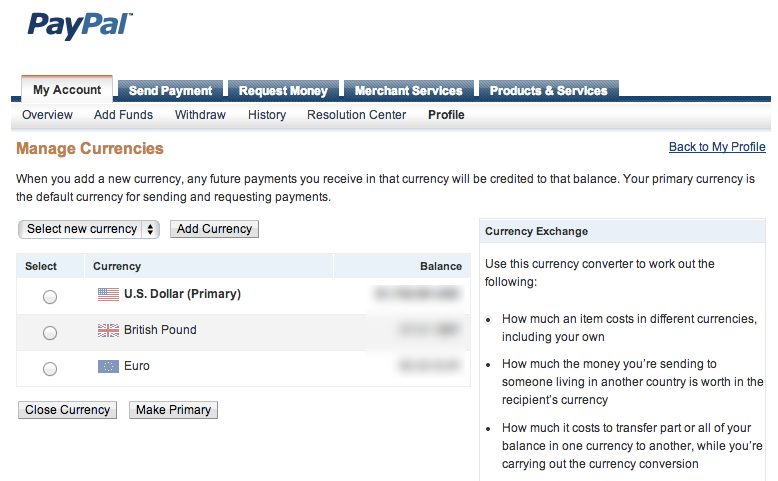

I’ve already written about how to avoid losing money from PayPal’s disadvantageous exchange rates when withdrawing money from your PayPal account to your local bank account, but in this post, I will be showing the exact process that is used at this point in time (June 2014) for anyone who wants to do the same. Unfortunately, you won’t find this information anywhere on PayPal’s website, so I had to figure things out myself by contacting their support staff.

First of all, a quick explanation of why I wanted to change my withdrawal currency. My local bank accounts are in Euro and since my business is based in Malta I am only allowed to withdraw money to the credit card issued by my bank or to a Euro bank account.

