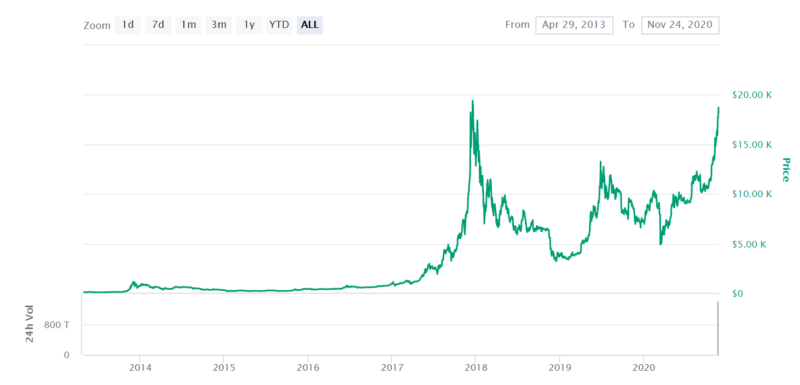

Some of you might be well versed in Bitcoin. If not, you might have only recently come across this innovative digital currency. After all, the price of Bitcoin has exploded in recent months, reaching and destroying its previous all-time highs.

If you’re interested in gaining exposure to the world’s largest and most popular cryptocurrency, there are actually many, many ways in which you can do this. As I uncover in my guide, this includes everything from traditional ownership and CFDs, to futures and options.

If you’re keen to learn more about the many ways in which you can profit from Bitcoin – read on. My comprehensive guide not only covers the various Bitcoin marketplaces available in the online space but also the best brokers and platforms to do this with.

The Price of Bitcoin – How Does it Work

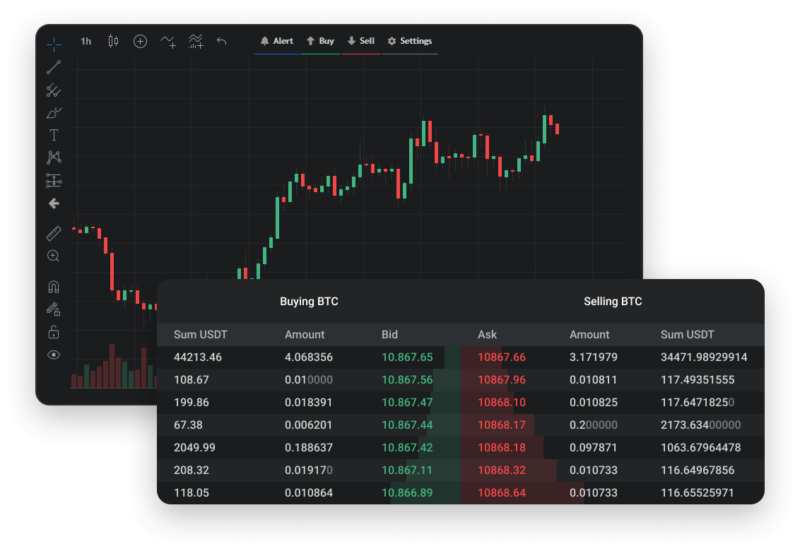

It doesn’t matter which financial instrument you opt for – whether that’s buying the digital currency and storing it in a private wallet or trading CFDs. Your ability to make a profit is determined by one thing and one thing only – the market price of Bitcoin.

This operates in exactly the same way as any other asset class – such as stocks and shares. That is to say, the value of Bitcoin is dictated by the demand and supply of the wider marketplace.

- If the general sentiment on Bitcoin is positive, then there will be more buyers than sellers. In turn, this will translate into the value of Bitcoin increases – much like it is at the time of writing.

- On the flip side, if the market sentiment is weak and sellers outweigh buyers, the opposite will happen.

As I uncover in more detail shortly, there are tradable Bitcoin markets now available that not only allow you to profit when the price of the digital currency goes up, but also down. This is known as short-selling and it means that you are speculating on the price of Bitcoin dropping.

Nevertheless, Bitcoin can be traded 24 hours per day and 7 days per week. Its price will change on a second-by-second basis and the digital currency can at times be overly volatile.

Keeping Things Simply by Buying Bitcoin

Before I even get to more complex financial instruments like CFDs, futures, and options – a lot of you will ultimately prefer to keep things simple. By this, I mean buying Bitcoin in the traditional sense with the hope that it increases in value. If it does, you will then be able to sell your Bitcoin for a higher price than you originally paid.

