These are some of my thoughts and lessons that I’ve learned over the years and want to share here. At some point, I might dig deeper into some of these topics and split this up into several articles. In the meantime, enjoy and do let me know if you have any thoughts of your own on these subjects.

The Meaning of Life

George Mallory, a mountaineer who led early British expeditions to Mount Everest in the 1920s, on the joy of climbing and meaning of life:

“People ask me, ‘What is the use of climbing Mount Everest?’ and my answer must at once be, ‘It is of no use.’ There is not the slightest prospect of any gain whatsoever. Oh, we may learn a little about the behavior of the human body at high altitudes, and possibly medical men may turn our observation to some account for the purposes of aviation. But otherwise nothing will come of it. We shall not bring back a single bit of gold or silver, not a gem, nor any coal or iron… If you cannot understand that there is something in man which responds to the challenge of this mountain and goes out to meet it, that the struggle is the struggle of life itself upward and forever upward, then you won’t see why we go. What we get from this adventure is just sheer joy. And joy is, after all, the end goal of life. We do not live to eat and make money. We eat and make money to be able to live. That is what life means and what life is for.”

All In

I’m the type of person who is either all in on something, or totally out. While that has its advantages and disadvantages, I’ve designed my life around that trait and it works well for me.

Quite beyond my own personality, however, there are many things in life that by their nature only work when you commit very seriously to them.

The excerpt below is from an excellent Farnam Street blog post on the topic:

Commitment means all in, all the time.

It’s easy to trick yourself into thinking that if you put in half the effort, you can get 80 percent of the results. While that might work for some things, it doesn’t work for anything important.

If you’re half trustworthy, you’re not trustworthy. If you’re often reliable, you’re not reliable. If you’re mostly consistent, you’re not consistent.

The key to doing anything well is commitment. Not only does commitment help you become better at what you do, but it also makes other people want to help you.

If you see your job as punching the clock, not only will you never be great at it, but your employer won’t invest in you. The best relationships are the ones where both partners go all in all the time to make the relationship amazing.

If committing sounds like a lot of work, it is. That’s why so many people are half-in. The problem with half-in and half-committed is that it doesn’t get you the results you want. If you’re not committed, get out.

The committed person gets both the opportunity and the results.

All in, all the time.

Letting Go

When I was a young kid I was brought up to always strive for excellence in academic subjects and in sports, although it applied to most other areas as well.

Perhaps the area in which this strive for excellence had the biggest impact on me is academics. Education in Malta when I was in school was very competitive, with exams being a do-or-die affair that determined whether you would advance to the next year or not.

Failing, especially in the year-end exams, was pretty much unacceptable as it would mean a ruined summer studying for the resits in September, potentially losing all friends if you fail to advance to the next year, and feeling like a total failure. Not to mention the scolding to be received from parents and teachers for not trying hard enough.

I’ve always been inclined to do things my way and on my own terms; my motivation to do anything almost always comes from within and very seldomly from outward expectations. It was therefore a big struggle for me to find the motivation to study for what I regarded as pointless exams. I had to study subjects that I was not necessarily interested in, and for which I saw no future utility. On the other hand, teachers and parents knew that I was no slouch and had the ability to excel in any subject, so anything less was deemed as me not trying hard enough, not being disciplined, keeping bad company, etc etc.

This created a serious internal conflict in me, and in many ways psychologically scarred me. I still have nightmares involving me the day before an exam, not being confident of doing well and dreading the consequences. Thankfully they are not frequent, but the feelings are the same ones I had twenty to thirty years ago, which is incredible.

Over the past few years, as I was working with a psychotherapist to improve several things, this was one of the topics that came up, and was one of the hardest ones for me to work through. The thing is, that that as I grew older, this strive for excellence became internalized, and I no longer needed teachers or parents to be bearing down on me with their expectations. I became the one to set those expectations for myself and to judge myself if I fell short of any of them.

I suspect that this made things even worse than when the expectations and judgment came from others. As an adult, I had now the full freedom to seek my own choices in life, and as I’m interested in many topics, by default I set up all these internal goals that I was expected to reach. With hindsight, this dangerous cocktail set me up for years of stress and unhappiness. I was never really aware of what was happening until I started digging deeper in my psyche with the help of the psychotherapist.

Even with her help though, I struggled to understand if this was really a problem or not. You see, this internal drive for excellence was also the catalyst to most of my success in life. My initial reaction was to feel proud of my drive to excel and be the best at anything I put my mind too. And I had a string of successes to prove it. At the same time, with time I had to admit that it was also the source of unnecessary stress, anxiety and pressure, that was also affecting my relationships with others.

Like many other things, an attribute has a positive and a negative side. I think one of the most important exercises in psychotherapy is that of realizing what attributes one possesses and where they came from. This first step of understanding who you are and why you are so is extremely important. I went into my psychotherapy experience with a list of negative things that I wanted to eliminate, but discovered that most of those things also had extremely beneficial things on the other side of the coin, and that I really didn’t want to eliminate them outright.

Did I really want to get rid of my internal drive to excel? Would it make me a couch potato with no motivation to do anything? I had to come to terms that you just can’t have perfection in life. You can have the efficiency and productivity of northern European countries, but then you can’t also have the joie de vivre and friendliness of the southern ones. I realised that I’ve been trying too hard to optimise things and pick and choose attributes in myself and in my surroundings. I was on an impossible mission that would only bring internal strife and unhappiness.

I’ve been setting up many small and big goals that are not really that important, but I’ve been judging myself and feeling bad for not reaching them. We are surrounded by blogs and books that promise to teach us how to be more productive and achieve more success etc, and they all come with a long list of todos in order to reach the promised state. I think I’ve read enough and have enough todos to last me 5 lifetimes; what I really need is to let go and start enjoying the simpler things in life.

