is limited. When investing in P2B loans I look for well-established companies who are not likely to default or have their new project fail. One area I will be looking into during the coming months is factoring and supply chain finance for well-established businesses. I’ll report on that once I have seen some results from my investments.

Overall I think that everyone is happy about the returns that many platforms are offering, the question is for how long this is sustainable. While I’ve invested a lot of money into P2P platforms, I keep a very close eye on the overall financial markets and the platforms to try to anticipate any negative trends and take my money out before it’s too late. So far so good, we’re still in the growth stage for these platforms, so it’s natural to have a very positive air around the industry, strong incentives for investors and high returns. Let’s see how far it goes.

Yes, good points. I tend to make sure that my p2b investments have a loan duration of max. 1 year and I keep an eye on the respective markets (essentially the Baltic States for p2b platforms like Envestio, Crowdestor, Kuetzal etc).

As you said, it’s a growing business and everyone is in that positive spirit which is great as long as we keep our eyes open.

cheers

Marian

Very helpful article. Thanks for sharing Peer-to-Peer Lending history. This definitely helps me a lot to be more knowledgeable about Peer-to-Peer Lending. I think that I can use this for my business.

Hi Jean, thanks for your post. I have just start reading about p2p lending when I came across to your blog.

You mentioned that “(…)We are living in an age of abnormally low interest rates and low inflation.” which is indeed true.

But one thing that intrigues me is that with such a low interest rates, why companies would pay 10-15%y when they could borrow much cheaper money from a bank/ financial institution? As non-expert in this field, the unique reason I can see for this is that the lenders believe that it is too risky for their portfolio.

Could you please elaborate more on that?

Thanks

Good question Ged. That was one of the first questions I asked myself when I came across P2P lending. The simple fact is that after the big global crisis a few years back banks tightened their lending policies severely, partly to protect themselves and partly because the governments and powers that be put a lot of pressure on them to keep within certain parameters.

We can also see the same happening with opening bank accounts nowadays.

Perhaps you remember that 10 years ago it was much easier to open a bank account anywhere in the world. Nowadays both private clients and corporate clients are put through hell by banks demanding reams of KYC and AML documentation, and sometimes outright refused due to their not fitting into what the banks deem “low-risk” clients and businesses.

These two facts result in a situation where many people and businesses are struggling to obtain funding through the traditional means (banks) and thus are forced to seek alternatives. That’s where loan originators and P2P lending platforms come in.

Essentially, companies and individuals are ready to accept much higher interest rates since they have no other alternative of obtaining finance, since they’ve been excluded by the banks.

While it is true that many of these businesses and individuals can have certain elements of risk, we must keep in mind that risk is a very subjective thing, and just because it is risky for a traditional bank doesn’t mean that that individual or company must not be lent to.

A simple example that you will surely understand is the following. Consider two individuals, Person A with a net worth of €500,000 (ownership of various assets including shares and other financial instruments) and Person B with a net worth of €10,000. Both go to apply for a car loan but only one gets it. Why?

The bank does the standard paperwork and discovers that Person A does not have a monthly income, but rather relies on his considerable savings to live off. He retired young and does not need to work to support his monthly family expenses since he has good investments that have been appreciating over the years. Person B, on the other hand, has an entry-level but stable job that pays him €1,300 a month.

In this situation, most if not all banks would rather issue a loan to Person B since they know he has a monthly income and part of that can be destined to paying back the loan, but Person A offers no such guarantees as he cannot show the bank any monthly payslips or regular income.

If these two people came to me, on the other hand, the decision wouldn’t be as clear cut, in fact I would probably be more likely to lend money to Person A rather than Person B because I have very different criteria than traditional banks. As you can see from this example, Person A is being forced to sing alternative funding for his loan because he does not fit into the “good borrower” definition of traditional banks.

Happy to discuss further if you want to follow up.

Quite clear, Jean. Thanks again.

Looking forward to go through the blog content.

Regards

Interesting read, but does it pay to ‘re finance a commercial real estate loan using P2P platforms and are any active in the Maltese market?

Things have gone well so far for me by none of the platforms are active in the Maltese market nor do I expect any to be doing so in the near future.

I think the Maltese market is in a bubble at the moment and I can’t see how the rises in rent and purchase prices can sustain itself much longer. I wouldn’t invest in the Maltese market myself, at least not on a long term basis, which is usually the horizon in looking at with my investments.

Welltrado is an affiliate site at the moment. They have been in the market for more than 3 years already and i do not understand the purpose of their business yet. We have started in January, launched private beta in May and we already bring value for customers, where they can deposit money with us and invest in 10+ platforms and 10 countries with one account.

Evo Estate earns money from platforms/originators – they share their commissions with us. Our investors basically get same deal as if they have invested in originator platform directly.

Hi Jean

I just discovered your blog and found it very interesting!

Have you ever used the website Fastinvest? If not, what have you heard about it? I have been using it for 9months and seems quite good.

Thanks Steve, I am familiar with FastInvest but it’s not one of my favorite platforms due to a dubious founding story and lack of transparency with their financials and loans.