For example:

- You want to invest $2,000 into Bitcoin

- Right now, the price of Bitcoin is $18,105

- You hold onto your investment for two years

- When you get around to cashing out, Bitcoin is valued at $32,500

- This means that the price of the digital currency in the open marketplace has increased by 79%

- The value of your original $2,000 investment has also increased by 79%

- As such, when you sell your Bitcoin you get $3580 back.

The above example illustrates a classic ‘buy and hold’ strategy. Or, in the weird and wonderful world of cryptocurrencies – this is known as HODLing. In other words, you are buying Bitcoin and you plan to hold onto your investment for several months or years.

This is a simple investment strategy that ultimately means you can avoid the stress of short-term volatility. Sure, the value of Bitcoin will go through ups and downs. But, if you believe that in the long run the digital currency will continue to grow – then you simply need to buy Bitcoin and forget about it until it’s time to sell.

In terms of how you do this, the easiest, safest, and most cost-effective way is to buy Bitcoin online. You will be doing with this a third-party broker and depositing funds with an everyday payment method like a debit card or bank transfer.

In terms of platforms, Coinbase is arguably one of the best options in the space. This is because you can easily deposit funds via bank transfer (SEPA, SWIFT, etc.) at virtually no cost.

And, trading commission amounts to just 0.26%. I also like Coinbase because it has been active in the Bitcoin exchange scene for over 9 years and as such possesses a great reputation.

If for some reason Coinbase doesn’t quite meet your needs, another platform to consider is Binance.

Binance is one of the largest cryptocurrency exchanges in the industry. The platform hosts hundreds of cryptocurrency pairs that you can trade at commissions of just 0.1%. Binance also allows you to buy Bitcoin with a debit card – although the fees are a bit on the high side. You can read my full Binance review here.

Irrespective of which Bitcoin trading site you use to invest, you need to think about storage. This is because Bitcoin needs to be stored in a digital cryptocurrency wallet. These can be downloaded free of charge onto your desktop device or mobile phone.

For even more security, you might consider a hardware wallet like Trezor or Ledger Nano. If you prioritize convenience and ease-of-access over security, you can also store your Bitcoin at your chosen broker.