The coronavirus lockdown has been a great teacher for me this year. It came at a point where I was really maxing out my energy chasing several goals at once and the first two weeks were an absolute relief as I was forced to relinquish some of those goals and focus on fewer things. But then in the following weeks, I realised that I was again running out of time and feeling like I have too much to do every single day. It made it super clear to me that the problem was in my mentality rather than anything else.

It become crystal clear to me that the number of goals and things on my to-do list was hilariously impossible to achieve. I had been pretending to do all the things I had listed before the lockdown and aiming to achieve them, but even after being forced to stop training (which took up a good part of my daily routine) and several errands I still could not fit everything into my day. It was pretty obvious that I was taking on too many things at once. This has been a perennial problem for me and it is time to call an end to it.

Here’s one example. I decided to start waking up at 6 am and sleeping at 10 pm. It worked for a few days but I soon started shifting the hours again after the hour change due to the new season. I became frustrated that I was not disciplined enough to stick to the plan. The problem is the plan itself, however. It’s a much better idea to set a goal to sleep between 10 and 12 and wake up between 6 and 8 in the morning. The Spanish lifestyle and timezone make the evening much more active than in other countries, thus it doesn’t always make sense to sleep at 10, and even midnight feels early in seasons like summer. So why not be flexible and go with the seasonal rhythms instead?

As for me, my resolution is to let go of many arbitrary “goals” that I’ve set for myself, simply because they have been doing more harm than good. I look forward to enjoying more of every moment instead of continuously pushing myself harder and harder while the goalposts keep on moving.

Enjoying the Process

One of the main reasons why I get too stressed is that I am always too focused on the goal. That’s also been part of my childhood, as the thing that mattered most was always the result. Anything in between the start and the end was just there to be criticized and refined further until the final desired goal would be reached.

We all know that 99% of any journey consists of a process, and the rest of the 1% is the very start and the very end; minuscule parts in the great scheme of things. The beginning typically brings excitement and happiness, while the end can bring emotions such as relief, satisfaction and a sense of triumph over all the odds encountered.

But really, those two moments are very fleeting.

The excitement of the start of a new project almost always quickly takes a back seat as the hard work of whatever I’m working on becomes the new reality, with many challenges, obstacles and setbacks to deal with.

Once I finish something, I’m thinking about an improved version of whatever I’m working on, or moving on to a new project in no time.

Looking at it this way it seems very obvious why I’m setting up myself to be unhappy most of the time, even if I’m doing things that I enjoy. In recent years, there has been no clearer example of this taking place than during my padel journey. I was so focused on the objective I had set for myself that I lost touch with the amazing reality that I was improving and having a great time playing the sport and meeting people as well as learning about life as an athlete. In retrospect, I can see what a great journey it was, but at the time I wasn’t enjoying the process as much as I should have.

That’s a lesson I’ve learned and I now keep it in mind in my day-to-day activities.

Avoiding the Wrong People

Few things are more important in life than avoiding the wrong people.

It’s tempting to think that we are strong enough to avoid adopting the worst of others, but that’s not how it typically works.

We unconsciously become what we’re near. If you work for a jerk, sooner or later, you’ll become one yourself. If your colleagues are selfish, sooner or later, you become selfish. If you hang around someone who’s unkind, you’ll slowly become unkind. Little by little, you adopt the thoughts and feelings, the attitudes and standards of the people around you.

The changes are too gradual to notice until they’re too large to address.

On Buying Things and Minimalism

Minimalism has become a poplar trend in the 00s, probably as a counter to the extreme consumerist culture that had been fostered in the previous decade or two. Most people in developed countries own way too many things, and this stuff can actually detract from quality of life. Again, no surprise someone like Marie Kondo achieved huge success off her idea of tidying up closets and getting rid of unused and old things.

Minimalism, however takes things to an extreme that does not entirely vibe with me. I actually love high quality products and derive a lot of satisfaction from owning, taking care of, and using things. Therefore striving for absolute minimalism does not make sense for me. A classic example is car ownerhsip. Most minimalists proudly state that they use public transport and have absolutely no need for a car, especially if they live in a big city. I’ve tried both, and owning a car is an infinitely better choice for me since it has opened up the door to having so many amazing experiences with one day trips or even longer trips around Europe. Not only that but I can also travel in comfort without being annoyed by other users on public transport systems. And when you have kids, I’d argue a car becomes kind of a necessity.

Perhaps my biggest issue isn’t with minimalism as a philosophy, but with people defining themselves as minimalists. Simply put, my style of minimalism typically involves owning more things than the typical minimalist.

The Magic of Three Goals

I’ve written about the shiny object syndrome and trying to do too many things before, but today I’d like to add one more realization, which I call the magic of three goals.

Basically, it means that the ideal number of goals or tasks per timeframe is three. For example, when playing a padel match, I usually think about all the improvements I am going to apply to my game in this particular match. In the past, I never thought about setting any limits. I eventually realized that it was impossible to apply a dozen improvements all in one match. More likely, I would end up too overwhelmed and just defaulting back to my usual game. When I started to limit myself to three particular improvements it became much more achievable and manageable.

The same applies to team meetings. Before we start a meeting, we set three objectives at a maximum. That way at the end of the meeting we can review our meeting and hopefully see that we completed our big three goals. Of course, there usually are more than three things on the agenda, which is great, but it’s important to select a maximum of three big ones. That way we are setting ourselves up for success rather than failure.

Having too many goals for one session, be it sports, a meeting, or even a workday, sets you up for failure and frustration. Set three goals and focus on achieving them.

I’ve also written about finding three life priorities and the importance of finding three hobbies. Seems like the number three is an important guiding force.