Hey Jean, Incredible piece of information over here.

you make some good points about Best European P2P Lending Platforms to Invest in 2019 that I never thought about.

Thanks for sharing!

You’re welcome John.

Hi Jean. Awesome catchy post, i agree on most of your points!

You talk about the importance of liquidity, but i generally see direct P2P lending (without loan originators) to be more secure, even though the liquidity might be lower compared to the mass production loan originator service Mintos provides. Can’t it be two-folded? I mean would you definitely only go for the top 20 largest p2p lending providers compared to those listed with a lower total funding volume on a site like say p2pmarketdata.com – or do you differentiate in the three party platforms vs. four party platforms (with loan originator intermediates)?

Thanks Martin. Very interesting question, thank you. I tend to look at many factors and the bigger platforms like Mintos tend to have not only higher liquidity but easier ways to get in touch (support in multiple languages), a better interface, a bigger secondary market, etc.

I’m not saying it’s the best way to do things, but I don’t want to spend a lot of time on P2P loans every month, so working with the big and proven platforms gives me more peace of mind and saves me from spending time to learn new interfaces, getting to know new people at each website etc.

Are you still satisfied with Twino or are you experiencing heavy cash drag?

Twino is still good, but I don’t see it surviving long-term against Mintos. We now have a market saturation with so many platforms, and inevitably some of those will have to fold in the coming years, unless they pivot or diversify in a significant way.

In the case of Twino, as an example, their offering is pretty much identical to Mintos, but they have not managed to keep up with the growth of that platform, hence I see investors shifting to Mintos in the coming months/years. This is also something that I am doing myself and would recommend. That’s not to say that Mintos is guaranteed to stand the test of time, but right now I think it’s safe to say that it is the most successful and stable P2P loan platform in Europe.

I completely agree with twino vs mintos. That is why i have withdrawn all the money from Twino recently

Good to know. Would you recommend other platforms that are as stable as Mintos?

I am cofounder of EvoEstate.com – Real Estate P2P aggregator – our goal is to have the safest investments (only real estate as collateral) and most geographically diversified. Our clients have invested in 8 European countries through the platform.

I see, that’s a novel and interesting concept. Can you explain how it works?

Here is explanation how it works: https://evoestate.com/page/how-it-works/

In short: we are intermediaries. Investors do not pay us any fees. Investor gets value ad: easy diversification and secondary due diligence of projects by us

I see, then you must be making your money off some form of affiliate agreement with the platforms. It’s the first time I see something like this being done apart from Welltrado which I think was setting up something similar. I’m not sure there will be that much demand for an intermediated service like this, and I personally think that it’s one intermediation too far.

However, it’s still early days in this market and it might very well be that investors like this simplified approach to investing. Good luck with the project.

We are not working as Welltrado or affiliate. You can have one wallet with EvoEstate and invest through it to all other platforms. Also when you do your taxes, you get one account statement, which saves you time.

How is it different from welltrado and how do you make your profits?

Hi Jean,

Great site. Last year I started to invest in various P2P companies and used reviews like this to choose my investment platforms. I find them very helpful!

I hadn’t heard much about Lendix before, so I had a look at your review. Something I noticed was that Lendix changed their name from Lendix to October. I read that the change was due to Lendix/October wanting to expand into other financial products, not just lending. They thought October was a better name…

Also, have you had much to do with Grupeer?

Keep up the good work!

All the best,

Matt

Thanks for stopping by Matt, I’m not sure why October would be deemed to be a better name, although Lendix is a bit generic given the number of platforms with the word “Lend” in their name, especially if they wanted to expand to other financial products.

In any case, I really like October, it’s a no-nonsense platform, less flashy and marketing-oriented compared to other platforms, but they deliver the goods. I have had no problems with loans I invested in, and they tend to supply the right amount of information (and in English) about the borrowers.

I only started recently with Grupeer so I’ll have more to say about that one in the next few months.

Hi Jean,

Thank you for the nice informative article, loved it!

I’m excited to start on Mintos soon.

Also, you mentioned that you also invest in stocks. Do you mean ETFs? I wanted to try out robo-advisors such as Betterment, but they only allow US residents. In your expert view, could you please recommend a good robo advisor with a low starting fund I could look into? What company or platform do you use to invest in stocks, loans and real estate?

I look forward to hearing from you. Thanks a lot 🙂

Excellent, Mintos is my favorite platform for P2P.

For roboadvisors I have no recommendations.

I have written about all the real estate platforms I use on this site, just use the search option and they’ll show up. It depends on which country you want to invest in, so make sure you include the country in your search query. I have invested in Spain, Italy, Portugal, Germany, UK real estate so far.

With regard to stocks I like the dividend growth investing approach, and the choice of platform really depends on what kind of trading and investing you plan on doing, the amounts you want to invest and where you’re a resident. Some good brokers to look into are Interactive Brokers, Saxo Bank and DeGiro. I’ve written about the best stock brokers in Spain as well as the best stock brokers in Europe based on my experience and research.