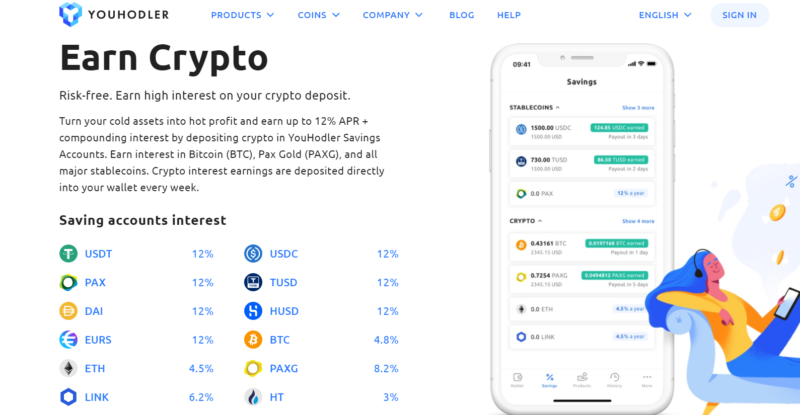

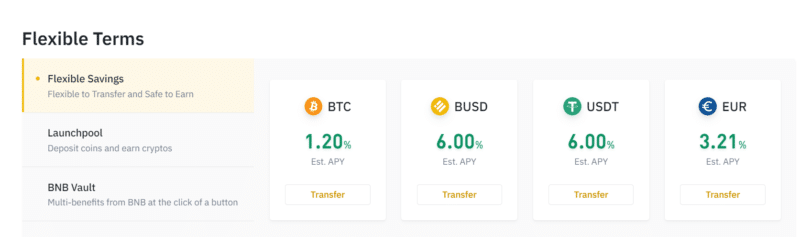

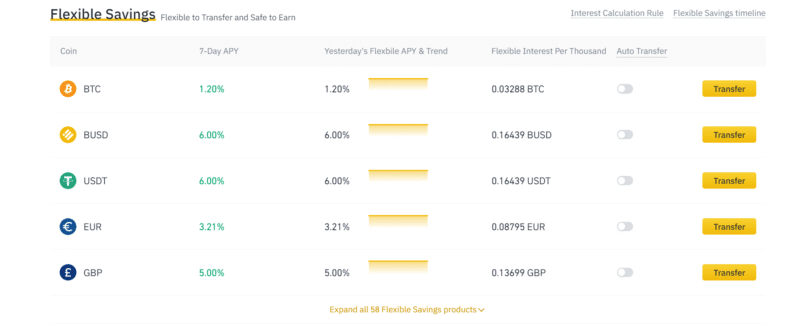

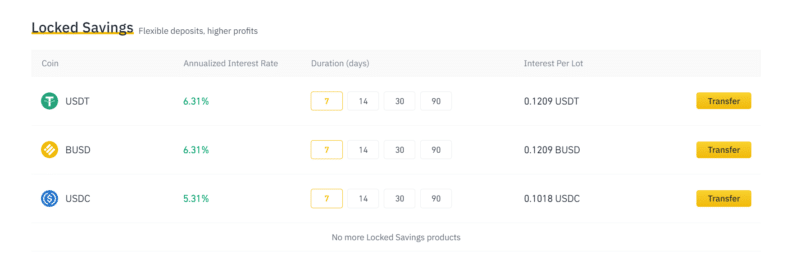

On the other hand, Bitcoin can also become an income-producing asset for you if you opt to earn interest on your crypto holdings by using crypto lending platforms like Nexo and YouHodler.

Trading Bitcoin CFDs

While the vast majority of you will likely want to stick with a simple, long-term buy and hold strategy – some will want to engage in more sophisticated traders. If this sounds like you, then Bitcoin CFDs are worth considering.

CFDs are contracts-for-differences and they allow you to trade assets without taking ownership. This is because the CFD simply tracks the current market price of the said asset. As I explain in a moment, this comes with several benefits.

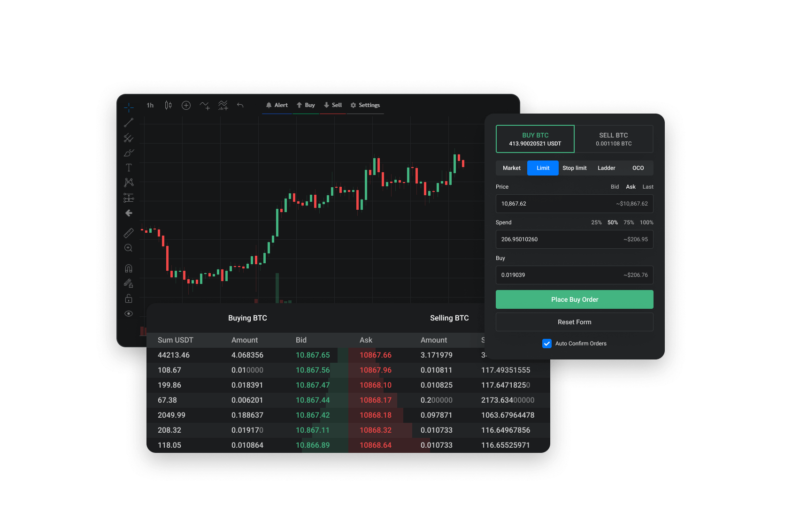

Before I get to that, let me illustrate how a Bitcoin CFD instrument works:

- The global market price of Bitcoin is $17,408

- Your chosen CFD broker also quotes a price of $17,408

- A few minutes later the spot price of Bitcoin is $17,447

- Once again, your chosen CFD broker also quotes a price of $17,447

In other words, if the market value of Bitcoin increases by 1.2%, so will your CFD instrument. Similarly, if Bitcoin drops by 4%, so will the CFD.

So that begs the question – why trade Bitcoin CFDs as opposed to buying the digital currency outright? Let me explain.

Leverage

First and foremost, Bitcoin CFDs give you access to leverage. If you’re unfamiliar with leverage, this simply means that you can trade with more than you have available in your brokerage account.

You can view leverage as a factor or multiple – but the end result remains the same. For example, your chosen CFD platform might offer leverage of 1:2 or 2x – which means that you are trading with twice the amount you stake. In other words, a $500 stake at a leverage of 1:2 would mean that your CFD order is worth $1,000.

Here’s an example of how leverage can amplify your potential Bitcoin trading gains:

- You stake $1,000 on a Bitcoin CFD buy order

- You apply leverage of 1:2

- A few hours later, the price of Bitcoin has increased by 3%

- You are happy with your profits so you close the trade

- Ordinarily, 3% gains on a $1,000 stake translates to a profit of $30

- But, as you applied leverage of 1:2, your total profit stands at $60

It goes without saying that leverage can be beneficial if you want to trade with more than you have available in capital. It is also useful if you feel extra-confident on your Bitcoin trade and want to boost your stake.