Enjoy Life in Your Twenties

Looking back at this decade and all the things I’ve done, I’m really amazed by how much I managed to fit in and the diversity of my experiences. In my view, the twenties are a time when you have maximum freedom, and you should make the most of it. If you haven’t started working after finishing your studies, why not take a year off to travel and get new experiences? Even if you do get a job, make sure you take regular time off and explore distant places to get a good idea of how other cultures work.

I partied hard in my early twenties and have no regrets. The party scene at the university in Loughborough, as well as the Maltese summers were just amazing. I made a lot of friends and explored their outlooks on life, from which I learned a lot. Use alcohol if it helps you enjoy the partying more and loosens you up, but don’t get drunk. There’s no fun in not remembering what you did last night or spending the night vomiting and the next day with a bad hangover. Whatever you do, don’t take up stupid habits like smoking that will damage your lifelong health. I never used drugs myself so I can’t comment on that topic, although psychedelics are experiencing a revival lately. I would only consider using them in controlled environments and later on in life.

Don’t be a Donkey in Your Thirties

One of my favorite podcasts is The Tim Ferriss Show, hosted of course by 4 hour workweek mastermind Tim Ferriss. If you haven’t checked out his latest book, head over to Amazon right now, you need to get a copy of it: Tools of Titans.

One of the guests on Tim’s show was Derek Sivers, and I’m also a big fan of his blog, especially his book summaries.

So in this interview Tim asks Derek what advice he’d give to his thirty year old self.

Derek replies: “Don’t be a donkey”.

I found the reply and it’s explanation very fascinating and it really hit home.

So what does Derek mean by that?

Many 30 year olds are trying to pursue many different directions at once, but not making progress in any.

Or they get frustrated because the world wants them to pick one thing, and they want to do them all. Why do I have to choose?! I cannot choose!

The problem is that they’re acting short term, as if you don’t do them all this week, they won’t ever happen. But the solution is to think long term; to realize that you can do one of the things for a few years, then do another one for a few years, and so on.

The analogy with the donkey comes from a fable in which a donkey that is equally hungry and thirsty is placed precisely midway between a stack of hay and a pail of water. Since the paradox assumes the ass will always go to whichever is closer, it will die of both hunger and thirst since it cannot make any rational decision to choose one over the other.

A donkey can’t think of the future, if he did clearly he would realize that he could first drink the water and then go eat the hay, or vice versa.

I’m in my early thirties and I can relate to this issue 100%, in fact I’ve already written about the shiny object syndrome in the past. I’m also currently stacking up books about decision making and going through them, precisely in order to help me make sense of the many opportunities that present themselves and avoid that dreaded FOMO (Fear Of Missing Out) and decision paralysis.

If I look back at my life it seems clear to me that my twenties were a period of experimentation and grappling at life to try to make some sense of things as well as try to enjoy my youth to the fullest. This was a journey that involved going abroad to study, being in several relationships, and trying my hand at different businesses. In the latter part of my twenties I also became a digital nomad and that was another huge personal growth spurt for me. Those were years of highly accelerated learning and changes in my outlook on life. They were enormously fruitful and led to what I can consider another section in my life, early thirties.

Derek was spot on with his analysis of the typical thirty year old. At this stage I feel that with the knowledge accumulated in my twenties I can do so many things and pursue different goals, many of them incompatible with each other or mutually exclusive. Clearly I can’t do everything but my mind still dreams and my heart still races at each different opportunity that I’m aware of.

I am therefore trying to follow Derek’s advice and think long term. I like to plan things on paper in terms of five year and ten year plans, and that helps me to space things out, but it’s still hard to actually choose what I want to pursue. There is a lot of pain in consciously giving up good opportunities to pursue others.

For this reason I am digging into research about decision making and strategy. Apart from that research proving essential in the area of business, I believe it will also help me on a personal level in order to make choices more rational and easier. Being able to clearly analyze an opportunity and describe why you choose to pursue it or leave it on the table is a very important skill to have and will be of great help against this “can’t choose, won’t choose” issue that Derek speaks about when he thinks of his thirty year old self.

Are you in the same boat? Are you a bit older and can relate to this? I’d love to know what others think and perhaps have some more advice on the topic.

Travel and live abroad

I lived in several countries, and every one of those experiences was incredibly formative. It helped me learn new languages, deepen my spirituality and explore other religions, as well as truly understand the global nature of humanity. It helped me let go of the notion of pride in my nationality or country of origin, and feel more like a global citizen, essentially breaking down the walls we tend to build to separate ourselves from people who look or act differently from us.

Be Entrepreneurial

By all means, try to build a business of your own. Even if it’s just a side hustle that goes along with your day job, it is an incredibly enriching journey to start from zero and build a business that gives you income every month and delivers value to other people. I was lucky enough to be successful in building a business that provided my main income and allowed me to travel and work remotely. Not everyone can be an entrepreneur, but I think everyone can try to have an entrepreneurial mindset.

Another alternative to building your own business or side hustle is to be intrapreneurial. This means that you can look at the processes of the company or institution in which you work and try to introduce a new way of doing things, or suggest the creation of some new product or service. If you have good bosses, they will appreciate your hard-working and creative attitude and possibly put you in charge of leading the changes, which can be just as rewarding as building your own business and provide similar lessons and value.

Continue Learning and Reading

Most people stop learning once they graduate from University and start their work lives. I can honestly say that I accelerated my learning after graduating instead, and it made a huge difference in my outlook on life and decision-making abilities. The difference becomes really apparent from the thirties onwards. I can clearly see the difference when I talk to people my age who haven’t read a lot and continued to study on their own after finishing formal education.

Can Money Buy Happiness?