You should not forget all the risks Mintos have. Especially now, when they got denied by FCA.

All loan platforms have inherent risk and I would agree that they should be a minimal part of one’s portfolio. On your blog you make some important accusations with regards to Mintos, but you don’t reply a comment stating Mintos’ own reply. Would be nice to see your reply to their reaction.

1. The accusation part is a copy from Blogspot – I have put a copy so that it does not disappear.

2. The reply is not by Mintos, but by some other 3d party, who got the reply from Mintos.

3. I have not found any article on Mintos Blog related to Shareholder Relations between Mintos, Mogo and others.

Ok but since Mintos addressed the concerns you highlighted, what’s your reply to what they said?

so there are 2 issues:

1. Buy-Back guarantee. Everything is fine here and they probably have changed terms and conditions.

2. Relationship between loan originators (Mogo, Hipocredit and others) – i could NOT find any article in their blog as they claim:

“We also have published information on our platform when there are overlapping between Mintos and loan originators shareholders.”

Thanks for expanding on that.

Shame he wouldn’t expand on how they make money ….

Hi John, if you mean how the platforms make money, that is a good point indeed and would be a good addition to the post. I’ll add in a section about it, thanks for your feedback.

Thanks for sharing a informative post.It is really informative and helpful.valuable information provided.An installment loan is a loan that is repaid over time with a set number of scheduled payments;[1] normally at least two payments are made towards the loan. The term of loan may be as little as a few months and as long as 30 years.

Hi jean, I appreciate the site, recently moved to Eire from UK, I wanted mention I’ve bn using funding circle zopa rayesetter in UK for last 2 years so I’m used of the concept, I moved here year ago and inbvestef in linked finance , but I have bn looking into European p to p sites, thanks to yours asmd others I started invest mintos October 2018 and when exchange Rateimprove all use twino and lendix

I do have a question for you , I wish to invest into equities like a MAP or something like that a fund that would be fairly safe I guess, as i take my risks with p2p

Do you recommend any funds I could look at? They are so many , its tricky to know which way to turn ,

The sum I wish to usebis approx 50\60k euro

This would diversify my money nicely between p2p UK Eire and Europe ,, not intrested in owning property again , way too much hassle , p2p has given me my time bk so…..

Appreciate your thoughts and if u wanted to know anything of my experiences using p2p in UK

Kind regards

Mal

Hi Malcolm, it would be cool to know about your p2p experience in the UK for sure.

With regard to equities I’m not an expert in that area but Vanguard index funds are always highly rated. I would recommend De Giro as a broker.

There was a very good informative post that does an excellent job of introducing the concept of top European peer to peer landing sites in 2018. Thank You.

You’re welcome.

Hi Jean, thanks for the post! Can USA investors invest in Mintos and Twino?

I believe so Tom, here’s what it says on the Mintos FAQ:

Both individuals and entities can invest through Mintos. Individual investors must be at least 18 years old, have a bank account in the European Union or third countries currently considered to have AML/CFT systems equivalent to the EU, and have their identity successfully verified by Mintos.

Family trusts, partnerships, limited liability companies and other organizations must have a bank account and be registered in the EU or third countries currently considered to have AML/CFT systems equivalent to the EU.

what is the incentive for you advertise a good P2P platform that you invest through? I also invest through these platforms but will not tell any of my friends, let alone write a blog about it. You know, success attracts more money and before you know it returns will come down. Also i fear that the really successful platforms may be bought up by big banks or hedge funds and then they will put their own funding in and shut it down for retail investors. So, shhhht don’t write about this anymore. It is our secret ok?

I take that as a tongue-in-cheek comment but it’s worth mentioning why I share this stuff. Blogging about my investments helps me learn and also helps many of my friends learn from my experiences. I love sharing and teaching and blogging about many topics comes natural to me. The argument about attracting jealous eyes or having others flood the market has existed since the beginning of time. Yes there is this risk, but the benefits I obtain from blogging far outweigh the downsides. For every set of jealous eyes, there are 3 or 4 other people who read my articles and leave valuable feedback that makes me a more informed person and better investor.

Great Article…I mainly use Mintos; will see others though as well. May I ask you Jean if you ever had a loan yourself with one of the sites mentioned or others? If yes how was it? Maybe an article about the experience? Mintos don’t give loans as I checked….You can just invest….

Hi Joseph,

I’ve only been active on these platforms as an investor.

ok thanks. I will try to get a loan from them…if you want i will report back to you how it was

Sure, that would be interesting thanks.

Will do…Cheers

Very interesting article! I read about Mintos and Twino from other blog posts and articles, and it looks like they are quite reliable with good returns too. Are there any other platforms that you would recommend that are known to accept investors from Malta? Also, how does the tax system work after starting to get the returns?

Thanks Bjorn, those are the only two I would recommend at the moment. You would need to declare the returns in Malta, they give you the gross sum and then you deduct tax from it and declare it, leaving you with the net amount. Best to check with an accountant exactly how it is noted on the Maltese tax return.