But, leverage is also fraught with risk. If, for example, you apply leverage of 1:2 and your trade moves in the wrong direction by 50%, then your chosen broker will close the position. In doing so, you will lose your entire stake.

This is because you are trading with twice the amount you stake and thus – if the value of your order drops by more than half the position will be liquidated. In terms of how much leverage you can apply, regulated brokers accepting European and UK clients will cap you to 1:2. Other nationalities might get more.

I should note that US citizens are not allowed to trade CFDs. This is why a lot of Americans opt to use non-regulated cryptocurrency platforms to obtain leverage. You do, of course, need to be extremely careful when taking such an approach.

Short-Selling

On top of being able to apply leverage, Bitcoin CFDs also allow you to engage in short-selling. As the name suggests, you will be selling Bitcoin as opposed to buying it.

In Layman’s terms, this means that you are speculating on the value of Bitcoin going down. If your speculation is correct, then you will make a profit.

For example:

- Let’s suppose that Bitcoin is currently priced at $18,500

- You think this is overvalued so you place a sell order via a CFD broker

- You decide to stake a total of $1,000 on your prediction

- Later in the week, Bitcoin has dropped to $15,500

- This represents a decline of 16%

- You staked $1,000 on your short-selling position so you made a profit of $160

As you can see, Bitcoin CFDs allow you to profit in the event that you think the digital currency is likely to decline in value.

What to Know About Bitcoin CFDs

Before you take the plunge by trading Bitcoin CFDs, there are some important points that I need to mention.

Firstly, Bitcoin CFDs are only suitable for short-term trades. This is because you need to pay something called ‘overnight financing fees’ for each day that you keep a CFD position open. This is like an annual interest fee that is charged on a daily basis.

The fee will kick in at a certain time of the day – such as 10 pm. As such, for each day that your Bitcoin CFD trade stays open for 10 pm, you’ll pay a fee. This can make the trade unviable if you keep it open for too long.

Additionally, CFDs are complex financial instruments – so the industry is heavily regulated which enables heaps of regulatory protections – such as segregated client funds and regular audits.

You can read my full guide on CFD trading here.

Buying Bitcoin on Margin

Leverage and margin are two terms that are often used interchangeably. Although they refer to the same concept – being able to trade with more than you have in your account, they actually mean different things.

- Leverage is a multiple that amplifies your stake. For example, leverage of 1:2 will multiply your stake by a factor of 2.

- Margin is the percentage of your desired stake that you need to cover with an available account balance. For example, if the platform requires a margin of 10%, then a $1,000 stake would only require an account balance of $100.

The reason that I have separated the two terms with their own section is that some platforms allow you to buy Bitcoin on margin outside of the CFD arena.

In a nutshell, Coinbase allows you to buy Bitcoin with a minimum margin requirement of just 20%. This means that you can buy $10,000 worth of Bitcoin with an account balance of just $2,000.

However, I must make it clear that the underlying fundamentals of margin trading at Coinbase mirror that of CFDs.

For example:

- You will still need to pay ongoing fees for keeping your position open. At Coinbase, for example, this stands at 0.01% for every four hours that your Bitcoin trade remains in play.

- You stand the chance of being liquidated and thus – you can lose your margin in its entirety.

- This form of trading is only suitable for short-term positions

Ultimately, margin trading at Coinbase operates like-for-like with a CFD position. The only difference is that Coinbase does not offer its margin trading services via a CFD instrument, meaning that it doesn’t need to follow the same regulatory conditions. This is why you are able to get margin at 1:5 on Bitcoin, while most CFD platforms are capped at 1:2.

Bitcoin Derivatives

I am now going to move onto an even more complex form of Bitcoin trading – derivatives. Put simply, a derivative is a financial contract that is valued based on the movement of an underlying asset.

This allows you to place trades in a sophisticated and highly bespoke manner. There are many different Bitcoin derivatives available in the market – some more accessible than others.

This includes:

Bitcoin Futures

The first Bitcoin derivative that springs to mind is that of futures. The first regulated Bitcoin futures market was launched in late 2017. Two providers, in particular, took the bull by the horn – the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE).

These are two of the largest derivatives exchanges globally. While the CME is active in the Bitcoin futures scene, the CBOE halted its offering in 2019 due to lower trading volumes. Nevertheless, the CME is a marketplace for institutional investors, meaning that the Average Joe trader won’t be able to get a look in.