Yes. To a certain extent. Money solves a lot of problems although it doesn’t directly bring you happiness. Those problems that money eliminates can definitely cause you a lot of unhappiness, on the other hand. One of the big leaps, as you make more money, is that you start focusing on quality more than price. I feel that that is a huge leap in quality of life and affects the most essential of things such as our health and our food choices, not to mention education. These elements are crucial in living a good life and being in a position to achieve a state of happiness.

You Will Get Screwed

Life isn’t fair. The sooner you accept that the better.

An important step towards finding happiness is to accept that fairness is an artificial human construct.

You can either complain about all the ways you’re being screwed and point fingers at people and situations or focus on stacking the odds in your favor. Your choice.

Am I Lucky?

Ever since my childhood, I remember friends remarking about how lucky I am. I’ve never believed in luck one bit and always felt it was just a different mindset that created this effect. What I do acknowledge is the obvious element of chance that determines where we are born and who are parents are.

I recently came across this podcast that very accurately discusses this topic; Dr Bush perfectly articulates my feelings on the question of luck. Looking at all the “lucky” moments in my life, almost all if not all of these moments were the result of an optimistic growth mindset and careful long-term strategies that I chose to follow.

Struggling with Perfection and Choice

According to Aristotle, happiness consists in achieving, through the course of a whole lifetime, all the goods — health, wealth, knowledge, friends, etc. — that lead to the perfection of human nature and to the enrichment of human life. This requires us to make choices, some of which may be very difficult.

One thing that I struggled a lot with before I made an important realisation, is the quest for perfection as well as a struggle of deciding between many things I could do.

Here’s a quote lifted from the amazing Sam Berns, which perfectly sums up the problem I had and the solution:

Be OK with what you ultimately can’t do, because there is so much you CAN do.

Facing Our Fears

Here’s a great lesson on facing fears, from the legendary Will Smith. He talks about the strong fear he faced the night before going skydiving and all throughout the run up to the actual jump.

As soon as he’s pushed off the plane he realizes that it’s the most blissful experience of his life. There is zero fear, the point of maximum danger is the point of minimum fear.

The best things in life are on the other side of terror or maximum fear. I’ve found this to be so true in my life, but Will illustrates the point in the best way in this video.

So what’s the fear that is currently holding you back from achieving your next breakthrough?

Spend a few minutes thinking about that, then take action!

Time is Our Scarcest Resource and Ultimate Wealth

An abundance of time is extremely hard to achieve, especially combined with the pursuit of money. Having time on your hands in our society seems to be associated with being lazy and comes with the pressure to do “something useful” or “work harder”. The default is to fill every minute with being productive and working.

I’ve managed to always have an abundance of time to do things I want to, by building income streams that do not require daily work. This is something I’ve focused on right from the early days of my working life. It’s an uncommon state to be in, and I wish more of my friends had more time so that I could do more things with them.

I also appreciate having time because it is essential for me to fulfill the most important mission in my life at the moment – that of raising my children and enjoying as many intense experiences as possible with them.

If you bungle raising your children, I don’t think whatever else you do matters very much. – Jackie Kennedy

It’s sad to see so many parents having to outsource the upbringing of their children and send them off to daycare or schools at early ages. I believe this lack of time for parent-child connections is having a very damaging effect on our society.

One intermediate step to being time-wealthy is to have flexibility on when you work. Since most people work during the week and have the weekends free, there are so many opportunities to have fantastic experiences during the week and during mornings, for example, but people lose out on them due to being at work or busy with other things.