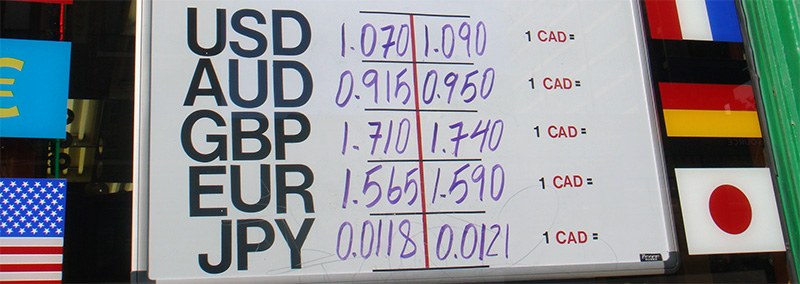

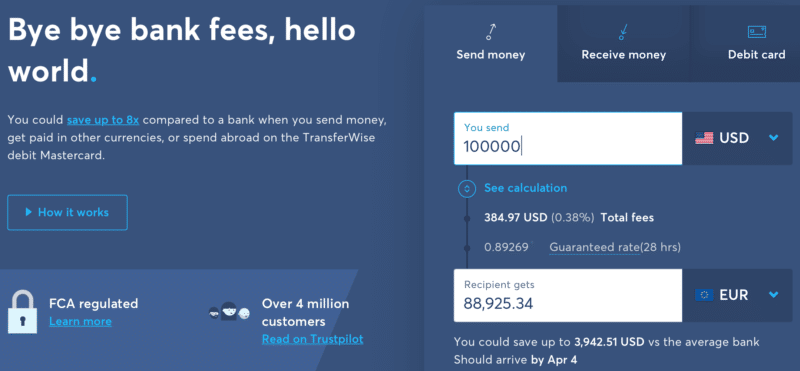

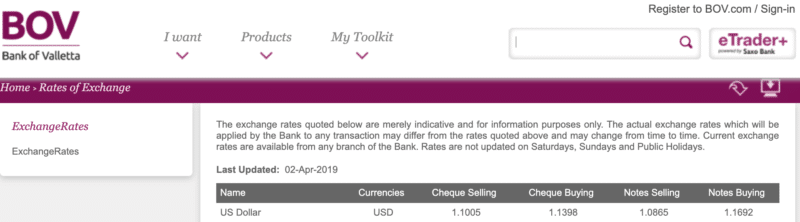

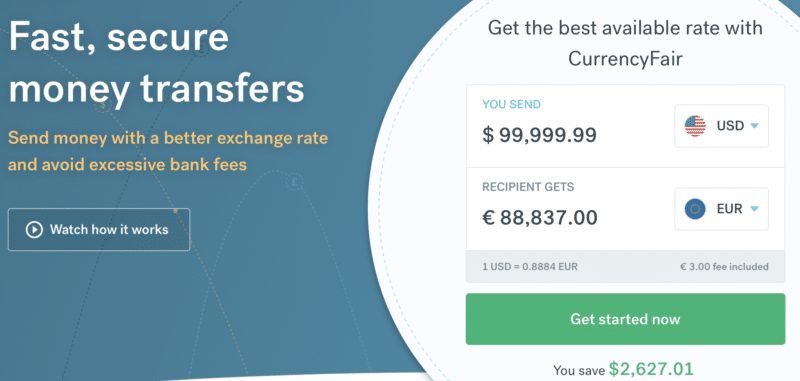

Sadly there is no option to have a credit card account in USD. Therefore what was happening was that whenever I withdraw from PayPal (where most of my funds are in USD), the PayPal system would automatically convert from USD to EUR to match my local bank account. The problem is that the rates PayPal uses are much worse than the conversion rates at my local bank. So I wanted the conversion to happen on the bank’s side rather than PayPal’s.

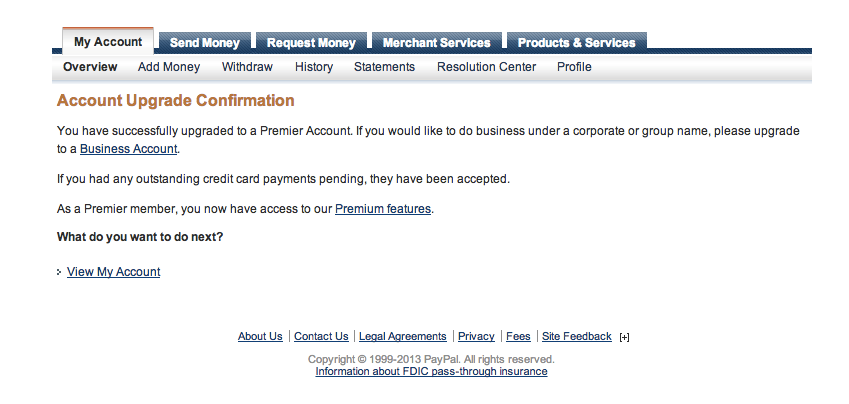

Luckily it turns out to be easy to do. All you need to do is notify PayPal manually that you want that particular credit card to receive USD rather than EUR, and you can do this by opening a support ticket from PayPal’s website. Below I am reproducing the reply I got from PayPal when I asked them to change my withdrawal currency:

Thank you for contacting PayPal regarding questions about the withdrawal options for your Business account in Malta.

For bank withdrawals, you can only add a US bank account to your Business account, and then withdraw your PayPal USD balance to there.

For credit card withdrawals into USD, we can change the currency for your cards added to your account into USD on your request. If you wish to do this, please confirm the last 4 digits of the card that you want to be changed to USD and we will then update this in our system. This will also resolve any currency conversion loss for you when making withdrawals.

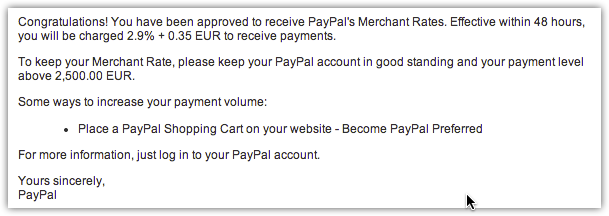

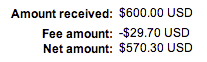

Another annoying thing for me is the $2,500 limit for every withdrawal. There is a charge for every transaction, so it is not only inconvenient to be limited in this way, but I am also getting charged for multiple transactions when I could have more easily done one. Sadly there isn’t a solution to this latter issue. This is what the PayPal support rep had to say about my query in this regard:

Regarding your question about the 2500 USD withdrawal limit per transaction, I confirm that all withdrawal limits are overridden on your account from PayPal´s side. The 2500 USD withdrawal limit is a worldwide regulation on VISA´s side, so I regret that we cannot lift this limit. However, you can make as many withdrawals per day as you want, as long as they don´t exceed 2500 USD per transaction.

I hope this post helps clear things further for those of you who have asked me how to perform this little trick and save money on your withdrawals.

Note: If you have any questions after reading this and the several other articles relating to PayPal on this site, please leave a comment or contact PayPal directly. Unfortunately, due to time constraints, I am unable to offer any advice over email so all emails related to PayPal will remain unanswered.