In addition to several other barriers, the minimum futures trade size is 5 contracts – with each contract worth 5 Bitcoin. As such, this amounts to 25 Bitcoin, which at the time of writing is worth over $450,000!

If you don’t have that sort of money lying around, the good news is that there are several cryptocurrency platforms offering Bitcoin futures markets that are accessible to retail clients. Before I get to that, it probably makes sense for me to explain how futures actually work.

How do Futures Work?

Irrespective of the underlying asset – whether that is stocks, commodities, or Bitcoin – futures work in exactly the same way. Put simply, they allow you to speculate on the ‘future’ value of an asset.

Each futures market will have an expiry date – which usually runs in cycles of three months. All futures markets also have a ‘strike price’. This is the price that you will be speculating on. That is to say if the strike price of a 3-month Bitcoin futures market is $16,500 – you need to predict whether you think the contract will expire at a price higher or lower than this figure.

In the vast majority of cases, you can actually offload your futures contract before they expire. The value of the contract will therefore move up and down depending on how likely the contract is to finish above or below the strike price on expiry.

If you are holding the futures contract when it expires, you have a legal obligation to buy or sell the asset. This is why futures are more conducive for institutional trading, as the futures contract often needs to be settled in the underlying asset.

Here’s an example of how a Bitcoin futures trade would work in practice:

- A Bitcoin futures contract has an expiry date of 3 months

- The price of Bitcoin is currently $17,200

- The strike price of the Bitcoin futures contract is $18,500

As per the above, this means that the wider markets think that Bitcoin will be worth more in 3 months’ time – hence the strike price being higher than the current market price.

- You agree with the wider market sentiment that Bitcoin is on the up

- As such, you buy 10 futures contracts – each of which are worth 0.1 Bitcoin

- For simplicity, we’ll say this amounts to a real-world value of $1,700 per contract

- As such, your total stake is $17,000 ($1,700 x 10 contracts)

A few days before the futures contracts expire, Bitcoin is priced at $19,400

- This is $900 higher than the strike price of $18,500

- You own 10 contracts, meaning that your profit amounts to $9,000

- In order to cash out these gains you offload the futures contracts on the secondary markets

As you can see from the above example, futures allow you to speculate on the price of Bitcoin in a more flexible manner. This is because you are tasked with assessing how accurately the wider market has got its strike price.

I should also note that futures contracts allow you to go long and short. As such, if you think the market has overvalued the strike price of the futures contract, this gives you the opportunity to profit from this.

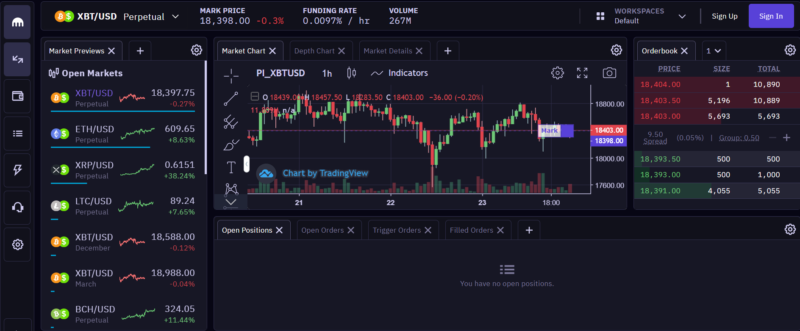

Where to Access Bitcoin Futures?

Once again, I would argue that Coinbase stands out in terms of a platform to access Bitcoin futures. First and foremost, the trading site offers several types of Bitcoin futures with various durations.

This includes:

- Perpetual Bitcoin Futures

- Monthly Bitcoin Futures

- Quarterly Bitcoin Futures

- Semiannual Bitcoin Futures

For those unaware, ‘perpetual’ Bitcoin futures have no expiry date. As such, they operate much like a CFD instrument, and thus – you can keep the position open for as long as you wish.

The minimum contract size when trading Bitcoin futures at Coinbase is just $1. You can go long or short on the futures contract – and leverage is available, too. In fact, you can trade Bitcoin futures at Coinbase with leverage of up to 1:50. This means that you only need to put a 2% margin down on your required trade size.

For example:

- You want to purchase $20,000 worth of Bitcoin futures

- Coinbase requires just 2% upfront – meaning an available balance of at least $400

- This $400 is your margin

- As such, you stand to lose your full $400 margin if your 1:50 leveraged trade goes against you by 2% or more

I should warn you of the risks of trading with a margin as high as 1:50. Although your trade will for sure be liquidated if it goes against you by 2% – it will likely happen long before this. Coinbase will usually send you a ‘margin call’ when your margin drops by 40%.