Money

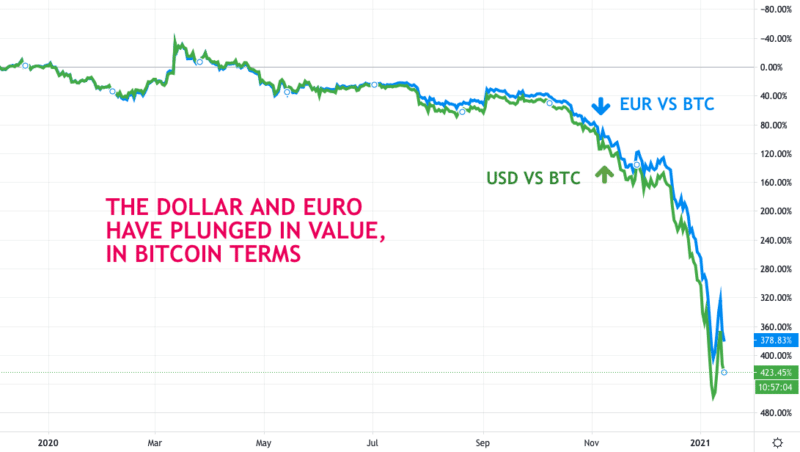

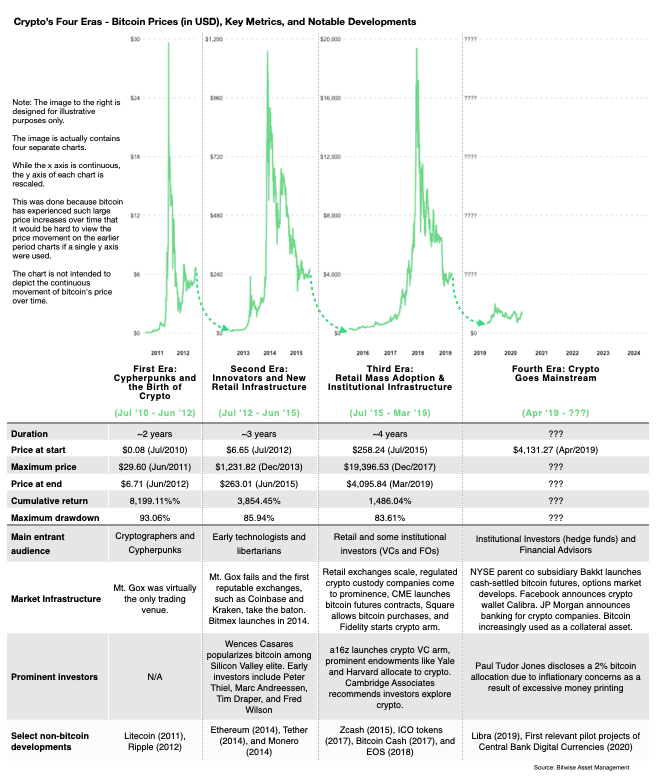

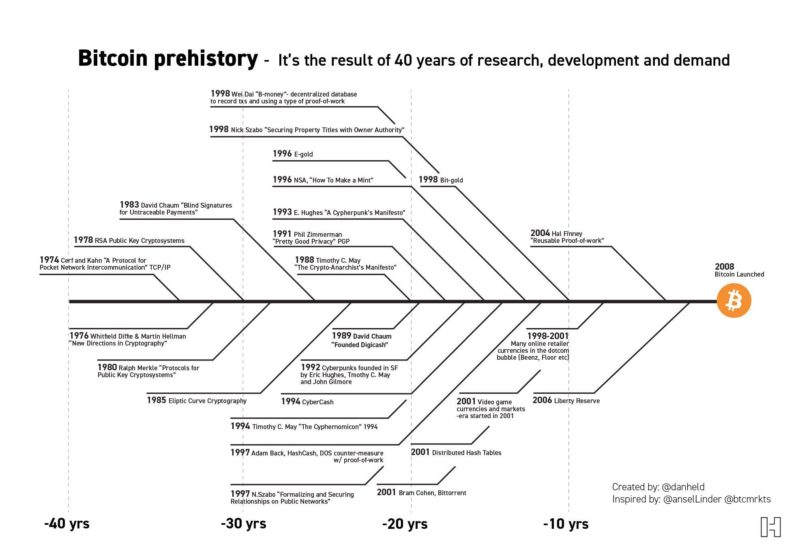

Money is the biggest problem for most people. It’s not a well-understood topic, and society pressures you to always want more of it. Our financial systems are built in such a way that it’s hard to save, meaning that you’re constantly in a rat race to earn more and more money to keep up. Bitcoin promises to solve this problem. Learn about it if you haven’t already taken a deep dive into that topic.

Some people are lucky enough to make money when they’re young and make it quickly – this oftentimes leads to cockiness and a know-it-all mentality. Making money is not that hard in the grand scheme of things, it’s keeping it over the long run that is the bigger challenge. If you strive for wealth according to my definition, you’ll enhance your chances of doing well over your whole life and not only for a few wild years while things are smooth sailing.

To sum it up, money is a real problem whether you have too little or too much of it. Too little and you can’t aspire to higher goals, while with too much of it you’re likely to unbalance yourself either by working too hard to keep that level of money or income, or by getting high on the money and doing stupid things with it.

Being at Cause

My biggest regrets in life have been things that I have not done, and not those that i did try. This means that there have been opportunities and situations that for some reason I have not taken action upon and now I regret the fact that I didn’t do anything about them. I wonder how many people feel the same way too, I would be interested to have some feedback on this.

For me and others who feel the same way, it clearly means that we have to start being less shy, more spontaneous and having a ‘Just Do It’ attitude. After all, even if things do not turn out as planned, it’s an occasion to get feedback and learn something useful for the future.

Now in order to empower ourselves in order to start taking action on whatever the problems/opportunities are, we need to step up our belief system and get rid of all the negative beliefs we have about ourselves, such as ‘I’m not a good talker, I’m not so attractive etc.’. I’ll go ino more detail on believe systems later on, however the basic principle is that most of us have alot of limiting beliefs which we need to analyse and eliminate as they are holding us back from achieving our full potential.

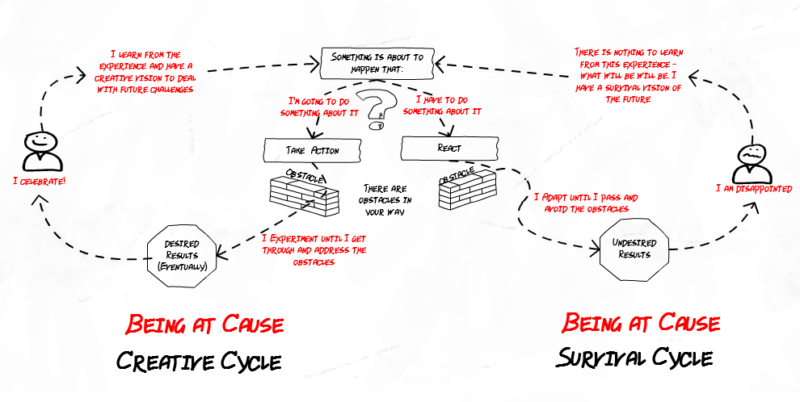

We also have to consider the Cause>Effect principle. It is important to be aware of whether we live our life at cause or at effect. It is quite rare to find someone who always lives his or her life at cause, indeed far too many of us live a large portion of our lives at effect — responding to the whims, desires or emotional states of others.

Being at cause means that you are decisive in creating what you want in life and taking responsibility for what you have achieved or will achieve. You see the world as a place of opportunity and you move towards achieving what you desire. If things are not unfolding as you would like, you take action and explore other possibilities. Above all, you know you have choice in what you do and how you react to people and events.

If you are at effect you may blame others or circumstances for your bad moods or for what you have not achieved or for your life in general. You may feel powerless or depend on others in order for you to feel good about yourself or about life — If only my spouse, my boss, my coworkers, my parents, my children, … understood me and helped me achieve my dreams or did what I wanted or what is best for me, then life would be great. If you wait and hope for things to be different or for others to provide, then you are at effect or a victim of circumstances. And really, how much fun is that? And how much fun do you think it is for others to be around you? Believing that someone else is responsible or making them responsible for your happiness or your different moods is very limiting and gives this person some mystical power over you, which can cause you a great deal of anguish.

Being at cause means you have choices in your life — you can choose what is best for you while ensuring the choice is ecological for those around you, those in your community and your society. That is, you consider the consequences of your actions on others, while not taking responsibility for their emotional well-being — believing you are responsible for the emotional well-being of someone else places a heavy burden on you and can cause a great deal of stress.

Those who live their lives at effect often see themselves or live their lives as victims with no choices whatsoever. The irony is that they do have choice and they have chosen not to choose but to be responsive to whatever is given to them.

With hindsight, traveling extensively has taught me that many things that we think are impossible are really possible with some lateral thinking and creativity, plus a whole lot of effort. Sometimes we need to put ourselves in uncomfortable situations and take risks to really achieve things.

Having grown up on a small island in a relatively protected environment, I think I spent many years living life at effect. However my curiosity and entrepreneurial spirit, coupled together with the right people and travel, have helped me move into being at cause. It’s not always easy to stay in this mindset, and it takes constant work and psychological training, but it’s definitely possible, and it gives you a much better chance at feeling fulfilled with your life.

Chasing Freedom

Freedom is an even higher goal.

I’ve always chased freedom ever since I was young, and in my mind wealth and freedom are very close relatives.

I wouldn’t consider myself free without the wealth component, but freedom incorporates one very important key aspect to the true quality of life. It’s knowledge. This statement needs some more unpacking.

To be truly free, you need to understand yourself at a very deep and intimate level and accept everything you are. The ultimate aim is to not only accept yourself but to learn to love yourself. That’s the first pillar of knowledge.

Second, you need to understand the world around you. This will enable you to see things how they truly are, free of indoctrination and the powerful forces of popular media, religion and politics.

Things you can do to seek this understanding of the world:

- Study history – you’ll learn to recognize patterns in people’s behavior.

- Travel – different cultures will teach you what the history books can’t.

- Keep educating yourself on a daily basis

You’ll know when you’ve attained the required base level of knowledge, because you’ll realise that you have much deeper perspectives on many different topics than most people around you. You’ll also start to immediately spot the bullshit in mainstream media and political and corporate propaganda. People might also start labeling you in pejorative ways and accusing you of things. This is a good sign that you’re well on your way to become a free and independent thinker.

Finding Purpose and Meaning

Something worth reading is Hunter S. Thompson’s Letter on Finding Your Purpose and Living a Meaningful Life.

I truly believe in breaking the conventions, doing something you love and that you are passionate about. Only by doing this will you ever be happy in your life.

I believe in playing throughout life, trying and failing over and over at the many things that pique my interest.

Don’t you have a feeling, like me, that most people spend their lives chasing a highly paid job or career promotion? That might give you more financial security, but what are you sacrificing?

Think about it.

What about the stress, being forced to fit into a system, the office politics, and going against your core values. All these are daily features of corporate life. At one point you will end up asking yourself: what am I doing with my life?

Life is not about how much money you have, or the heights you’ve reached in your career. It is about you and your talents, and how you are going to use them as best as you can, doing something you truly love.

Everyone has to find his own ingredients for a happy and fulfilling life, but some of mine are:

- Exercise and keeping healthy

- Having a close and valued circle of family and friends

- Spirituality and an inner life

- Fulfilling work

- Enjoying good food and travel

Of course, it’s also true that you need money to be happy. It’s not something that will make you happy, but it will solve many problems that make you unhappy and prevent you from pursuing your dreams.

Amateurs VS Professionals

Over the past twenty years I’ve learned how to distinguish between amateurs and professionals. I’ve seen the difference in many areas of work and life and at the core it’s always the same concepts that differ the best performers from the mediocre.

So what are these differences between amateurs and professionals; what sets the great thinkers and action-takers apart?

The answer is nuanced and likely multifaceted.

- Amateurs have a goal. Professionals have a process.

- Amateurs give up at the first sign of trouble and assume they’re failures. Professionals see failure as part of the path to growth and mastery.

- Amateurs focus on identifying their weaknesses and improving them. Professionals focus on their strengths.

- Amateurs complain about mankind’s flaws, biases, and contradictions; professionals exploit them for fun and profit.

- Amateurs think good outcomes are the result of their brilliance. Professionals understand good outcomes are (also, largely) the result of luck and randomness.

- Amateurs want money. Professionals want freedom.

- Amateurs focus on the short term. Professionals focus on the long term.

- Amateurs avoid risks. Professionals take and domesticate risks.

- Amateurs think in absolutes. Professionals think in probabilities.

- Amateurs seek to win the rat race. Professionals seek to escape it.

- Amateurs look for problems. Professionals look for solutions.

- Amateurs save money. Professionals both save and invest money.

Reference: Farnam Street Blog

Intentional “Mistakes” and Fake Apologies

One of the reasons that I am not interested in politics is the fact that most of what politicians say is just fluff and outright lies. When their lies and corruption gets uncovered later, they resort to apologies and pronounce them “mistakes”.

Big businesses, like politicians, have a habit of making very good use of the words “apology”, “mistake” and “sorry” for things that were not mistakes in the first place, and for which they are not really sorry in the original sense of the word.

Here’s an excerpt from an excellent Jalopnik.com article on this topic of fake mistakes and apologies, which I highly suggest reading in full.

Across the world, but particularly in the United States, people of power and import recite the word “mistake” as an incantation to disappear the harm they have caused.

When Volkswagen was caught making a series of engineering decisions to knowingly and intentionally cheat emissions tests around the world, Chairman Hans Dieter Pötsch said the company made not one mistake, but “a chain of mistakes,” which is a wild way to describe years of systematic trickery that also involved one of its largest supplier companies.