This means that you’ll receive a notification from the platform if your position goes in the wrong direction by just 1.2% (2% margin less 40%).

Bitcoin Options

Much like futures, Bitcoin options are getting more and more popular with traders that want access to this digital currency in a sophisticated manner. There are a lot of similarities between these two derivatives.

For example, both futures and options always have an expiry date – with the exception of perpetual contracts. Similarly, both mediums allow you to go long and short and in most cases – cashout before the expiry date arrives.

However, the overarching difference is that while you have a legal obligation to buy or sell the underlying asset when holding futures until expiry, options give you the ‘right’ but not ‘obligation’.

In addition to this, options can be accessed by paying a small ‘premium’, which is the most that you can lose if the trade goes against you. This premium is usually around 5% of the total contract value.

Taking these complexities into account, let me give you an example of how a Bitcoin options trade would work in practice.

Example of Bitcoin Options Trade

- Let’s say that Bitcoin is currently priced at $15,000

- You are interested in 3-month Bitcoin options contracts

- The contract has a strike price of $16,000

- The premium required to access the market is $800 per contract

You think that the price of Bitcoin will finish higher than $16,000 in 3 months’ time, so you buy ‘calls’. If you thought the opposite, then you would be buying ‘puts’.

- You decide to purchase 5 call options – so your total outlay is $4,000 (5 contracts x $800 premium)

- 2 months into your trade, Bitcoin is valued at $18,000 on the open marketplace

- This is $2,000 higher than the strike price of $16,000

- You are happy with your gains so you offload the Bitcoin options

- Each contract made you $2,000 profit, but you also need to subtract the premium of $800 ($1,200 net)

- All in all, your 5 call options made you a total profit of $60,000 (5 x $1,200 per contract)

Now, the most appealing thing about options contracts is that your potential losses are 100% capped. That is to say, you can never lose more than the premium.

For example, let’s imagine that in the above scenario, you held onto the options until expiry. If the options expired at less than the $16,000 strike price, you would have lost $800 on each contract.

This is because unlike futures, you don’t need to exercise your right to buy the underlying asset. In other words, by simply letting the contracts expire worthless, you can only lose the initial premium that you paid to access the market.

Where can you Trade Bitcoin Options?

Make no mistake about it – there are very few platforms in the cryptocurrency scene that allow you to trade Bitcoin options. Sure, there are several CFD sites that claim to serve this purpose, but you are only trading the value of the contract.

As such, you can’t actually exercise your right to buy or sell the asset.

For American readers:

LedgerX is for sure the go-to platform to trade Bitcoin options in the traditional sense. In fact, this platform is regulated in the US – so you can rest assured that you are able to trade in a safe and secure environment.

Crucially, LedgerX is suitable for traders of all shapes and sizes – even retail clients. This is because you can access Bitcoin options from just 0.01 BTC per contract. You also only need to purchase a minimum of 1 contract and fees will cost you just $0.05 for each contract that you buy.

The only downside to LedgerX is that it only supports US citizens.

For the rest of the world:

If you’re located elsewhere, the next best option to consider is Deribit. The platform gives you access to heaps of Bitcoin options markets with various strike prices and durations. In terms of fees, Deribit charges 0.0003 BTC per contract.

Read more about Deribit in my review of this platform.