General Motors’ deadly ignition switch fiasco years ago may have originated with a single “mistake,” but the subsequent mishaps around it and alleged cover-up over several years cannot charitably be described that way.

“We know we all made mistakes and got some things wrong,” Boeing CEO Dennis Muilenburg told a Senate committee about his company’s systematic prioritization of profit over safety even as people inside and outside his company repeatedly warned they were making decisions that could, and ultimately did, kill hundreds of people. Former FIFA president Sepp Blatter called awarding the 2022 World Cup to Qatar, a very wealthy nation with a horrendous human rights record that is building the venues for the tournament on the backs of indentured servants, a “mistake” but that “one makes lots of mistakes in life.” (He was, of course, talking about how it was a mistake to award the World Cup to Qatar because it is hot there.)

Mark Zuckerberg said “we made mistakes” after a whistleblower revealed Cambridge Analytica harvested data from Facebook, a massive private surveillance company masquerading as a communications firm, to target 50 million Americans with political advertising that helped elect Donald Trump.

In 2017, while being deposed in one of many lawsuits facing her company, Elizabeth Holmes allowed that, as CEO of Theranos, a wholly fraudulent company whose only true product was secrecy and intimidation, “I know that we made mistakes.”

Labeling these as “mistakes” is re-defining horrifying, unconscionable evil perpetrated by supposedly respectable businesspeople as nothing better or worse than forgetting to pay a parking ticket on time. It is spreading a glossy sheen over the well-defined landscape of morality, implying my mistake is just like your mistake.

Yearly Reviews

At the end of every year, most people focus on new year resolutions, which tends to be a shallow form of thinking and most resolutions end up fizzling out after a few days/weeks. A better exercise is to conduct an annual report or year review.

Assume Positive Intent

Many conflicts, arguments and disagreements tend to stem from the fact that we assume the offending party set out to harm us in some way. In other words, they have an evil agenda or negative intent.

Many conflicts, arguments and disagreements tend to stem from the fact that we assume the offending party set out to harm us in some way. In other words, they have an evil agenda or negative intent.

A better way of moving forward and making progress, be it as a global economy or even in our day-to-day interpersonal relationships, is to always assume positive intent.

In trying times, it is quite easy to fall into a mode of thinking where we look around and think everything is falling apart and nothing makes sense anymore. It might seem that everyone is out to get us and there is little hope.

If we take a step back, however, we can use tools like prayer or meditation to get into an objective state of mind and realize that everyone is acting according to their incentives and circumstances, and by and large, people are wired to be good to others around them, unless they suffer from some psychological problem that makes them act otherwise.

Once we assume positive intent, instead of defaulting to judgment and anger, we take on an inquisitive stance. We ask of the other party: “what are you trying to achieve by this behavior”.

Oftentimes, it’s even better to try to take a minute and take an educated guess on the other person’s needs and objectives. This is because many people don’t even know why they act the way they do. It’s often easier for a third party to understand someone’s behavior, which is why we have counselors, psychologists etc. to help us out.

When we start out from this position together with an inquisitive and non-judgmental attitude, it is guaranteed that we will at least be in a better psychological state ourselves. As a bonus, sometimes we can enter into a productive discussion that ends up changing the other person’s behavior or opinion, although this shouldn’t be our main goal.

What Would Jesus Do?

No, this is not a religious lesson…

Remember those WWJD bracelets that were all the rage in the 90s? The idea was that we would wear them to help us make better decisions daily.

How?

The concept is simple. Whenever you’d find yourself in doubt about something, you’d ask yourself: “What would Jesus do?

Although I never wore these bands, thinking about them inspired me to implement a simple productivity trick in my life right now. Here’s how it goes.

- Think of the most productive/inspirational person you know of.

- Imagine being in his/her company all day. Act accordingly.

That’s it. Very simple. Imagine your favourite productivity guru flew in to your city and asked to spend the day hanging with you, just watching you go about your day.

Would you try to impress him? Do you think you’d be more productive that day?

For me, the answer is “Hell yeah!”.

But wait a minute, isn’t that what I’m supposed to be doing every day? So why not act as if that person is accompanying me every day? You can imagine several people accompanying you if you want. When you hit the gym, imagine your fitness hero is your partner, so run that extra mile and do that extra rep to impress him.

Imagining that somebody is watching your every move provides real context to your actions. You naturally think differently, act differently, and likely make more positive choices than you would alone.

Cultivating Awareness

Awareness is our teacher.

A Buddhist zen master was once asked how he defined zen. His reply was sharp:

When you’re hungry, eat. When you’re tired, sleep.

The more awareness we can bring to our lives the more we’re able to see that we can shape our lives. When we apply awareness, the past doesn’t have to dictate our future; we can push outside of our comfort zone, make new choices, and take new actions. With awareness, the path ahead is ours to create.

We need a sense of awareness in all aspects of our being. Think about physical awareness, mental awareness, and spiritual awareness. It takes great discipline to maintain total awareness in your daily life.

That’s why the practice of meditation is so important. The aim of meditation is precisely that; full awareness and being in the here and now.

I’m a person who is easily distracted and my mind is quick to drift off into dreams and possibilities. Rather than looking at what I can do in the future, it also sometimes dwells on the past, regrets and all. The here and now thus gets squeezed out leading to me living either in the past or in the future.

Such a state of living is not at all healthy. There’s regrets from the past, anxiety about achieving future dreams, and a lot of time wasted by not being fully focused on the present and working hard towards achieving preset goals in a serene fashion.

The question then is obvious: How do we cultivate awareness?