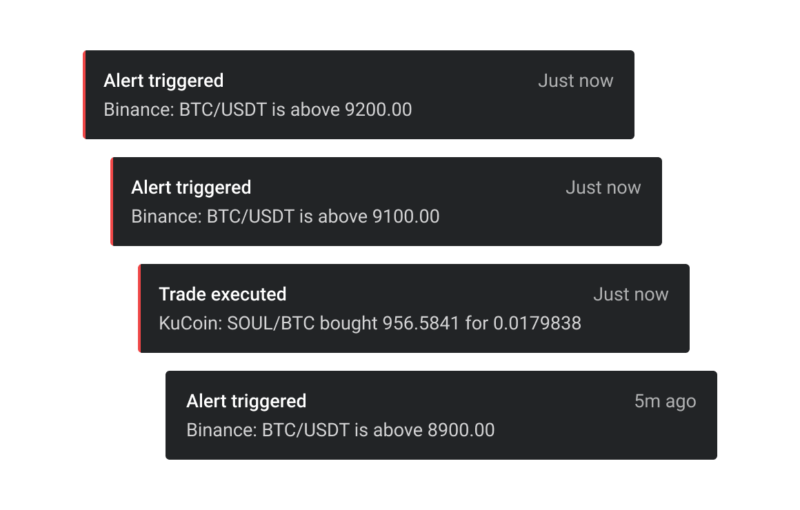

Automated Bitcoin Trading

So now that I have covered derivatives, I am now going to discuss the ins and outs of automated Bitcoin trading. As the name suggests, you will be trading Bitcoin in a fully-automated manner. That is to say, by using a Bitcoin bot – the underlying technology will place buy and sell orders on your behalf.

Although this might sound too good to be true, automated trading bots have been around for many years. In particular, the automated trading scene is very popular in the forex arena. The overarching objective is that you can leave the bot running on your device 24/7 and allow it to make consistent gains in a 100% passive manner.

Unfortunately, it’s not as simple as that. After all, if somebody has a Bitcoin trading bot that consistently outperforms the market, you need to ask yourself why they would release their secret sauce – even when a fee is involved. As a result, you need to do lots of research on your chosen Bitcoin bot provider before taking the financial plunge.

Now, you actually have a couple of options at your disposal when it comes to finding a bot – which I elaborate on below.

Software Bot via MT4

In the traditional trading scene, people typically turn to automated software that is compatible with MT4. This is the most popular third-party platform available in the conventional forex, stock, and CFD trading scene.

MT4 sits between you and your chosen broker. So, you need to download and install the bot into MT4 which in turn, will place buy and sell orders via the broker that you have linked the platform with.

In terms of finding bot software, there are hundreds of providers active in the space – most of which make super-bold claims that they can never meet. Once again, this is why research is crucial.

Specialist Automated Bitcoin Platforms

There are several online platforms that are now dedicated exclusively to automated Bitcoin trading services. The main premise is that you will need to pay a monthly subscription fee to the platform in question.

Read more: The best crypto trading bots

In turn, you can then build your own automated trading bot from the ground-up and simply buy a pre-programmed once from the site’s secondary marketplace. You then need to link the bot to your preferred cryptocurrency exchange – for example, Binance or Bitfinex.

In terms of the best providers active in this particular space, I would suggest considering the following:

Cryptohopper

Cryptohopper is a huge player in the automated Bitcoin trading scene. The main concept of the platform is that you get to implement your own trading strategies into the bot. That is to say, you will be required to create the trading conditions that the bot is tasked with implementing.

In its most basic form, this might be to place a buy order every time Bitcoin increases by more than 5% in a 12-hour period. Although this might sound somewhat complex, the Cryptohopper platform is designed for traders of all shapes and sizes. This is because the actual design process is based on a drop-and-drag format.

As such, you don’t need to have any experience in coding or programming. What I also like is that Cryptohopper offers backtesting. This simply means that your personal bot can be tested out in live market conditions. If you find that the bot isn’t quite performing as you had hoped, then you can go back to the drawing board and make the required tweaks.

If the thought of having to create your own bot conditions is daunting, Cryptohopper also has a marketplace. This is where people can sell the bots that they have created themselves. In turn, if you find a top-performing bot that you like the look of, it’s simply a case of buying it and allowing it to start trading for you.

In terms of the specifics, you can link your automated bot up to heaps of popular cryptocurrency exchanges. This includes the likes of Binance, Coinbase Pro, Bitfinex, Poloniex, Bittrex, and KuCoin.

There are four packages to choose from at Cryptohopper. This ranges from a basic and restrictive free plan, to a plan that permits up to 500 positions at any given time across 75 different cryptocurrencies.

HaasOnline

HaasOnline is another option on the table if you are interested in automated Bitcoin bots. The platform requires you to download software onto your desktop device. You can then choose from a variety of bots – each of which will have its own strategy and risk profile.

Much like Cryptohopper, HaasOnline can be connected to heaps of leading exchanges. If you’re an advanced user with experience in coding, HaasOnline bots can be fully adapted to your own trading style.

In terms of pricing, HaasOnline offers three packages. The cheapest will cost you 0.031 BTC per year – and this includes 10 active bots alongside heaps of other features. The most costly plan will set you back 0.088 BTC per year, and this offers unlimited bots, indicators, and the developer license itself.

Bitcoin Lending

If you want to gain exposure to the Bitcoin arena but have no interest in trading or complex financial instruments – then you might want to consider lending.

The best platforms are:

This is a whole new industry of its own – as it allows users from all over the world to lend out their cryptocurrency holdings and in return – will receive interest. At the other end of the spectrum, you can also borrow funds by putting up cryptocurrency as collateral.

Both of these mechanisms actually give you the opportunity to make a profit, which I explain in more detail below.

Finance Loans With Your Bitcoin Holdings

Unlike stocks, bonds, or real estate – Bitcoin is not an income-generating asset. That is to say, you won’t receive dividends or coupon payments of any sort. Much like gold and silver – your ability to make money is achieved when the value of Bitcoin increases (or you trade it).

With that being said, it is now entirely possible to earn interest on your idle Bitcoin holdings via a crypto-lending platform. In its most basic form, you will be depositing your Bitcoin into the platform in question.

In turn, the platform will use the funds to facilitate loans from borrowers. Those receiving the funds will be required to put up some cryptocurrency of their own – which essentially turns the agreement into a secured loan.

Here’s a basic example of how it works:

- You have 0.5 BTC sitting in your private Bitcoin wallet

- You deposit the funds into a crypto-lending site

- The provider loans the money out to borrowers

- You receive an annual interest fee of 5%

- You withdraw the original deposit out at a later date

As you can see from the above, the amount of interest that you earn is quantified in cryptocurrency as opposed to fiat currency. If you believe in the future of Bitcoin – which you likely will if you already had some coins in your portfolio, this means that you get the best of both worlds.

In other words, while you are able to earn interest on your idle Bitcoin, you are not selling it. As such, if and when the value of Bitcoin rises, you will still benefit from this. For example, you might deposit 0.5 BTC into a crypto-lending site when Bitcoin is worth $17,000 – but cash out your investment when the digital currency is valued at $23,000.

As I uncover shortly, there are also platforms that allow you to lend your Bitcoin to traders that require increased capital. Once again, you’ll earn interest on the Bitcoin you lend out.

Borrow Bitcoin to Increase Exposure

This particular option is a think outside the box approach to increasing your exposure to Bitcoin. In a nutshell – and as noted above, there are crypto-lending platforms that allow you to borrow funds when you put Bitcoin up as collateral.

For example, some platforms will offer you a 90% LTV (Loan to Value) ratio when you deposit Bitcoin as a security. In turn, by depositing $5,000 worth of Bitcoin, you’d be able to get $4,500 in another cryptocurrency like USDT. Then, you’d be able to exchange that USDT into Bitcoin at a third-party exchange like Binance – with the transaction costing you just 0.1% in commission.

The overarching concept here is that you have turned $5,000 worth of Bitcoin into $9,000 of Bitcoin through a crypto loan. Of course, you will need to pay interest on this loan – meaning that this will eat into your potential gains.

But, if you feel super-confident that Bitcoin increases at a greater rate than what you are paying in interest, so essentially allows you to increase your exposure to the market.

Crucial, this is different from trading on margin, as you actually own the underlying cryptocurrency. The key point is that you are paying fees via interest on the loan as opposed to CFD overnight financing fees.

Best Crypto Lending Platforms

It goes without saying that there are lots of crypto lending platforms out there that serve both of the above purposes. With that said, the platforms that I think you should consider are as follows:

YouHodler covers both bases, insofar that it allows you to lend your Bitcoin out and earn interest, while at the same time it also facilitates loans.

Regarding the former, you can earn up to 4.8% per year when lending out your Bitcoin. The minimum to be able to take advantage of this is the equivalent of $100 in BTC.

The interest rate of 4.8% is a great amount of interest to be earning when ordinarily your Bitcoin would just be sitting idle earning nothing.

If it’s loans you are interested in, you can borrow up to 90% of your Bitcoin holdings at YouHodler. When you put Bitcoin up as security, you can choose to have your loan paid in USDT, Euros, or US dollars. You can then use the loan funds to grow your exposure to Bitcoin – or another asset class entirely.

You can read my full YouHodler review here.

The Bottom Line

In summary, this guide has outlined the many ways in which you can attempt to make a profit from Bitcoin. At one end of the scale, you can simply buy Bitcoin with the hope that it will be worth more in several years to come.

At the other end, there are heaps of more sophisticated instruments that allow you to profit from Bitcoin, too. This includes everything from Bitcoin CFDs and loan financing to futures and options.

The most important thing to remember is that Bitcoin is a volatile asset class – so you should have at the very least have an understanding of the key risks before taking the plunge