I am using the Calm app (available on iPhone and Android, as well as a web version) to meditate as often as possible. My aim is to meditate in some form on a daily basis. I can easily recommend this app as a way to make significant changes to your life and well-being. Another popular meditation app is Headspace. Both are good, just give them a try and see which style suits you best.

Outdoor Hydromassage Spas and Hot Tubs are Great for Relaxation

At one of my favorite gyms in Barcelona, I’ve experienced the amazing benefits of having an outdoor hydromassage spa, and this can be most easily replicated in homes with a hot tub.

The best conditions to experience an outdoor spa pool are in a location that has clean air and an amazing view. This gym in particular ticks those boxes. Ideally, it is big enough for 4-5 people to fit comfortably, as you want to make it easy for multiple people to enjoy the spa without bothering each other, and it’s also great to have the ability to chat with others in such a nice environment.

Owning or enjoying an outdoor hot jacuzzi offers a myriad of health and mental benefits that can really boost overall well-being.

One of the primary health benefits of an outdoor hot jacuzzi is its potential to alleviate physical pain and discomfort. The combination of warm water, buoyancy, and targeted jets helps to relax muscles and ease tension. The water’s buoyancy also reduces the pressure on joints, providing a low-impact environment that can help promote healing and alleviate discomfort from injuries or surgery. For these reasons, I love using it in particular after training or after a padel match when the legs and feet are really sore.

Another significant health benefit is the improvement of circulation. The heat from the jacuzzi causes blood vessels to dilate, resulting in increased blood flow and the delivery of oxygen and nutrients to various parts of the body. This improved circulation can help reduce inflammation, speed up the healing process, and even lower blood pressure for some individuals.

The mental benefits of owning or enjoying an outdoor hot jacuzzi are just as noteworthy. The tranquil setting and warm water work in tandem to reduce stress and anxiety, helping individuals achieve a state of mental calm and relaxation. This reduction in stress has a ripple effect on various aspects of one’s life, including better sleep quality, improved mood, and increased mental clarity. The particular outdoor spa I’m describing has a “bed” area where you can lie down and enjoy the feeling of bubbles and their sounds. I find this area great to have a 30-minute nap and feel supremely refreshed after. Even if I don’t manage to completely sleep, I do get into a deep state of relaxation and can process lingering thoughts and get the creative juices flowing, which is amazing if I want to do some writing straight after.

The social aspect of an outdoor hot jacuzzi should not be overlooked. As I mentioned, if you have access to a big enough spa it can be a place where your family or friends can congregate to talk in a relaxed atmosphere. I have enjoyed many a conversation in the spa and it’s one of the best places I can think of to enjoy a good conversation.

So if you’re thinking about buying or building such a spa, I would highly recommend it.

Find Three Hobbies

Here’s one of my favorite quotes, although I don’t know its origins.

Find three hobbies you love: One to make you money, one to keep you fit, and one to be creative.

These can change over time, but right now for me these three are:

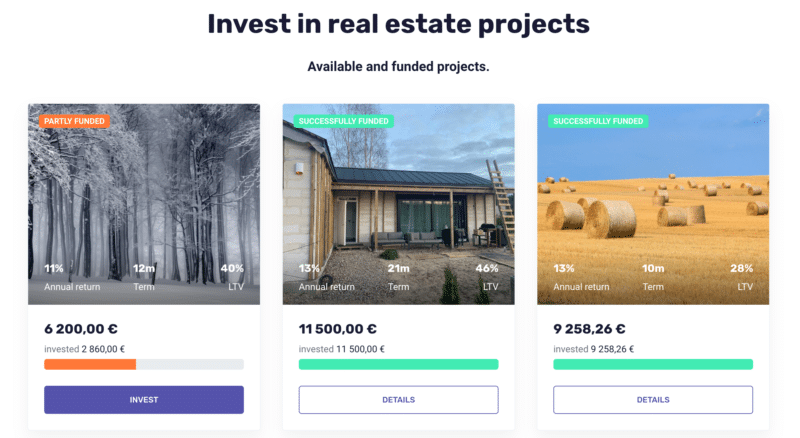

- investing

- padel

- reading/writing

I really think it’s important to have these three, not only because they’re your best chance to live a healthy and fulfilling life, but also because they feed into each other.

For example, to improve in padel and investing I read and write about these topics, and I can apply what I learnt from investing into the sport of padel. On the other hand, padel training has given me a lot of discipline and methodologies that I can then apply to my writing and investing.

The concept of them being named as hobbies also aligns with my idea that ideally there shouldn’t be a hard line between work and play in life. In fact I always strive to build a life that I don’t need to take a holiday from.

I don’t think of work as work and play as play. It’s all living. – Richard Branson

Most people go on holidays to forget their daily life during the rest of the year, while the most fulfilled and high performing people I know don’t have this concept in their lives. They find joy and fulfillment in their daily routines and if they take a holiday they don’t really treat it in the way that most people treat it. For them, it’s most likely part of the yearly routine and has a specific purpose that fits an overall goal.

What are your three hobbies?

Assume Incompetence

Instead of getting mad when people make mistakes, just assume they tried their best. If you are a high performer, you can’t expect everyone to be a high performer. It’s better to assume they made an honest mistake or they just weren’t fortunate enough to get your kind of education and life experience.

In a similar vein, you can assume terrible days for everyone you are going to interact with on any given day. They might be struggling to make ends meet (especially true in the service industry), having relationship trouble, health issues, etc etc. They aren’t purposefully trying to ruin your day.

Filtering People

The key to meeting new people is to do a filter without the filter. If you’re an expert in an area, ask the other person something about that area. They will rush to tell you their “opinions”. Since you’re an expert then follow up and ask if they consider themselves an expert in said area. If someone says factually incorrect stuff about something they “know well”, move on. Smile, nod, and agree. Don’t argue.